Bitcoin (BTC), the leading cryptocurrency, has seen a significant increase in capital inflows from US investors ahead of Donald Trump’s inauguration next Monday.

This trend shows that US investors are actively accumulating BTC, demonstrating growing confidence in its price momentum as Trump takes office as president.

Bitcoin Increases Demand From US Investors

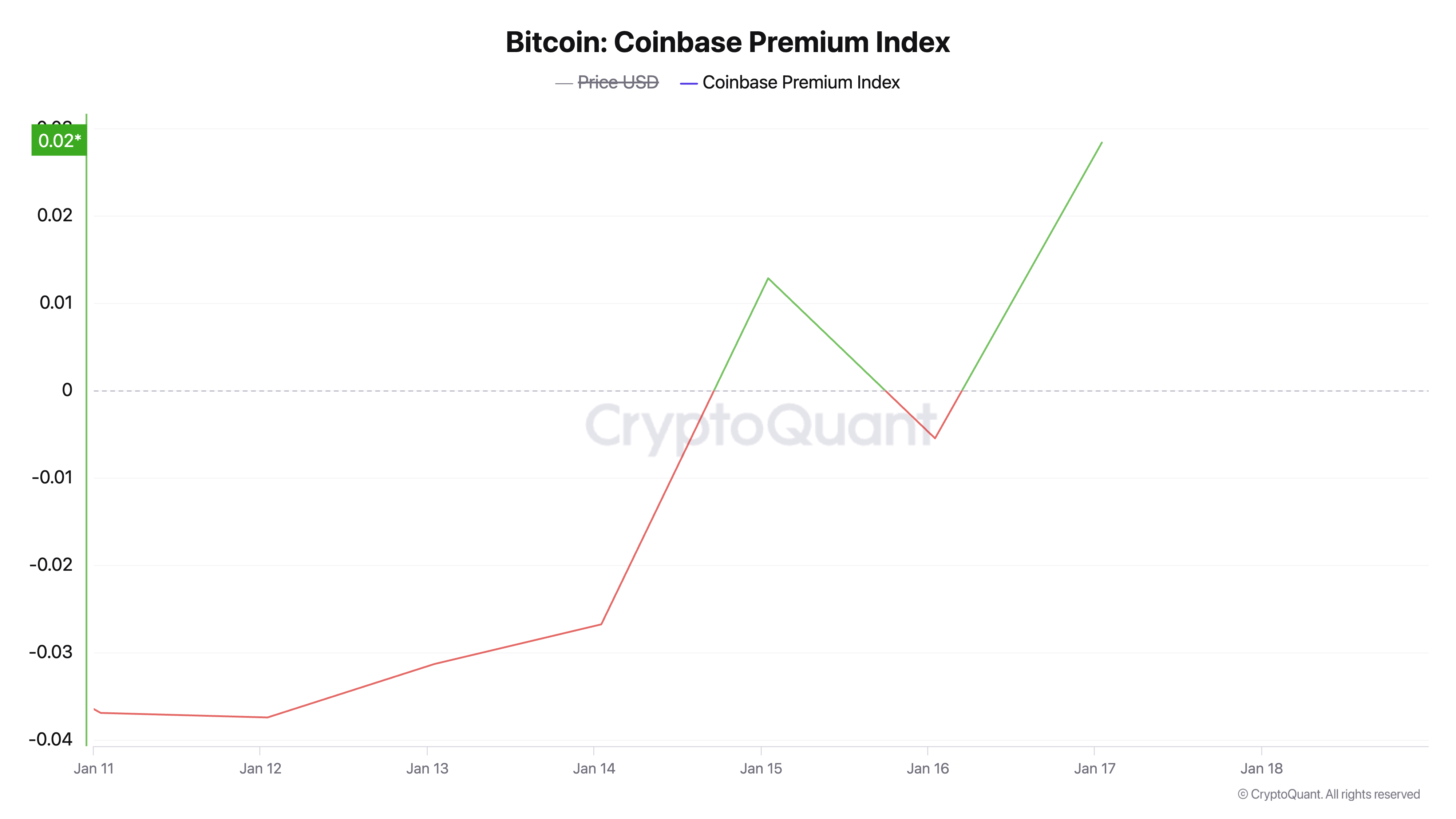

Bitcoin’s Coinbase Premium Index is rising, indicating rising demand for the leading coin among US investors. According to CryptoQuant, the index has increased 116% in the past seven days and is currently above zero at 0.02.

The Bitcoin Premium Coinbase Index measures the price difference between BTC on Coinbase and Binance. As the index rises, it points to stronger buying pressure from US investors, reflecting heightened demand in the region.

This is happening ahead of Donald Trump’s inauguration next Monday. The return of the pro-cryptocurrency candidate to the White House has fueled speculation about potential positive regulatory changes, causing Bitcoin to attract strong interest from US investors.

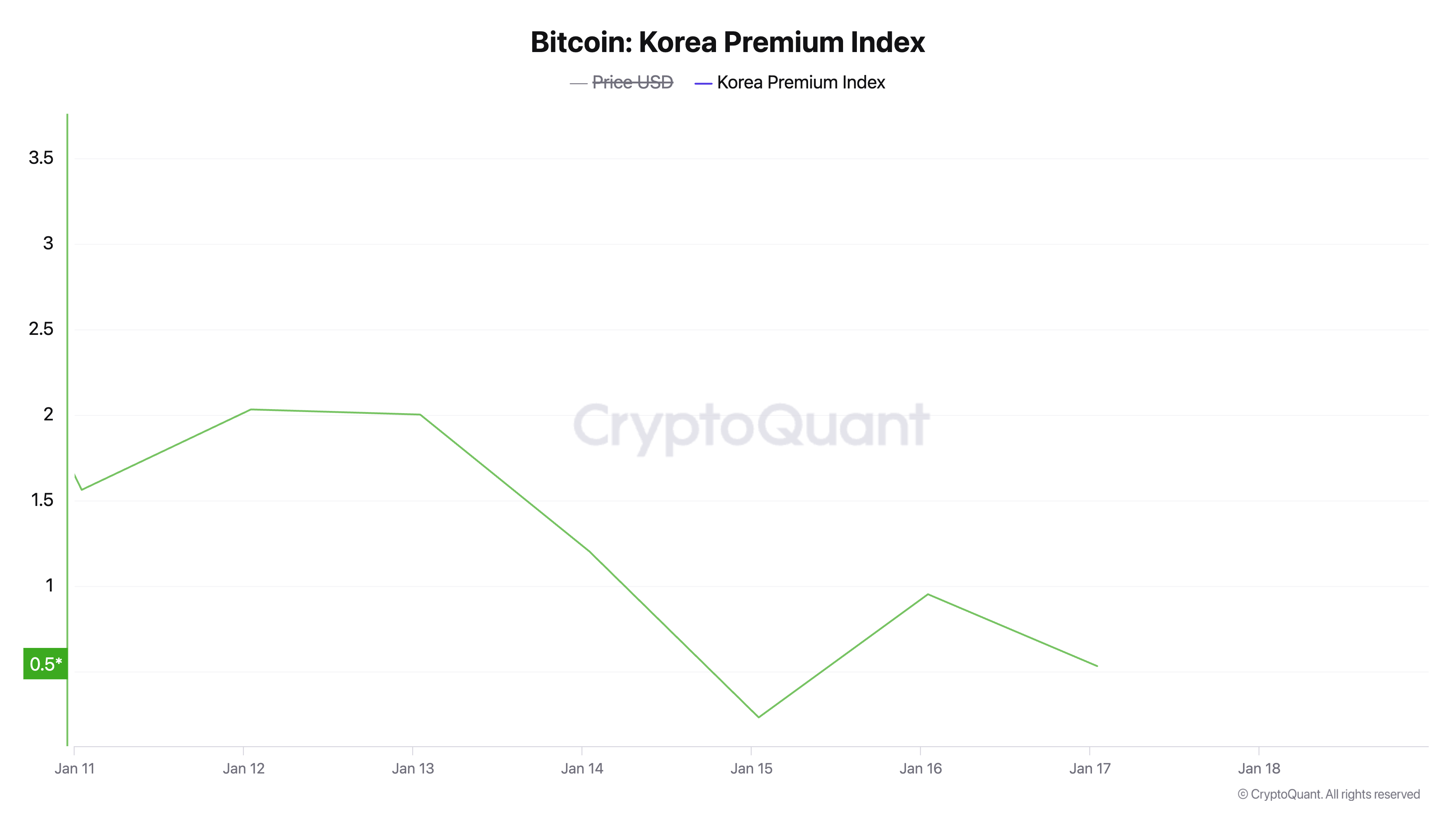

However, on the contrary, Asian investors seem to be more cautious. The Korea Premium Index, which reflects the price differential of BTC on Korean exchanges, is falling. At the moment, the index stands at 0.53, down 66% in the past seven days.

This decrease points to reduced trading activity in the region, which may be impacted by the market’s current consolidation period.

BTC Price Prediction: All-Time Highs Are On The Way Again

On the daily chart, BTC is currently trading at $103,107, slightly above key resistance at $102,538. If the coin accumulation by US investors continues, this could provide the necessary momentum for the coin to rise to its highest level of $108,388.

However, if buying activity declines, this could put downward pressure on the coin, sending it towards $95,513.