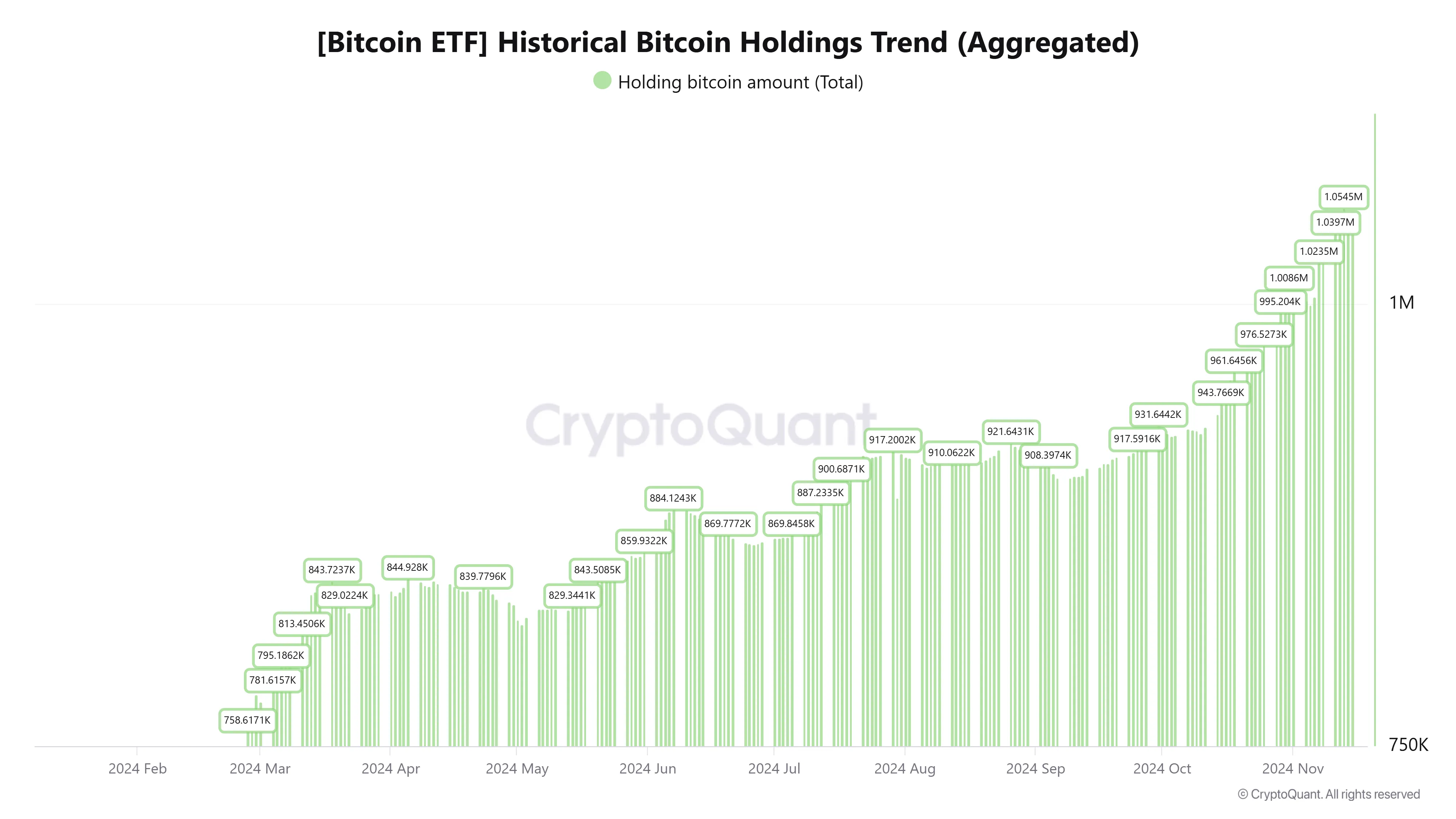

The prominent growth of spot Bitcoin ETFs is reshaping the cryptocurrency market. A CryptoQuant analyst, MAC_D, has revealed that these funds now hold 5.33% of the total mined BTC supply — a significant jump from the 3.15% recorded in January.

This marks an addition of 425K BTC in ten months, highlighting increased demand for real asset-backed Bitcoin ETFs.

Bitcoin ETF Accumulation Drives BTC Price Growth

The analyst highlights the strong correlation between Bitcoin accumulation by spot ETFs and its price movements. This trend was especially pronounced during Bitcoin’s bullish periods in March and October 1, driven by large inflows into ETFs and positive market sentiment.

“Spot ETF volume increased by +425K BTC to 629.9K BTC → 1.0545 million BTC in January when trading began. This is a 2.18% increase in just 10 months, from 3.15% → 5.33% of the total mined supply of 19.78 million BTC. Looking at March and October, with strong price increases, we can see that there is a strong connection between cumulative increases and prices,” the analyst said. explain in a post on X.

Indeed, in March, US-listed Bitcoin ETFs saw net inflows of an estimated $4 billion, while pushing trading volume to $111 billion — a nearly threefold increase from the month 2. During the same period, Bitcoin price jumped to a record level of over 73,777 USD on Coinbase.

Similarly, in October, following the re-election of Donald Trump and rising expectations of regulatory support for cryptocurrencies, Bitcoin surpassed $93,265 on Binance, marking its highest ever. its now.

“The more Bitcoin accumulated in spot ETFs, the stronger the price,” MAC_D added.

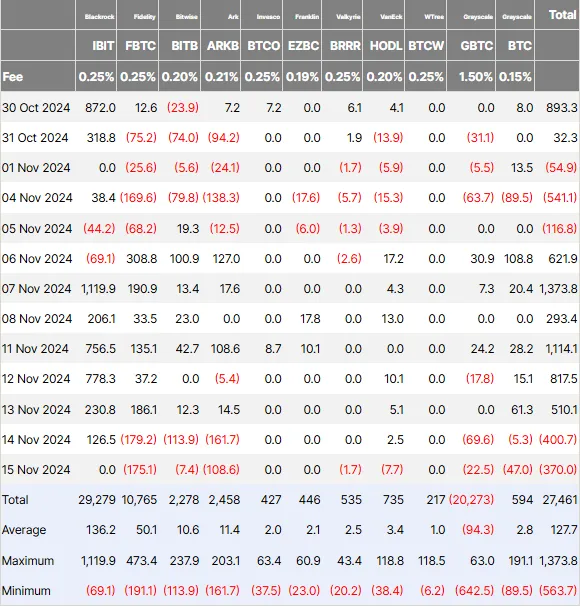

BlackRock’s iShares Bitcoin Trust (IBIT) continues to dominate the spot ETF market. Recent data shows the fund has surpassed $40 billion in assets, accounting for more than $3 billion in net inflows since October 6.

Although the US Bitcoin ETF market performed mixed this week, IBIT added $2 billion in net inflows, consolidating its leadership position.

Overall, Bitcoin ETFs in the US recorded $2.4 billion in inflows in the first half of last week. However, buybacks on Thursday and Friday cut the week’s net inflows to $1.6 billion as shown above.

Favorable regulatory conditions drive EPF growth

The increase in Bitcoin ETF adoption is closely linked to changes in the regulatory framework. Recently, the US Securities Exchange Commission (SEC) approved Bitcoin ETF options. This milestone coincides with recent progress from the Commodity Futures Trading Commission (CFTC), paving the way for spot Bitcoin options trading.

More recently, the SEC and CFTC approved the listing of the environmentally conscious 7RCC Bitcoin Futures and Carbon Credits ETF. These developments, when considered together, continue to strengthen the legal position of spot Bitcoin ETFs, enhancing their appeal to institutional investors. Support from these regulations plays an important role in promoting confidence and attracting capital to the market.

Optimism surrounding the favorable regulatory environment under the new US administration has also boosted capital flows into the Bitcoin ETF. This, in turn, has amplified expectations of supportive policies for the digital asset industry, thereby accelerating Bitcoin adoption through ETFs. TinTucBitcoin recently reported that Bitcoin ETFs are now present in 60% of the top portfolios of US hedge funds.

The role of macroeconomic factors, such as Federal Reserve policy and US elections, cannot be overlooked. As the Fed’s monetary tightening cools, risk assets like Bitcoin are regaining favor.

Looking ahead, analysts predict that increased adoption of spot Bitcoin ETFs could pave the way for Bitcoin’s recognition as a reserve asset. If the US government adopts this trend, capital flows into ETFs are expected to increase further, strengthening Bitcoin’s position in the global financial system.

Meanwhile, the growing proportion of Bitcoin held by spot ETFs is having broader implications for the cryptocurrency market. By controlling more than 5% of Bitcoin’s supply, these funds are stabilizing liquidity while potentially reducing market volatility.

Still, there are concerns about institutional control of Bitcoin, as this would go against the pioneering cryptocurrency’s original decentralized spirit.

“Doesn’t this take away the meaning of ‘decentralization’? BlackRock will become the largest rights holder, this couldn’t get more centralized,” said user X sarcastic.