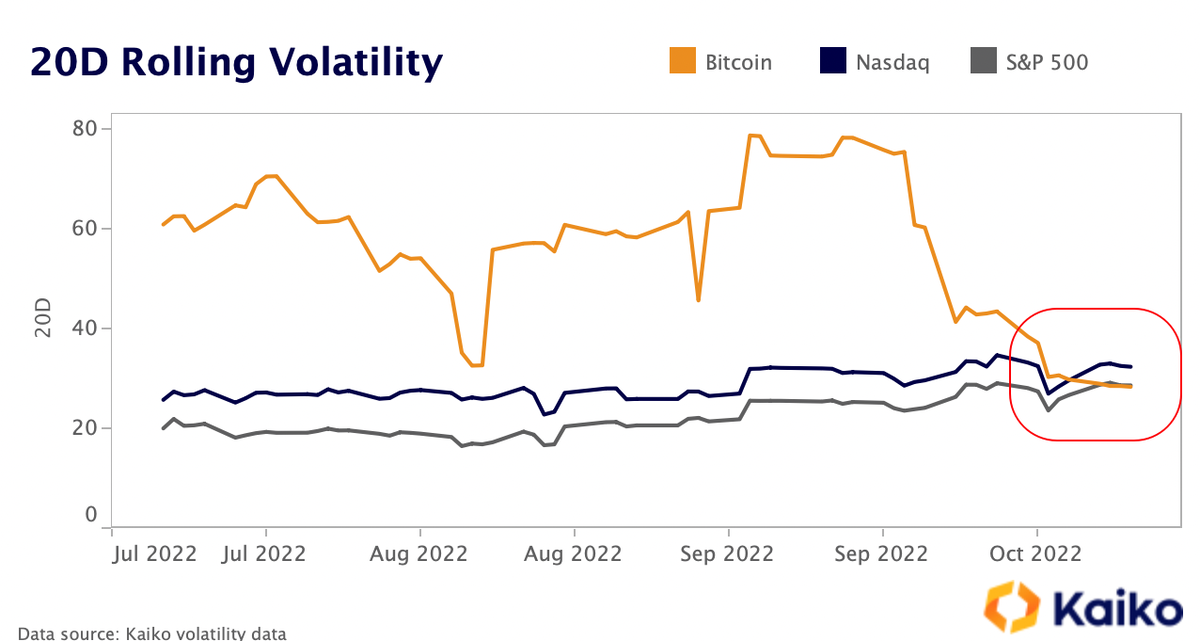

Bitcoin (BTC) is turning out to be a much more “stable” asset than US equities as the cryptocurrency marketplace extends its gloomy days.

According to the cryptographic information evaluation unit Kaiko, the twenty-day typical volatility of Bitcoin (BTC) has now fallen beneath each the Nasdaq and the S & P500, two of the main US equity indices.

This is the initially time this has occurred due to the fact 2020, when the cryptocurrency marketplace expert a COVID plunge and then elevated all through an uptrend cycle from late 2020 to early 2022.

However, in advance of the final twenty days, the volatility of each US stocks and Bitcoin itself peaked just after a time period exactly where it was influenced by macro data, notably continued US inflation in the higher US ranges, main to movements to increase curiosity prices to hold back from the Fed.

Clara Medalie, director of investigate at Kaiko, extra that Bitcoin’s volatility has appreciably decreased due to the fact July 2022, when the cryptocurrency marketplace just suffered the LUNA-UST crash and the liquidity crisis of massive organizations.

Even so, the volume of cryptocurrency trading on the marketplace has remained secure regardless of reduced volatility, indicating that a massive variety of traders are even now in the crypto area.

On the other hand, US stocks have expert extreme volatility due to several motives, like increasing curiosity prices, the US dollar recovery, higher inflation, the EU power crisis and the crisis. international money. Russia-Ukraine conflict.

Synthetic currency 68

Maybe you are interested: