- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Recent Bitcoin sell-off led to significant ETF investor losses.

- Outflows surpass $3 billion, affecting crypto market dynamics.

Bitcoin sell-off in November 2025 has pushed US spot Bitcoin ETF investors into losses, with significant outflows including a record $523 million from BlackRock’s IBIT.

ETF redemptions erase past gains, spooking crypto markets. Key issuers like BlackRock report heavy withdrawals, reflecting investor caution as Bitcoin trades below $90,000.

Recent Bitcoin sell-off has caused US spot Bitcoin ETF investors to face losses. In November 2025, nearly $3 billion in outflows occurred, impacting prominent ETFs, including BlackRock’s IBIT, with record redemptions erasing previous inflows.

Key industry players involved include BlackRock, Fidelity, Ark Invest, and Grayscale. BlackRock’s iShares Bitcoin Trust accounted for a significant $523 million outflow. These events have triggered broader caution across the crypto markets.

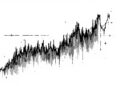

The immediate effects include a downturn in Bitcoin prices, falling below $90,000. This has put average ETF investors underwater, reflecting financial shifts and market volatility. Institutional ETF flows peaked early in 2025 and declined significantly.

Institutional and retail investors faced substantial losses. Analysts point to macroeconomic risks and liquidity challenges as contributing factors. The sell-off highlights the cyclical nature of crypto adoption, cautions analysts and investors.

Brian Armstrong, CEO, Coinbase, – “Recent ETF outflows highlight the cyclical nature of crypto adoption. Long-term fundamentals remain unchanged.”

Market analysts predict potential long-term market stabilization if inflow patterns reverse. On-chain data shows “smart money” traders are positioning with heightened caution amid present market uncertainties. ETF impacts extend to Ethereum and Solana with differing market responses.

Historical data indicates previous ETF outflows have led to short-term volatility, with February 2025 seeing a record monthly outflow. Regulatory and institutional responses may also shape future investor confidence in crypto-ETF products.