[ad_1]

During the third week of December, Bitcoin experienced a 15% correction, marking the largest price drop in a single week since August. Experts say this decline is related to the following factors: macroeconomic factors of the global economy, and warns that Bitcoin could continue to decline if these pressures increase.

However, Bitcoin also has internal factors to offset negative effects from macroeconomics.

Global liquidity has declined over the past two months

According to The Kobeissi Letter, Bitcoin price has historically shown a 10-week lag correlation with the global money supply (Global M2). In the past two months, Global M2 has dropped $4.1 trillion, hinting at the possibility that Bitcoin prices will continue to decline if this trend lasts.

Global M2 is a key economic index that measures the total money supply in the global economy, including cash, demand deposits (M1), time deposits and other liquid assets. Global M2’s fluctuations often affect both the stock and cryptocurrency markets.

“When the global money supply hit a record $108.5 trillion in October, Bitcoin price hit a record high of $108K. However, over the past two months, money supply has fallen by $4.1 trillion to $104.4 trillion, the lowest level since August. If this relationship persists, this means Bitcoin price could drop up to 20K USD in the next few weeks.” – Forecast by The Kobeissi Letter .

A month ago, Joe Consorti, Head of Development at Bitcoin custody company Theya, warned of a possible Bitcoin correction of 20% to 25% based on similar indicators. That prediction appears to be coming true.

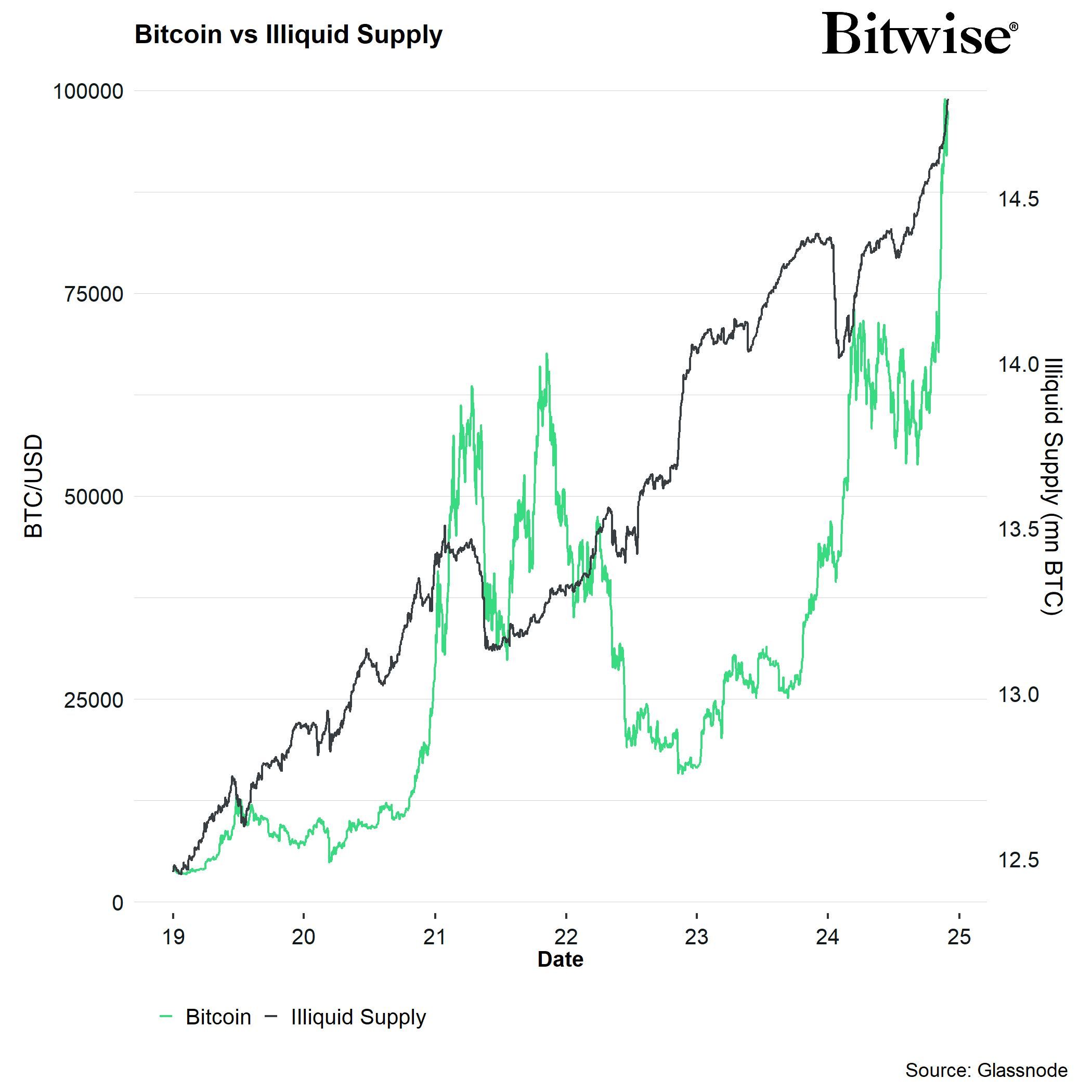

André Dragosch, Head of Research at Bitwise, shares a similar perspective. He predicts Bitcoin will continue to be under pressure due to increasingly tight liquidity in the United States. However, he emphasized a factor intrinsic to Bitcoin that could offset this liquidity squeeze: Bitcoin’s growing illiquid supply.

A higher illiquid supply suggests increased Bitcoin scarcity, potentially supporting the price according to supply-demand mechanics.

“Currently, Bitcoin is balancing between a) increased macro pressures from liquidity depletion in the US and globally, and b) ongoing on-chain factors from strong scarcity of BTC supply. Ultimately, positive on-chain factors will likely prevail over negative macro factors, but this is likely to create some volatility in early 2025 (and possibly some Attractive buying opportunity).” – André Dragosch comment.

Currently, Bitcoin price trades around 94K USD, with data from TinTucBitcoin showing the price dropped nearly 6% over the weekend.

General Bitcoin News

[ad_2]