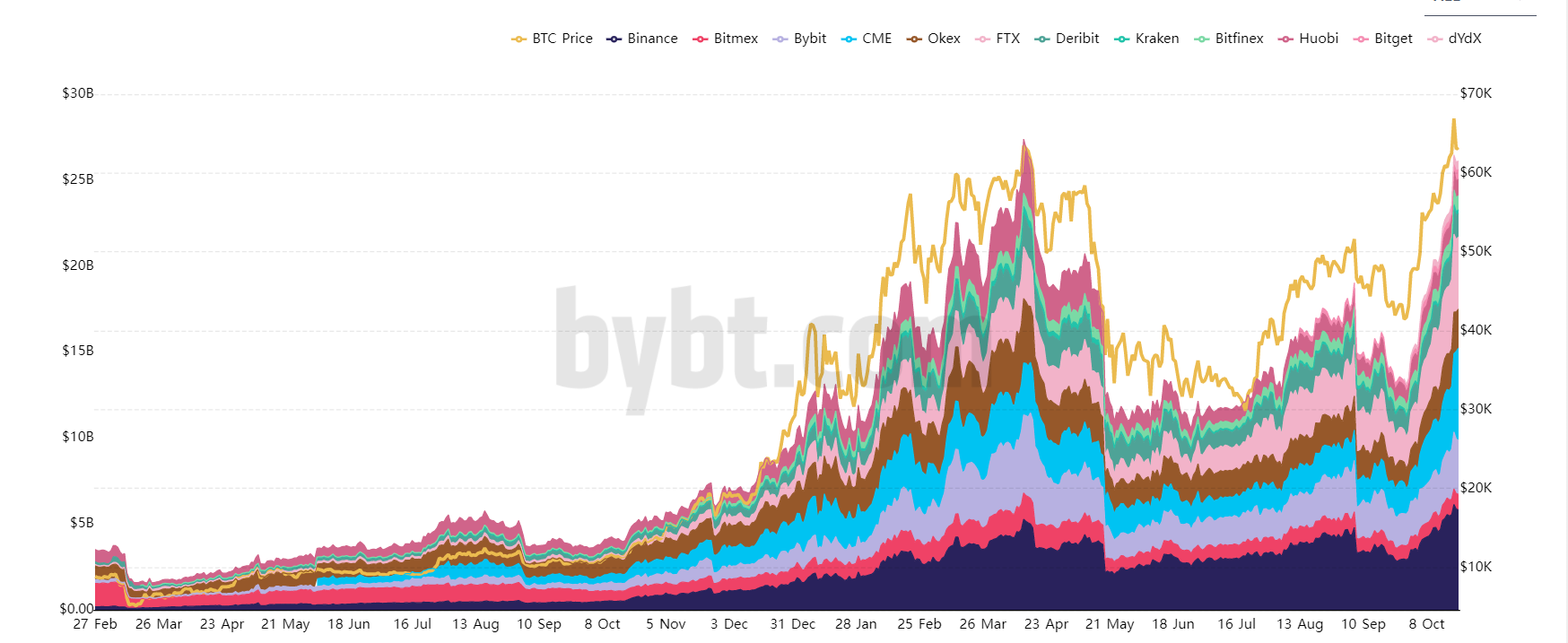

Aggregate open curiosity in Bitcoin futures on the world’s biggest exchanges has returned to an all-time higher ahead of BTC’s current bull run.

As of now, complete open curiosity for Bitcoin futures is $ 27.two billion, somewhat much less than the $ 27.38 billion recorded in mid-April.

