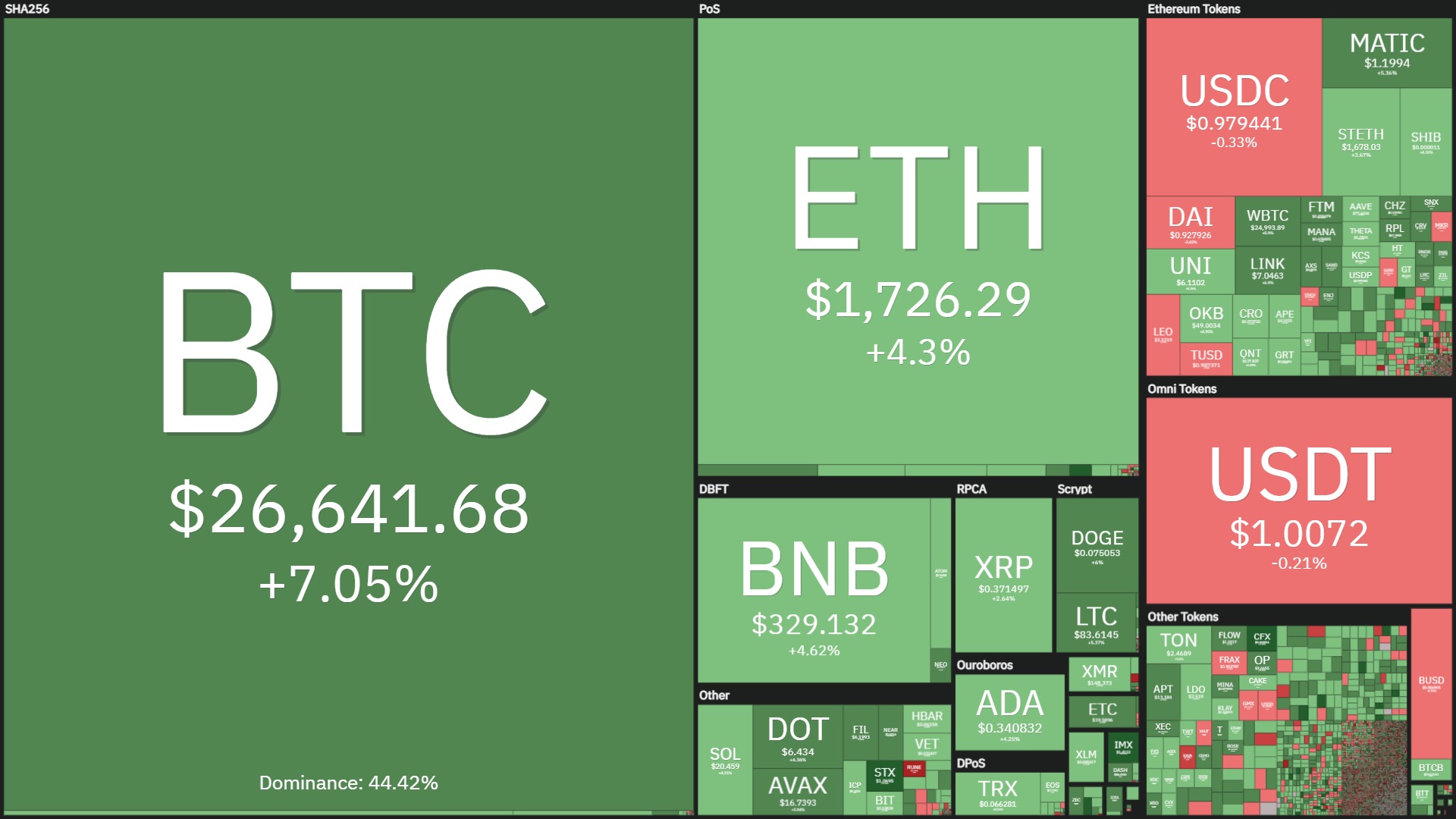

The world’s biggest cryptocurrency, Bitcoin, climbs to new 2023 highs on macro information from the Fed.

Bitcoin (BTC) rallied extra than seven% to $26,788 on the evening of March 17, surpassing its March 14 peak of $26,368 and setting a new 2023 worth record.

This is the highest worth threshold for Bitcoin due to the fact mid-June 2022, when the industry collapsed due to the fact the Three Arrows Capital fund ran into liquidity complications and then went bankrupt.

Bitcoin has had magnificent development momentum of up to 37% more than the previous seven days, from a very low of $19,549 on March ten to $26,788 on March 17.

BTC appropriate now a week in the past was even now “beaten” by a slew of negative information hitting the industry at the time, from curiosity fee details from the Fed chairman, the collapse of US banking institutions linked to the cryptocurrency sector, information that US imposes thirty% mining tax, Voyager sells assets, … and most importantly USDC depeg due to Silicon Valley Bank financial institution run and could not carry on to operate.

However, following the Fed and the US Department of Finance determined to stage in and bail out the financial institution, Bitcoin has constantly had solid up days.

More not too long ago, information from the US Federal Reserve demonstrates that the central financial institution of the world’s biggest economic climate pumped as substantially as $300 billion into the economic globe in just days. That sum is about half of the money withdrawn by the Fed for the duration of 2022, a time period of quantitative tightening and curiosity fee hikes in response to inflation, which is also the outcome of the Fed printing funds to conserve funds. in crisis due to the COVID-19 outbreak for the duration of 2020-2021, raising the funds provide from $four trillion to just about $9 trillion in significantly less than two many years.

Nearly half of the Fed’s quantitative tightening energy was wiped out in just one particular week. pic.twitter.com/G7unsEEOKj

— tedtalksmacro (@tedtalksmacro) March 16, 2023

There have been several opinions that ahead of the strain of the chain collapse of US banking institutions, the Fed will be forced to delay the approach of raising curiosity costs or at least slow the fee of curiosity fee hikes in the up coming meeting in the morning of 23/02.03 (Vietnam time). There are situations that even verify that this is the finish of the agency’s fee restriction policy.

Having extra USD in the industry will result in the US dollar to depreciate towards other assets like gold or cryptocurrencies, assisting them to enjoy, which is occurring appropriate now.

Another piece of information that also aided BTC climb was that exchange Binance announced earlier this week that it would be converting its BUSD one billion bailout fund into BTC, ETH and BNB to steer clear of the dangers of stablecoin, specifically when BUSD was warned by the US. Furthermore, the Mt. Gox asset trustee keeps moving the Bitcoin payment deadline to April, resulting in some BTC offering strain to ease in the industry.

The world’s 2nd-biggest cryptocurrency, Ethereum (ETH), edged up somewhat five% to $one,749, unable to surpass its March 14 peak of $one,780.

Most other substantial-cap altcoins are also up only four-six%, indicating that the rally noticed in the industry is fully driven by BTC.

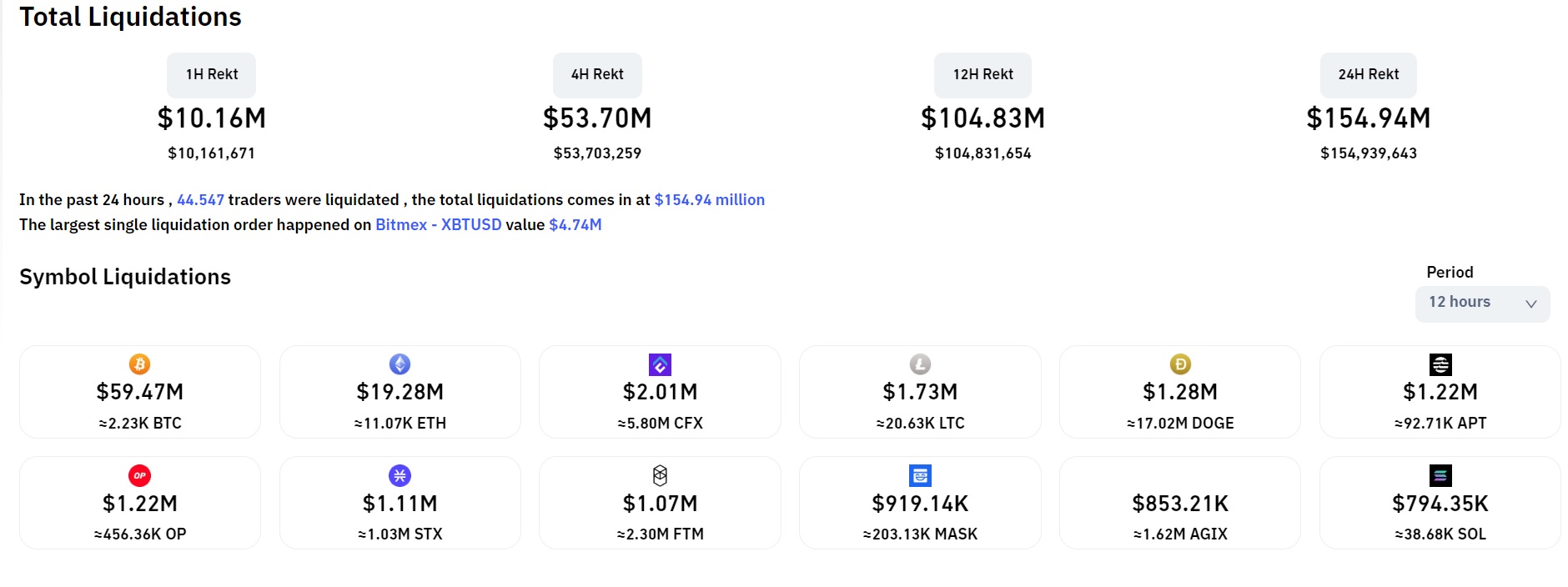

The liquidation fee more than the previous twelve hrs was 88% quick positions, with a complete worth of just about $105 million.

Synthetic currency68

Maybe you are interested: