According to the World Bank, approximately 1.4 billion adults globally still do not have access to banking services. The global financial system, despite its vast infrastructure, cannot serve the global population equitably on many fronts.

For many people, the glamorous promise of financial freedom is not just about surviving the daily struggle but also about inflation and documentation.

Bitcoin-Based Credit: A Lifeline for the Unbanked Worldwide

Millions of people remain underbanked or completely unbanked due to strict credit requirements, high fees, and limited access. From Palestinian refugees without citizenship documents, to single women without labor contracts in Egypt, to countless people facing record inflation of more than 120% in Argentina.

During the 2008 financial crisis, countless people in the US lost their homes due to brutal lending practices, illustrating the inherent instabilities in the system. Even today, high inflation erodes fiat savings, leaving consumers with fewer options in protecting their assets.

Meanwhile, small businesses around the world face rejection from banks due to rigid credit standards. One could say that money is the most violent political tool in the pockets of those in power.

This lack of equity and access demonstrates the urgent need for alternative financial systems. Bitcoin-based credit offers a viable solution that transcends the political agendas and economic constraints that keep the poor in poverty.

What Is a Bitcoin-Based Credit System?

Bitcoin-based credit systems allow borrowers to use their BTC holdings as collateral to borrow funds without having to sell their assets. These systems operate similarly to secured loans, where the borrower pledges an asset to access liquidity.

If the borrower fails to pay, the lender will liquidate the collateral to recover capital. Unlike traditional loans, these systems do not require a credit score or detailed documentation, making them more accessible to Cryptocurrency Holders.

“High inflation, currency devaluation, and low trust in centralized banks could boost demand for Bitcoin-based loans. Bitcoin’s stability and decentralization make it attractive in volatile economies, and DeFi platforms offer fewer barriers and better conditions than traditional lending,” Kevin Charles, Open Bitcoin Credit Protocol co-founder spoke in an interview with TinTucBitcoin.

The market for Bitcoin-based credit has grown, with key players such as BlockFi, Ledn, Celsius, and Nexo leading the way. These platforms allow users to maintain exposure to BTC while accessing liquidity in the form of fiat currency or stablecoins. The simplicity and appeal of these systems has fueled their adoption in recent years, the reason they have weathered bear markets unscathed.

A big advantage of BTC-based credit is the ability of Bitcoin to retain its value as prices rise. Borrowers can unlock liquidity without selling their BTC, allowing them to benefit from long-term price upside potential.

Additionally, Bitcoin-based loans act as a way to combat inflation by providing an alternative to increasingly devaluing fiat currencies. A Cryptocurrency Holder in Argentina, for example, can protect himself against the decline of the national currency and even earn extra money.

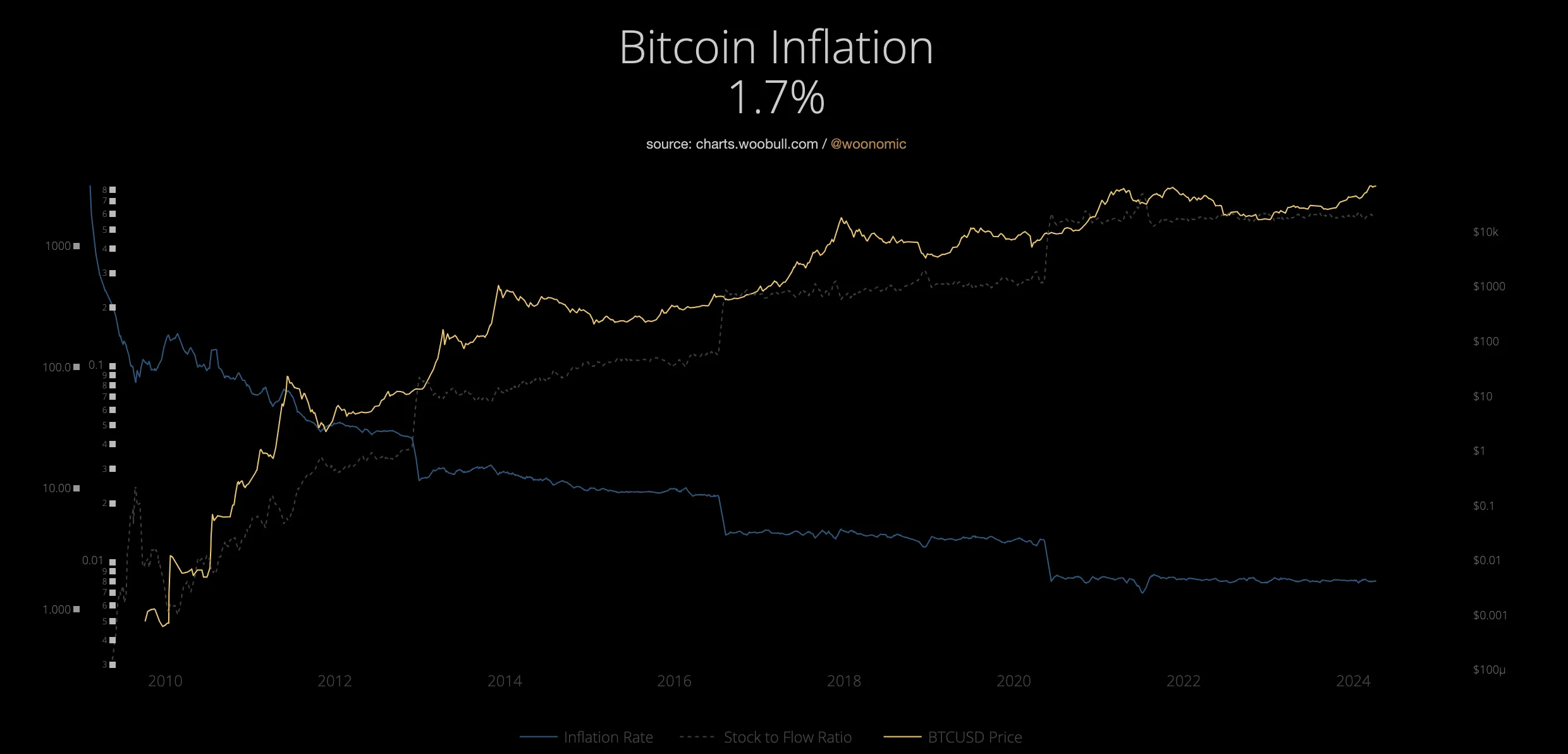

According to Bankrate, USD currently has an inflation rate of 2.4%, the lowest since February 2021. Meanwhile, BTC only has an inflation rate of 1.7%.

BTC-based loan systems also promote financial accessibility. Unlike traditional banks that require strict credit checks, Bitcoin-based credit platforms primarily assess the value of collateral. This approach is open to individuals in areas with limited banking infrastructure, providing an escape route for the unbanked.

For those committed to the spirit of decentralization, global inclusivity is the real selling point. Bitcoin-based credit has the potential to provide financial services to these populations, bridging the gap left by traditional systems. Central banks and global financial institutions keep a close eye on constant political changes.

In a country like Lebanon, where residents mainly trade in USD because the LBP currency is almost dead, people were banned from withdrawing their USD when the central bank encountered a USD shortage. According to conversion, one USD is equivalent to 89,550 LBP. In Egypt, rumors of withheld USD accounts also circulated before being denied by central bank officials.

“Bitcoin-based credit operates on a global, decentralized network, meaning access is not dependent on income, location, or credit history. By using Bitcoin as collateral, anyone who holds the asset can access a loan without the need for traditional gateways. DeFi platforms show increased adoption in areas with limited access to banking, highlighting the potential for financial inclusion,” Charles added.

However, despite all these advantages, the principle of duality is still the law of the universe. Bitcoin-based credit systems are not a magic solution; they carry significant risks.

The biggest concern is Bitcoin’s price volatility. A sudden drop in BTC value could trigger margin calls, forcing borrowers to add collateral or face collateral liquidation. During the 2022 Cryptocurrency market crisis, countless borrowers lost their collateral as prices plummeted. According to Charles, there are ways to reduce volatility.

“Volatility is managed through overcollateralization and automatic liquidation. By requiring more collateral than the loan value, platforms create a cushion against price drops. Additionally, real-time monitoring ensures that loans are adjusted to market conditions, maintaining stability even when prices plummet,” Charles added.

The Three-Eyed Trojan Horse: The Return of Focus

Still, Bitcoin-based credit systems have socio-economic implications worth considering. The first is that although these platforms democratize access to credit for Cryptocurrency Holders, they risk creating new financial regulators. Wealthy Cryptocurrency investors, or “Cryptocurrency whales,” have the best chance of benefiting, while average users with limited holdings may be excluded.

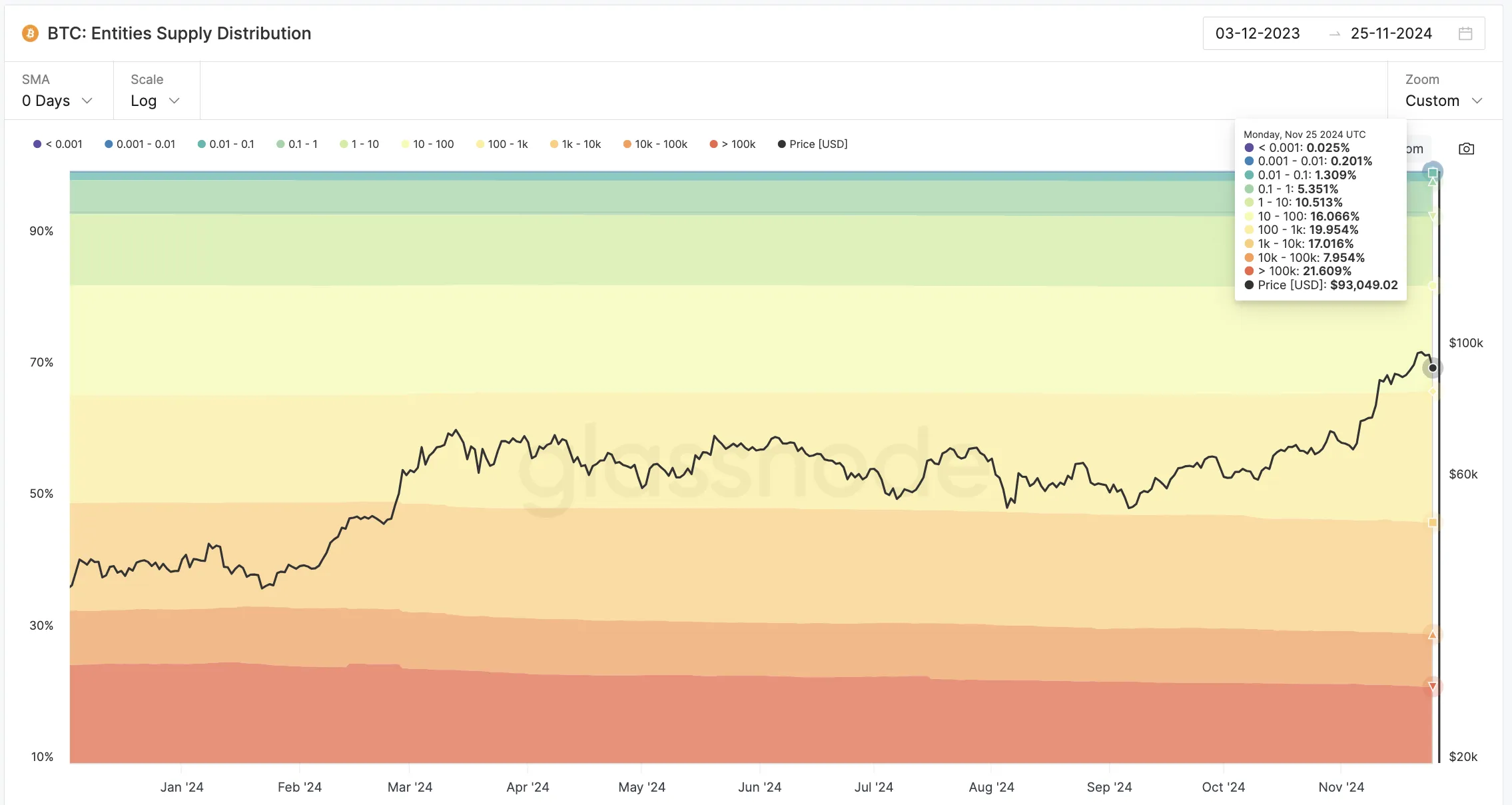

Whales, or addresses holding more than 100K BTC, hold 21% of the total Bitcoin supply. This move also maintains asset concentration in the Cryptocurrency space. If that happens, we can say goodbye to the promise of inclusion.

The second concern is traditional financial institutions. They are increasingly entering the Bitcoin-based credit market through acquisitions and regulatory influence.

Banks such as Goldman Sachs and JPMorgan have begun researching crypto-collateralized lending, signaling an integration between DeFi and traditional. In November, Bloomberg reported that Goldman Sachs is preparing to launch a new company focused on digital assets. While these developments provide legitimacy, they also raise concerns about usurpation of Bitcoin’s decentralized nature.

Then the 3rd and final Trojan horse: government surveillance. It brings both opportunities and challenges to Bitcoin-based credit systems.

Regulation could legitimize these platforms, ensuring consumer protection and stability. However, over-regulation can slow down innovation and obscure the decentralized nature.

For example, the European Union’s MiCA framework introduced clear but also strict compliance requirements, causing conflicts within the Cryptocurrency industry. Binance, the world’s largest cryptocurrency exchange by trading volume, had to disable copy trading services for European users in June after MiCA was announced.

Another issue that could impact accessibility is know-your-customer (KYC) standards, which could deter people from relying on Cryptocurrency wallets because they lack adequate personal documentation. Lawmakers often argue that platforms that do not strictly monitor KYC risk assisting criminals in money laundering activities. In 2023, Türkiye even enacted a new Cryptocurrency law to tighten KYC standards.

“We are witnessing a refocusing of a system designed for freedom. The challenge is to find a balance without diluting Bitcoin’s core principles,” Charles offers.

Platforms like Aave and Sovryn demonstrate a decentralized approach to Bitcoin-based credit. These systems rely on smart contracts to automate transactions, reduce the need for middlemen, and ensure transparency. However, decentralization also has its own challenges, including scalability, security vulnerabilities, and regulatory gray areas.

Yet success stories still exist. Borrowers have used Bitcoin-based loans to fund businesses, pay medical bills, or navigate economic uncertainty without selling their BTC. Conversely, others have experienced significant drops due to liquidations in bearish markets, emphasizing the high stakes of these systems.

Ultimately, Bitcoin-based credit represents both a financial revolution and a cautionary tale. Its future depends on its ability to scale, maintain accessibility, and adhere to the decentralized spirit of Bitcoin.

As traditional finance enters the space and regulatory frameworks evolve, the challenge will be to maintain a balance between innovation and inclusivity. Whether these systems democratize finance or simply transform gatekeepers remains to be seen.