Bitcoin (BTC) has experienced a slowdown in its recent price rise, struggling to reach its highly anticipated price mark of $100,000. The cryptocurrency has remained below this mark for the past few days, leading investors to speculate on its short-term price movements.

Despite this, several prominent crypto analysts remain optimistic about Bitcoin’s prospects in October. This analysis explores some of their predictions.

Analysts Say Bitcoin Could Surpass $100,000

According to Juan Pellicer, Senior Researcher at IntoTheBlock, October will be positive for Bitcoin. This price increase will be driven by “unprecedented institutional demand through inflows into Bitcoin ETFs,” which will take the coin’s price past $100,000.

“We are observing an extremely bullish case for Bitcoin entering October February, primarily driven by unprecedented institutional demand through inflows into Bitcoin ETFs. The increase in institutional participation, coupled with a significant reduction in macroeconomic pressures, puts BTC in a favorable position for a jump beyond $100K. The current market structure suggests periods of strong accumulation,” the analyst told TinTucBitcoin.

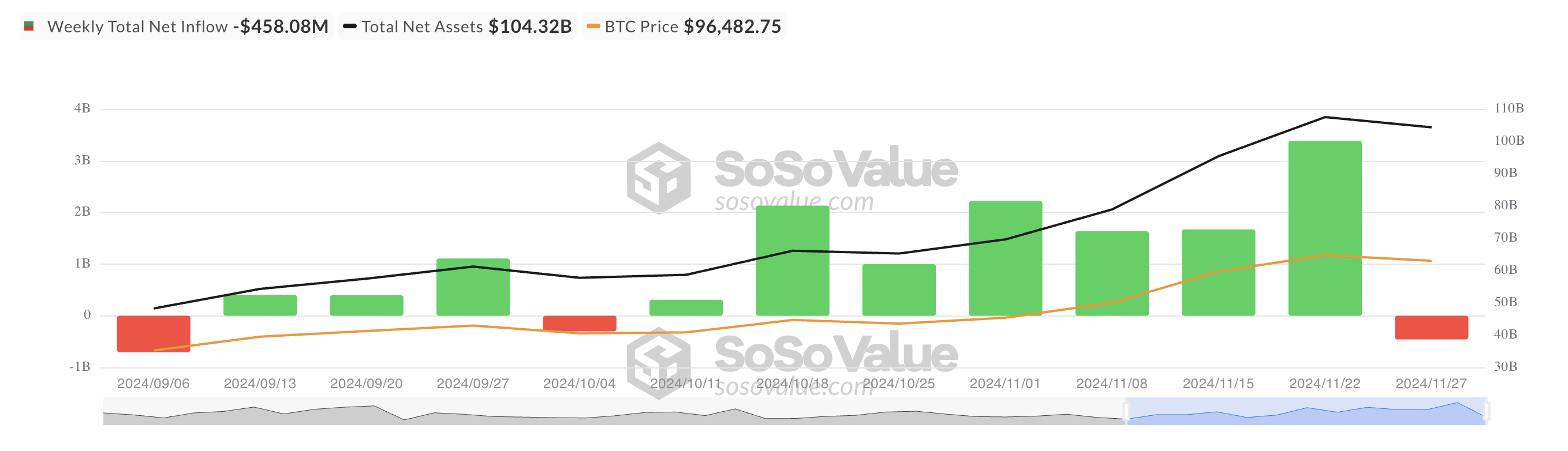

Interestingly, this week, Bitcoin ETFs recorded their first net outflows in two months. According to SoSoValue, capital outflows from these funds have reached 458 million USD. This drop comes on the heels of a significant drop in BTC price, which traded as low as $92,000 earlier this week. This price correction may have stimulated institutional investors to withdraw capital from these ETFs in response to market movements.

However, another analyst, Mr. Brian Quinlivan, Chief Analyst at Santiment, predicted an optimistic February for Bitcoin. According to Quinlivan, Bitcoin whales will fuel this growth if they continue to accumulate the king coin.

“Key BTC holders (wallets with more than 10 BTC) accumulated an additional 63,922 BTC in October alone, worth $6.06 billion. Even though the peak prices occurred on Friday, they haven’t slowed down in their accumulation rate at all. This should be seen as a positive sign that this slight pullback is just a small correction aimed at eliminating weak hands and traders buying at 98K/99K USD,” Quinlivan commented. .

BTC Price Prediction: This Support Level Is Key

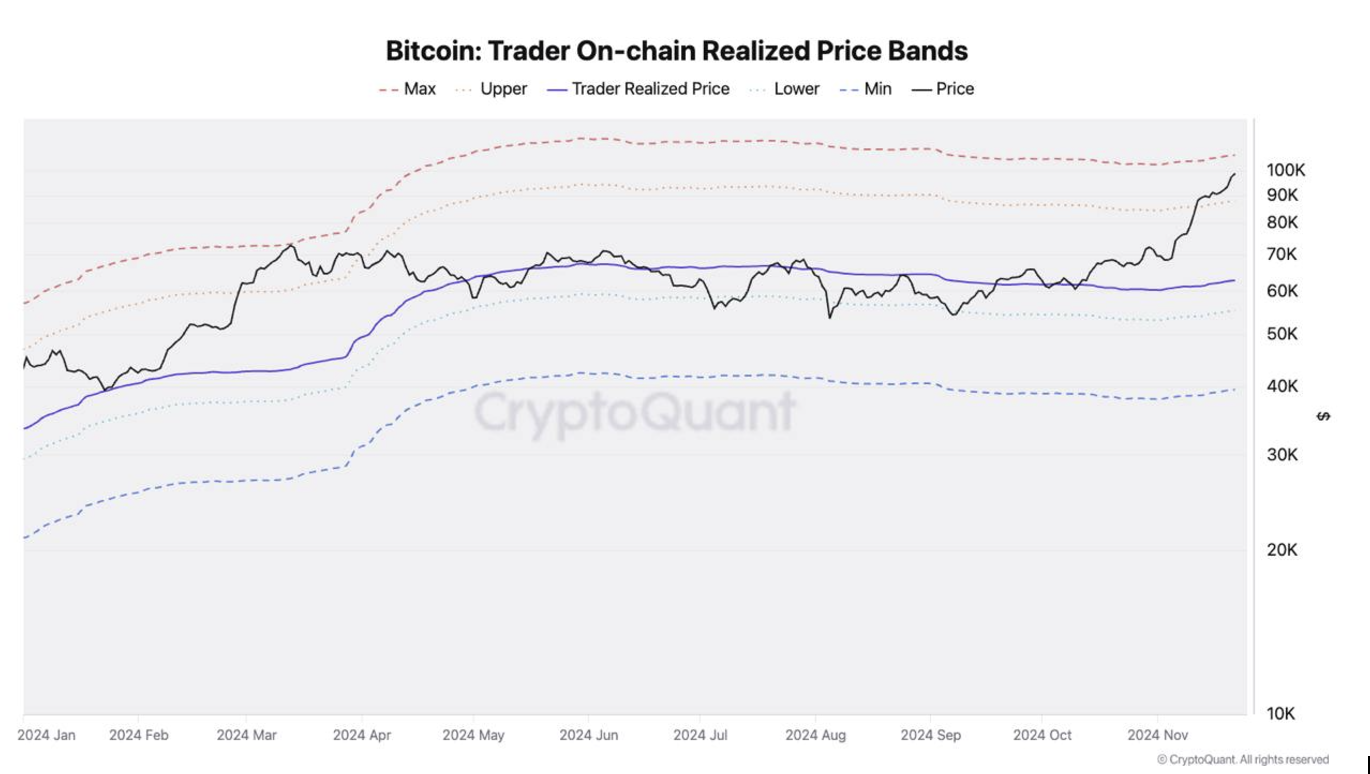

However, while agreeing that Bitcoin price could surpass $100,000 in October, Julio Moreno, Head of Research at CryptoQuant, opined that the coin could encounter short-term resistance at $105,000. .

According to Moreno, analysis of BTC’s actual on-chain freeze revealed that the freeze near $105,000 (max ice) was a key resistance level back in March when Bitcoin briefly reached $74,000. This historical resistance level could influence the coin’s future price movements.

This means that as BTC price approaches the maximum band around $105,000, it could witness a correction.

Currently, Bitcoin trades at $96,795. For the $100,000 predictions to come true, the coin needs to reclaim its high at $99,588, which has become a resistance level, and turn it into a support platform. If this happens, the coin could surpass $100,000 in October.

On the other hand, if selling pressure spikes, BTC price could fall towards $88,986, invalidating analysts’ positive predictions.