Bitcoin and the complete cryptocurrency industry recovered somewhat following a tricky begin to the week for traders. Supported by very good signals from the US Federal Reserve (Fed) and the emphasis of the Chinese authentic estate group Evergrande.

It is not just the cryptocurrency industry that has struggled, most stocks and other monetary markets had been “paralyzed” earlier this week, partly due to considerations more than the chance of a worldwide monetary crisis associated to the Chinese authentic estate giant. Evergrande. The organization has $ 300 billion in debt that it will not be in a position to repay, top to bankruptcy.

– See extra: Evergrande’s “real estate bubble” is probable to burst, how does it have an effect on Bitcoin and cryptocurrencies?

On September 22, on the other hand, Evergrande explained it had agreed to settle curiosity payments on the domestic bonds. Coupled with China’s move to inject $ 18.six billion into the banking process, it dispelled considerations that have been lurking in the worldwide industry in current days.

While considerations more than Evergrande seem to have subsided, the U.S. Federal Reserve (Fed) also announced on Sept. 22 that it will continue to keep the benchmark curiosity price close to zero, raising inflation expectations and bringing forward the timetable for easing purchases of central financial institution bonds till 2022.

An critical stage to note is that when the aforementioned Fed action very first took location, Bitcoin and other cryptocurrencies rose. This is for the reason that curiosity-bearing investments, this kind of as bonds or debt-primarily based monetary instruments, do not produce curiosity and are consequently significantly less interesting to traders.

Alternative assets, this kind of as Bitcoin, have consequently turn out to be extra interesting. Investors have misplaced faith in the US dollar as inflation has meant extra cash flowing into assets like Bitcoin, setting the stage for expanding industry capitalization and the trend in coin costs.

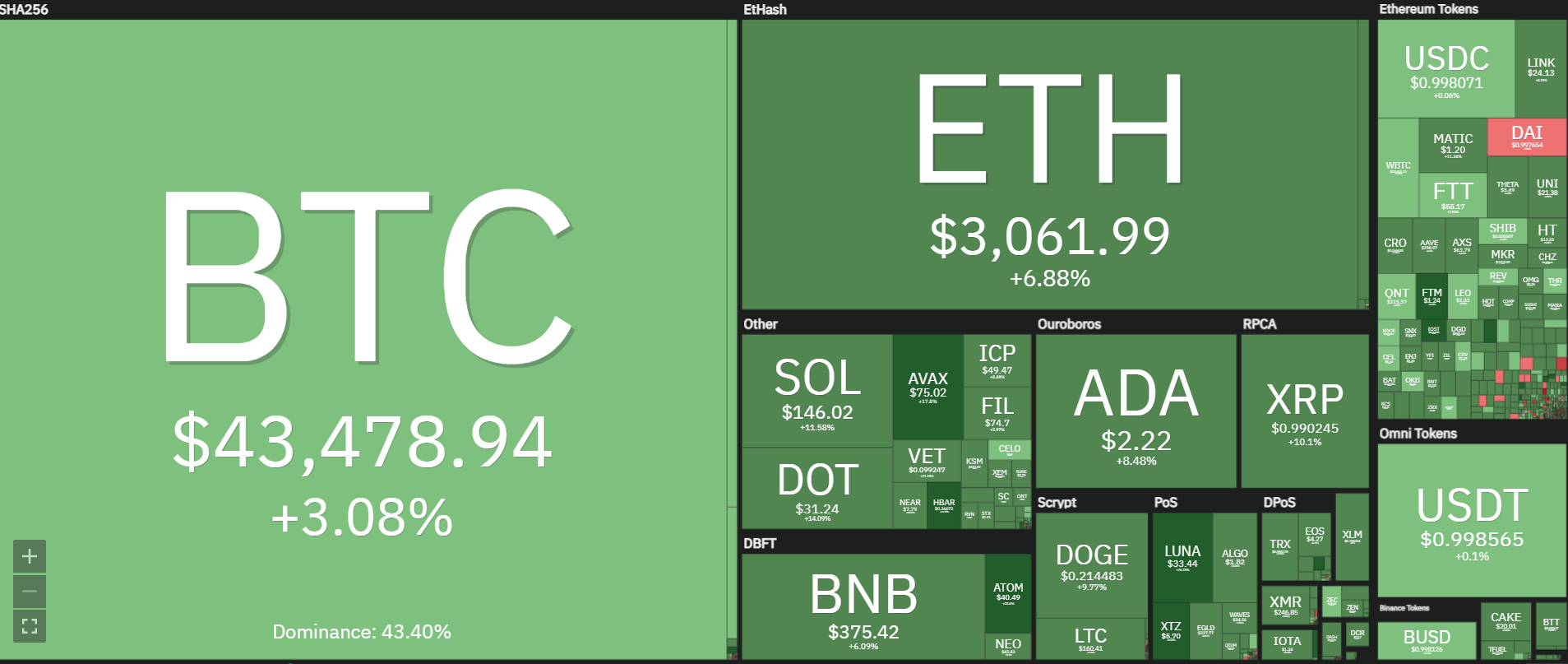

However, industry modifications have reacted fairly properly to the two critical pieces of facts over. The green shade is back following extra than three days of issues. Bitcoin stays the most influential and dominant coin on the industry, obtaining acquired three.08% in the previous 24 hrs and is at the moment trading at $ 43,478 at press time. Ethereum also retraced the $ three,000 threshold.

Along with this, the “balance” of Long / Short derivatives is returning to a extra balanced place on foreign exchange. This is also a very good signal for the industry. Because, the “snowball effect”, which negatively influences the selling price in a quick time, will be pretty unlikely with the hesitant fluctuations on the two sides.

However, with the macroeconomic condition slowly modifying, reigniting constructive information, we can be certain that not only Bitcoin but the complete cryptocurrency industry will begin to rebound more powerful following two consecutive many years of “strong dump” in just two weeks of September.

Synthetic currency 68

Maybe you are interested: