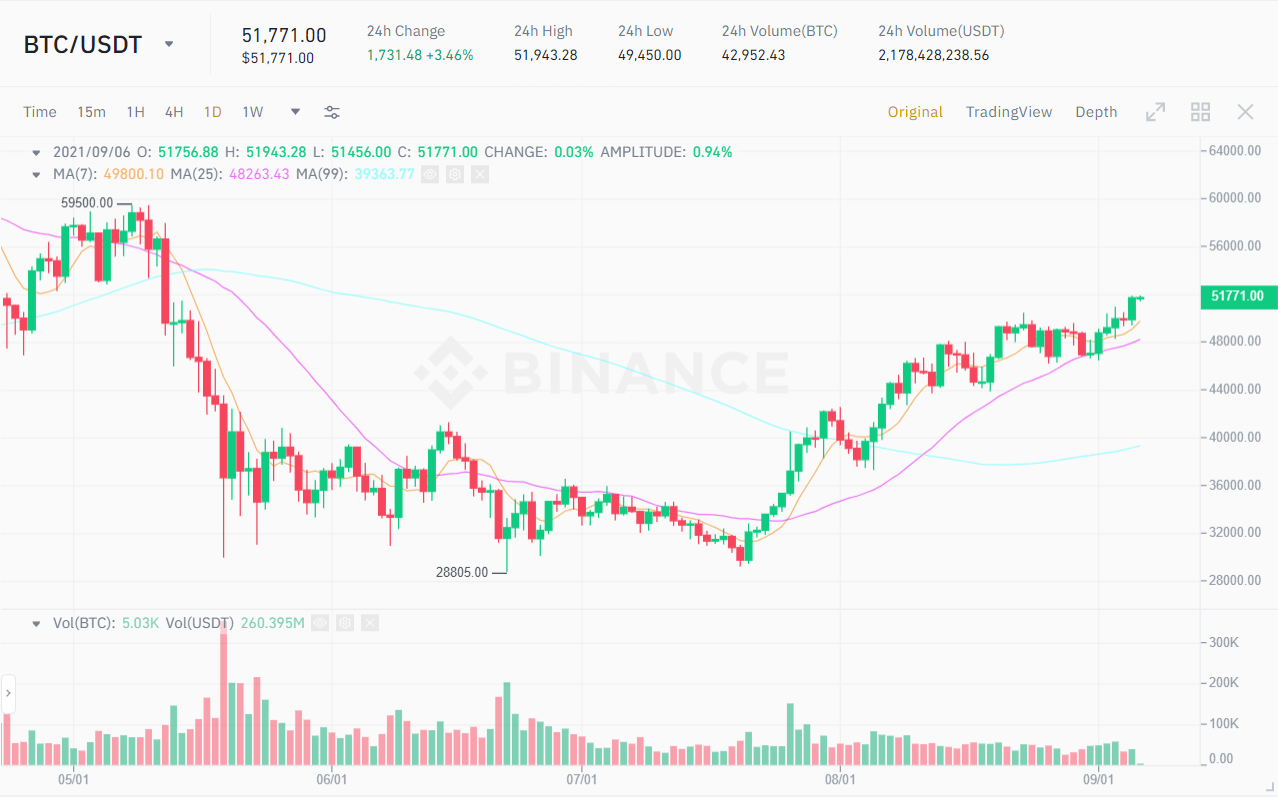

Bitcoin out of the blue approached $ 52,000, accelerating incredibly strongly to proceed the uptrend, this was as soon as deemed a solid help spot for BTC in advance of collapsing and turning into an spot of relative resistance at the second.

After Bitcoin’s return to $ 50,000, which bolstered self-assurance for an approaching altcoin season, BTC adapted incredibly swiftly to this selling price spot and continued to rise over $ 51,000 on September six. As of this creating, BTC is trading at USD 51,771.

– See additional: Bitcoin returns to $ 50,000, ADA breaks ATH, ETH accelerates – Altcoin beats?

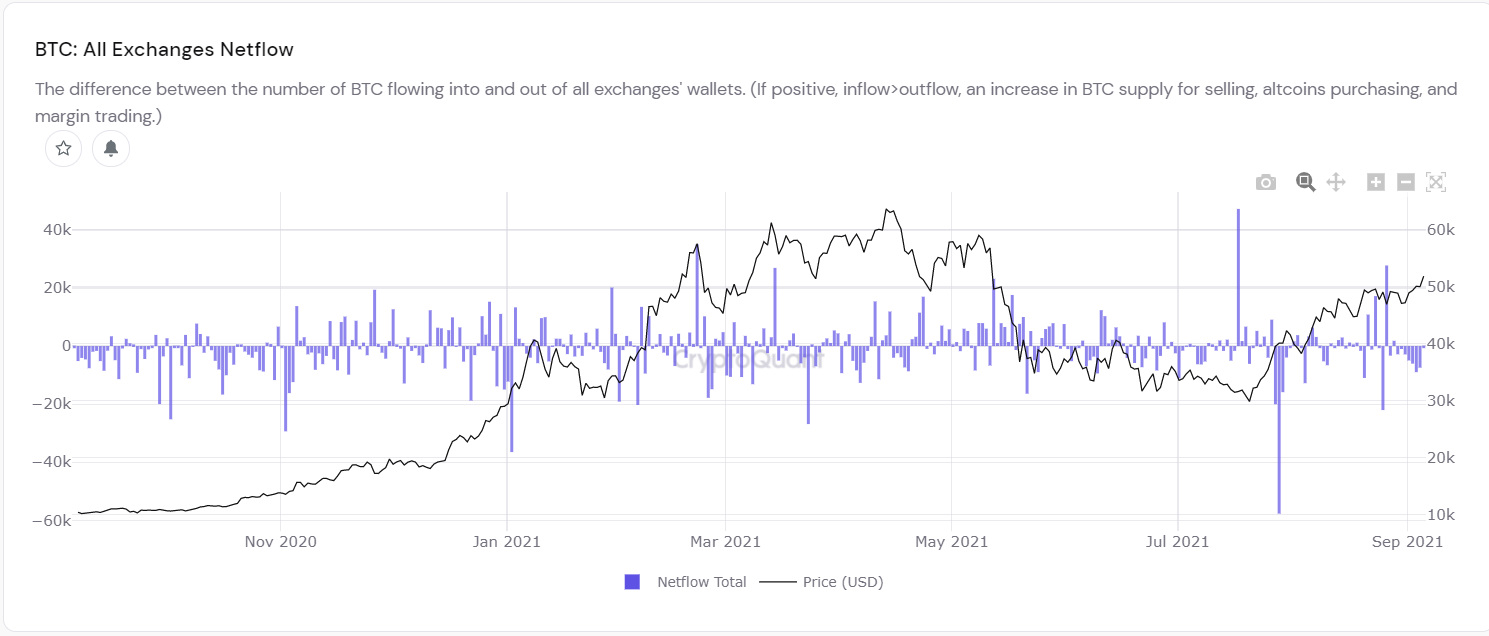

Although Bitcoin’s selling price conduct continues to rise, the volume of BTC on the exchanges has been constantly withdrawn in excess of the previous couple of days and there has been hardly any action to push BTC into the exchange, generating promoting stress. This demonstrates that, even with the existing BTC selling price over $ 51,000, institutional traders even now display the prospect of continuing to hoard for the extended-phrase aim.

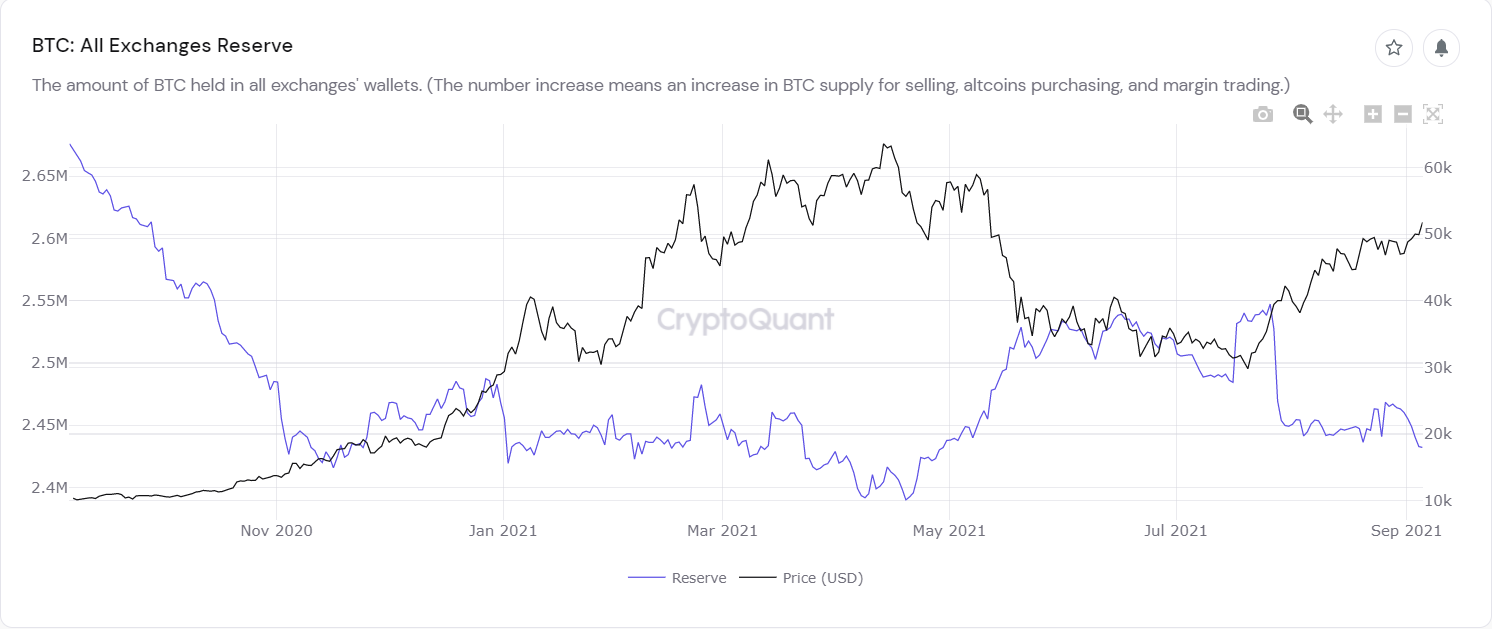

Along with that, BTC’s reserves on most exchanges are declining regardless of beneficial BTC selling price movements. The stock index is only a quick distance from the April milestone, when BTC and the total altcoin market place exploded. If the trend continues as it is and is sustainable, the provide shock is probably to peak, generating an vital stepping stone to open a super bullish cycle for BTC.

Another indicator we will need to spend interest to is Net Unrealized Profit and Loss (NUPL). NUPL was made to ascertain the complete revenue or reduction from the motion of a currency. To ascertain this, each and every coin in circulation balances the variation concerning the existing selling price and the final move selling price.

According to CryptoQuant information, anytime the NUPL line (blue line) enters the spot over .65, the quick response will be a “crash” shortly thereafter to restart the market place. Thankfully at the second, at the selling price of 51,000 USD, we are only at .fifty five – .six.

Synthetic currency 68

Maybe you are interested: