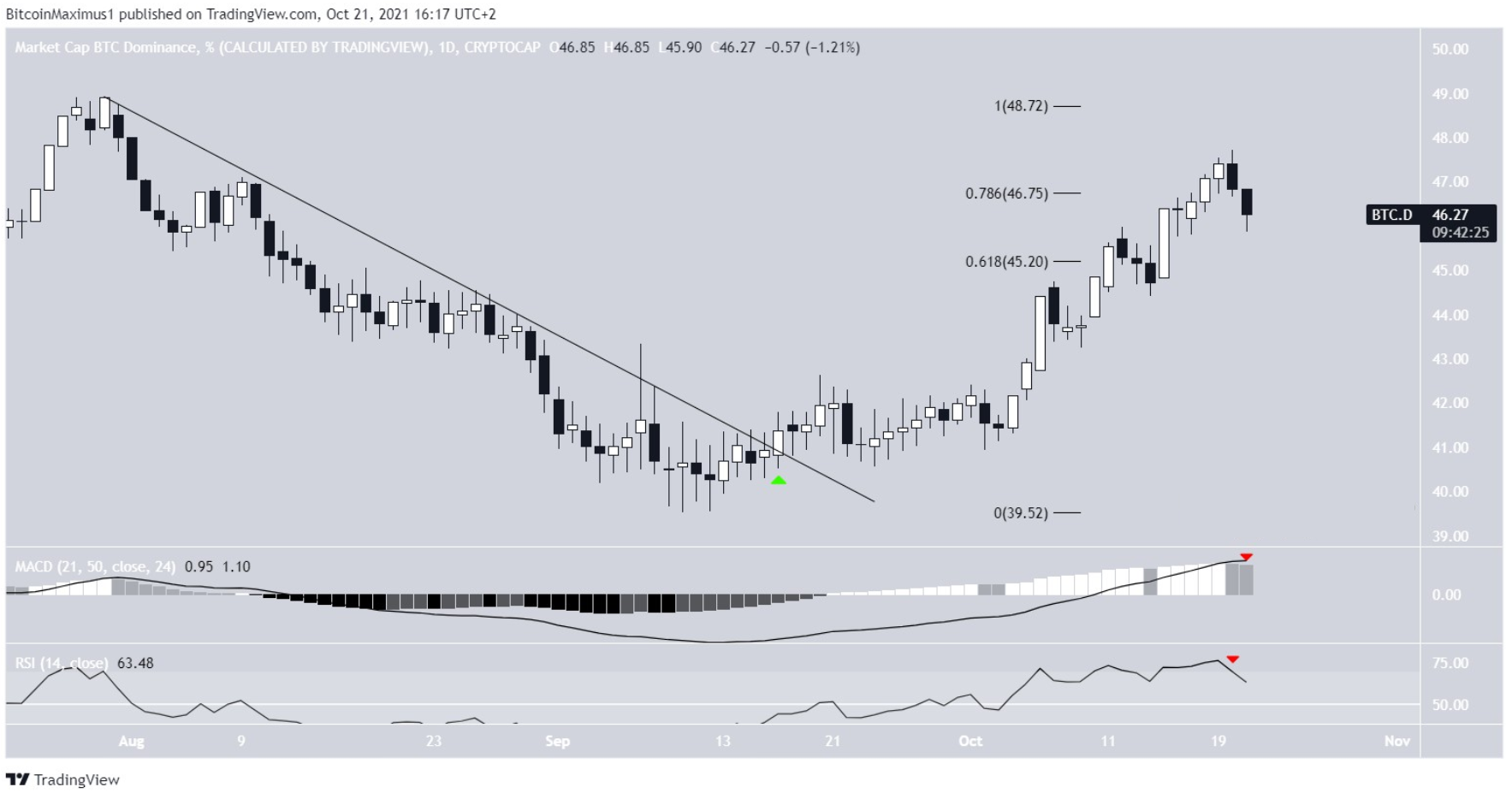

Bitcoin Dominance (BTCD) may perhaps have reversed its trend soon after hitting a minimal on September ten and commencing a new uptrend. However, the emergence of weakness could lead to a quick-phrase correction.

Today’s Outlook

BTCD has been growing at a speedy price considering that September 17 when it broke the descending resistance line (green symbol). This line has been established considering that July thirty.

The breakout exhibits that the earlier downtrend has ended. So far, the uptrend has resulted in a higher of 47.72%, reached on October twenty.

An raise is not the identical as a correction. This indicates that it is not a rebound in response to a earlier drop, but the starting of a new uptrend. The most important purpose for this is that BTCD broke via the .618 and .786 Fib resistance values.

If this move is a correction, BTCD will be rejected at one particular of these amounts and proceed to decline. However, there are indicators of weakness.

The MACD histogram exhibits a reduce momentum bar (red icon). This is a indicator that the quick-phrase trend is dropping velocity in contrast to the extended-phrase trend. However, considering that the MACD is even now in the optimistic zone, it indicates that the quick-phrase trend is normally more rapidly than the extended-phrase trend.

The RSI falls beneath 70 (red icon). RSI is an indicator of momentum and this drop exhibits that the trend is dropping power, despite the fact that it continues to rise.

Therefore, in spite of the uptrend, a quick-phrase correction is even now anticipated.

BTCD Daily Chart | Source: TradingView

Future BTCD motion

Trader @CryptoCapo_ outlined the BTCD chart and explained the uptrend could proceed to the 50% degree ahead of yet another drop happens.

Since the tweet, BTCD peaked at 48% ahead of falling.

The drop preceded the bearish divergence of RSI and MACD (blue line). This takes place when the selling price raise is not accompanied by upward momentum.

The most important funding parts are 44.one and 43.two%. These are the .five and .618 fib retracement help amounts that normally act as help soon after a pullback.

The to start with degree coincides with the midline of the ascending parallel channel, whilst the latter coincides with the help line of the channel.

BTCD six-hour chart | Source: TradingView

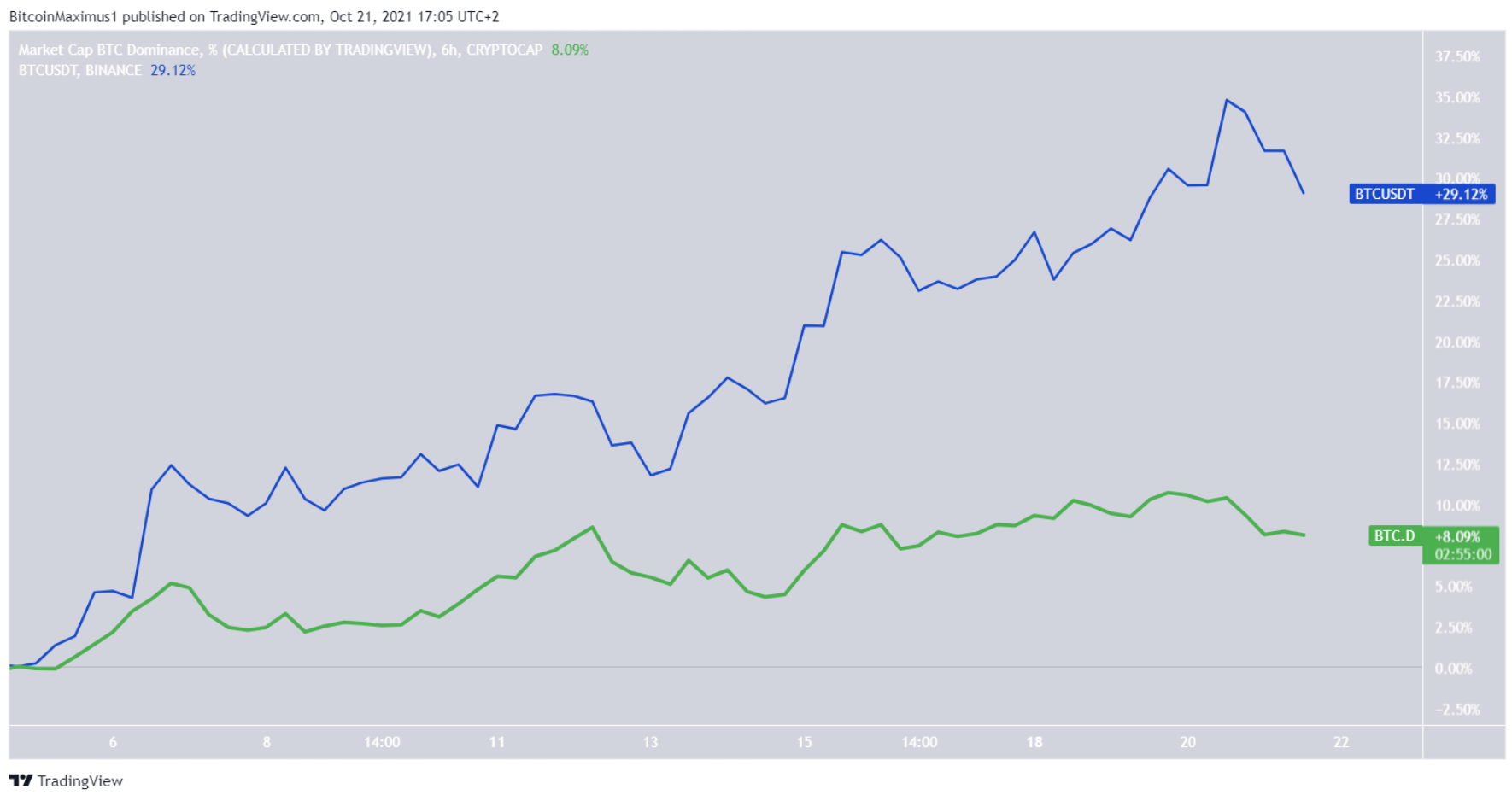

Relationship with BTC

Over the previous month, BTCD (green) has had a optimistic romance with BTC selling price (blue).

This indicates that an raise in one particular prospects to an raise in the other.

If the romance is in area, BTC selling price will decline with BTCD falling in the direction of the help amounts described over.

BTCD and BTC/USDT six-hour chart | Source: TradingView

You can see elements rates right here.

Join Bitcoin Telegram Magazine to comply with information and comment on this write-up: https://news.coincu.com

Disclaimer: This write-up is for informational functions only and is not investment suggestions. Investors need to do intensive exploration ahead of building a choice. We are not accountable for your investment choices.

SN_Nour

According to Beincrypto

Subscribe to Youtube channel | Crypto News | Follow the Facebook web page

.