The prospect of the United States integrating Bitcoin into its financial reserves remains the subject of fierce debate.

Many experts believe that this possibility is very low, especially in the short term, when uncertainty dominates discussions in the Cryptocurrency community.

Bitcoin reserve ratio drops as US policy analysts predict pushback

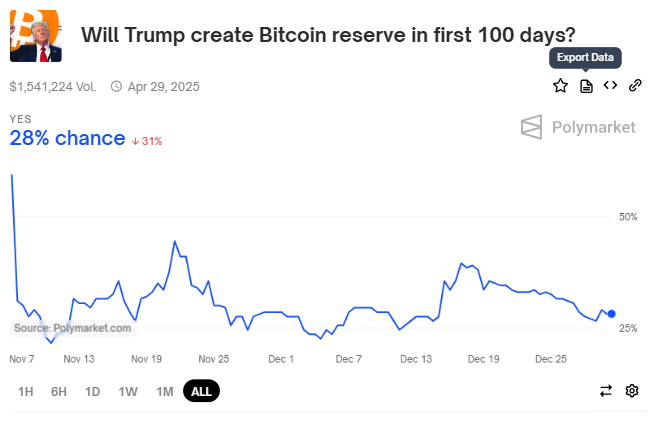

Prediction platforms and analysts offer mixed opinions on the possibility of Bitcoin joining the US reserve strategy. On Polymarket, users only rate a 29% chance that President-elect Donald Trump will introduce Bitcoin reserves in his first 100 days in office. This is a sharp decline from post-election optimism, when the rate reached 60%.

This decline reflects broader skepticism about Bitcoin’s place in US financial policy. Supporters see Bitcoin as a natural complement to existing reserves, like gold and oil. However, critics argue that political resistance and current economic conditions make such a move unfeasible.

Ki Young Ju, CEO of CryptoQuant, doubts the feasibility of the United States adopting Bitcoin as a reserve asset under Trump’s term. He suggested that such a change would only happen if the country’s global economic power was at great risk.

Ju drew parallels between today’s Bitcoin advocates and past campaigns to return to the gold standard. Both position alternative assets as the solution to economic uncertainties.

Yet historical trends show resistance to relying on a single asset. For example, calls to reestablish the gold standard in the late 1990s were rejected, and the United States chose to innovate its way out of economic challenges. Ju predicts Bitcoin could face similar rejection unless the country’s economic position weakens.

“If Trump succeeds in projecting U.S. economic power, consolidating dollar dominance, and raising his approval ratings, it is unclear whether he will maintain a strong pro-Bitcoin stance as shown in his campaign. He could easily back down from supporting Bitcoin, citing changing priorities, without alienating his voters,” Ju said.

Despite skepticism, some experts defend Bitcoin’s potential to reshape global finance. VanEck’s Mathew Sigel recently argued that the United States could reduce its national debt by up to 36% by 2050 through the adoption of Bitcoin Strategic Reserves. Sigel imagines Bitcoin becoming the leading settlement currency in global trade, especially for countries looking to bypass US sanctions.

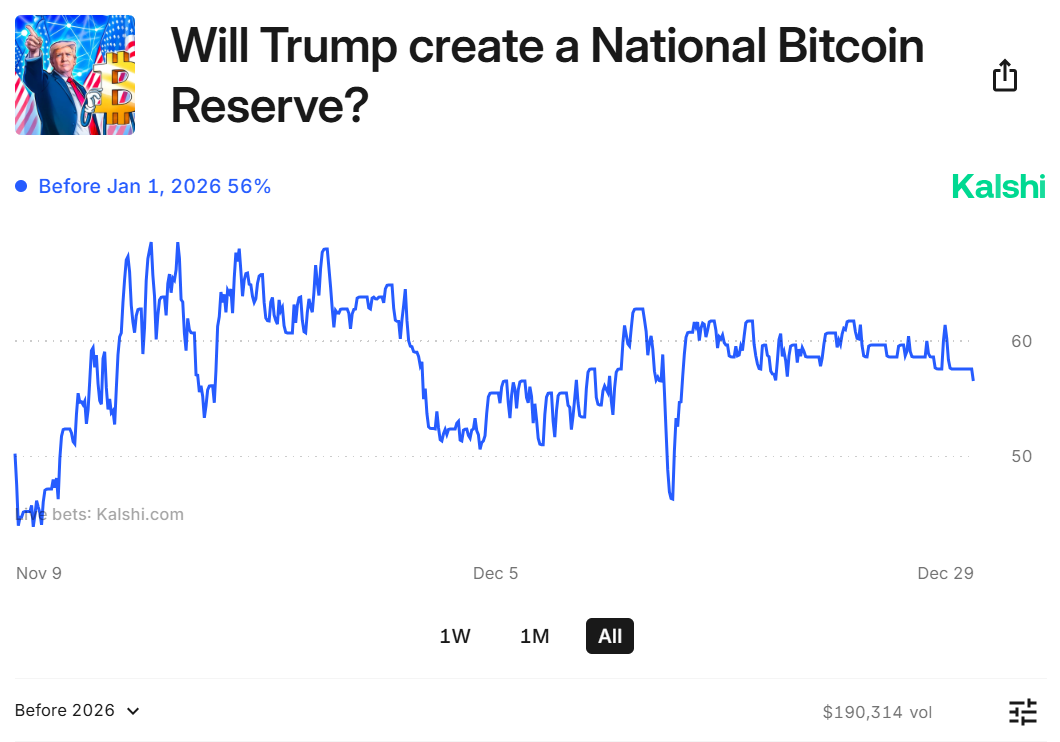

Meanwhile, some market watchers say the move could be made in 2026. Kalshi, a New York-based prediction market platform open to participants from the United States, rates the possibility The likelihood of this Bitcoin development occurring before January 2026 stands at 56%.