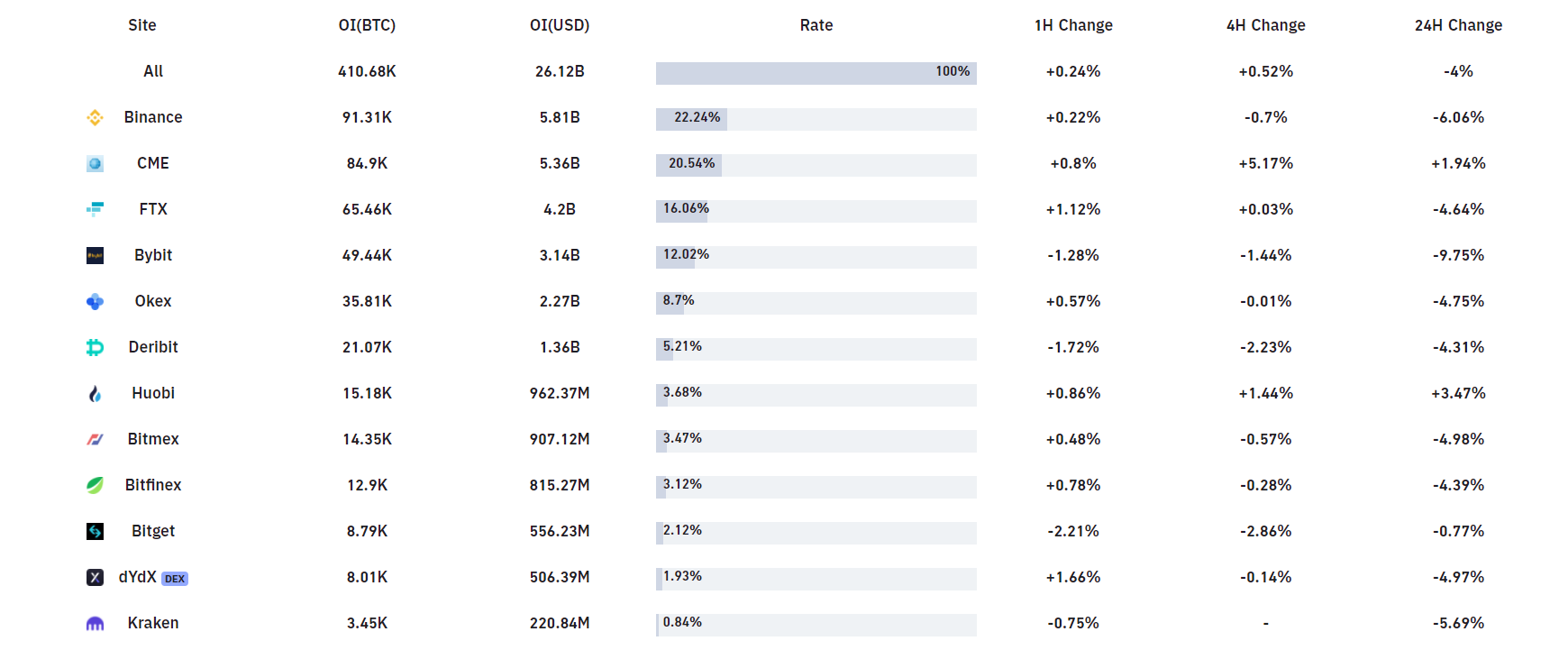

Open Interest in the US Derivatives Market CME has witnessed the greatest leap amongst key trading venues given that the record in mid-April, when Bitcoin 1st hit $ 64,000. Open curiosity in BTC futures on the CME marketplace now stands at $ five.36 billion, up extra than $ two billion from the April higher and is now the 2nd biggest marketplace soon after Binance.

Perhaps since the Bitcoin ETF “flame” showed no indications of cooling as the SEC not long ago recorded extra scenarios of Valkyrie and VanEck money that will be trading in the upcoming four days respectively, boosting investor volume. skyrocketed, open curiosity has given that been appreciably boosted. However, for the very same motive, the “snowball effect” occurred which developed a uncommon crash on October 21 with BTC and numerous other altcoins.

– See extra: The Bitcoin value on Binance.US “plummeted” to USD eight,200

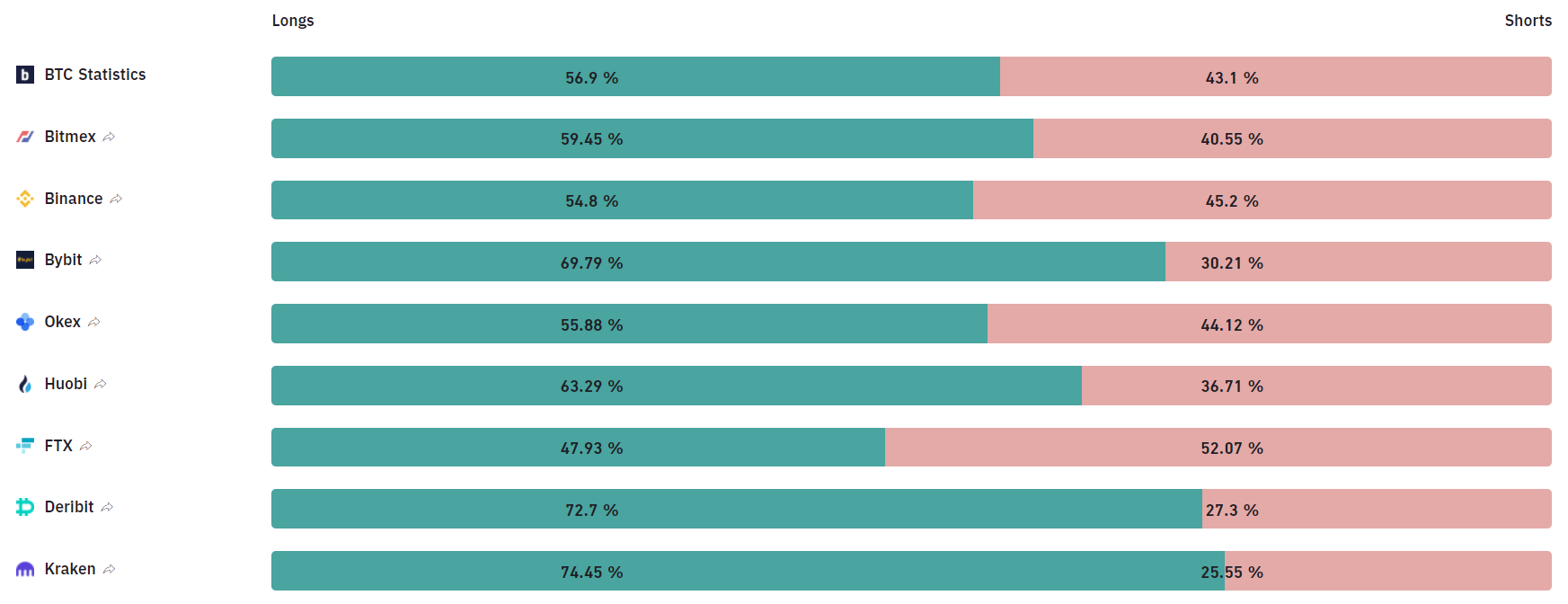

Generally, a stability is desired amongst prolonged / brief contracts in the derivatives marketplace, the driving force behind Bitcoin’s improvement in a more healthy way. Regardless of which side is dominant at any offered time, it swiftly “breaks” the immediate value response of BTC. Of program, this will negatively influence the prolonged-phrase development path of the total marketplace.

Synthetic currency 68

Maybe you are interested: