The world’s variety one cryptocurrency, Bitcoin, has hit a very low considering the fact that February three right after tensions concerning Russia and Ukraine started to rise once again.

At dawn on February 22, Bitcoin (BTC) corrected to $ 36,800, the lowest degree recorded considering the fact that February three.

In addition to the unfavorable macroeconomic problem with the dread that the Fed is about to increase curiosity costs to curb the inflationary momentum in the United States, the purpose for this lower derives from the most recent developments all over the chance of a possible international financial crisis. concerning Russia and Ukraine. Specifically, President Putin has just signed a decree recognizing the independence of Donetsk and Luhansk, two territories in eastern Ukraine occupied by separatists considering the fact that 2014.

Immediately, Western nations reacted to the new aggression from Russia. The Biden administration has pledged to impose sanctions, fiscal embargoes on the two republics of Donetsk and Luhansk, and extra harshly on Russia itself. Meanwhile, the European Commission has known as Russia’s actions “a flagrant violation of international law, the territorial integrity of Ukraine and the Minsk agreements”.

Tensions in the Russian-Ukrainian border location have proven no indications of cooling, as massive numbers of Russian soldiers and highly effective military products carry on to pour into this location, raising worries that Russia could quickly invade. of President Volodymyr Zelensky’s administration from continuing to lean in direction of the West and join NATO.

Not only the international fiscal sector, but also the cryptocurrency marketplace has reacted negatively to the over information.

In the previous 24 hrs, Bitcoin as soon as misplaced almost $ two,700 in worth when it hit a 3-week very low of $ 36,800.

And when calculated from the February peak of $ 45,821 reached on February ten, the # one cryptocurrency. one in the globe fell by 19.68%, or almost half of its worth.

However, if you seem at the value chart, you can see that BTC’s downward momentum is uneven. Instead, right after every sharp decline, the value has even now rebounded of the similar intensity, demonstrating that there is even now a portion of spot traders even now waiting for this kind of corrections to invest in extra.

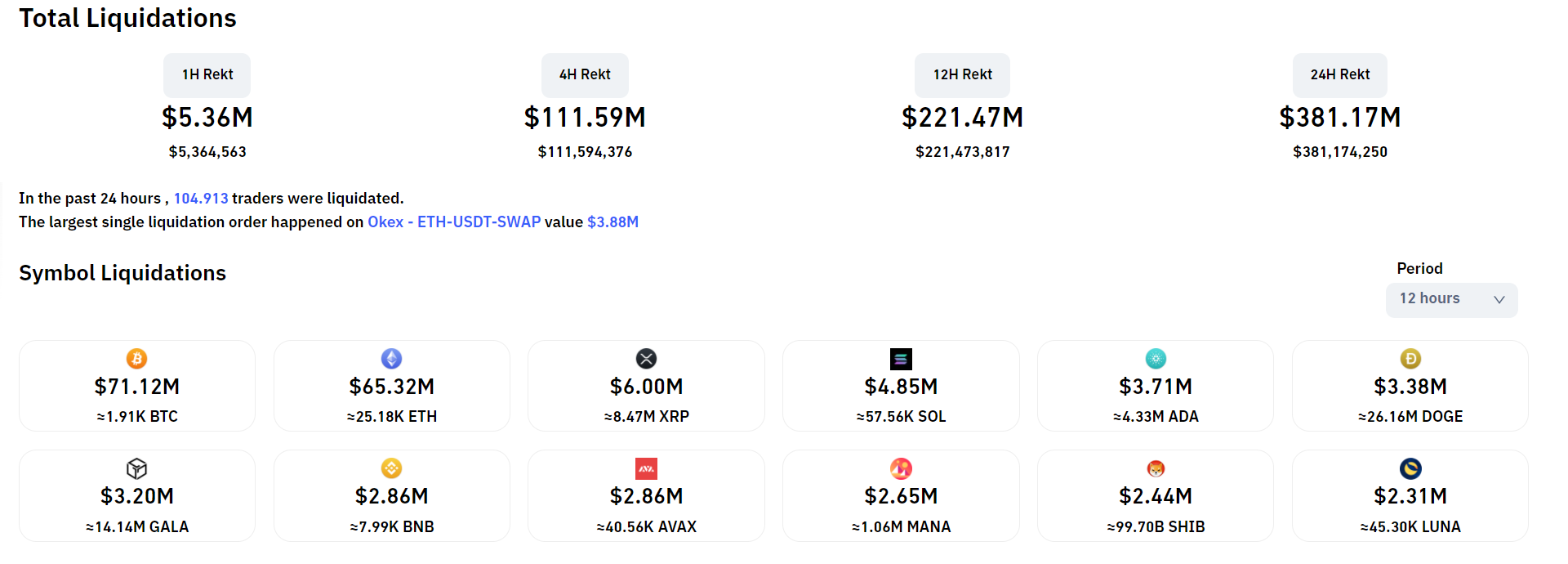

However, it really is one thing futures traders never want. According to information from Coinglass, almost $ 224 million really worth of futures orders have been cleared in the previous 24 hrs, focusing on significant currencies this kind of as BTC and ETH. However, in contrast to earlier marketplace declines, the prolonged purchase liquidation charge was only 64%, displaying that a lot of brief orders had been burned out mainly because the ups and downs did not observe the speed of the marketplace.

Similar to Bitcoin, other significant altcoins this kind of as ETH, ADA, SOL, AVAX at present charges are seeing double-digit declines considering the fact that their peak on February 10th.

Summary of Coinlive

Maybe you are interested: