- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Binance sees a 50% inflow decrease.

- Signals strong holding behavior among Bitcoin holders.

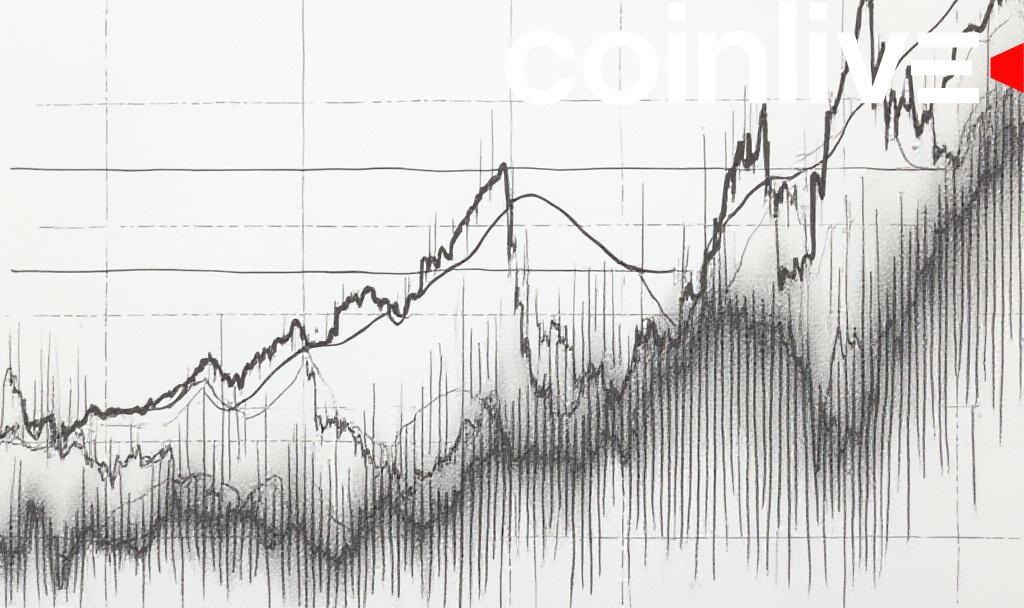

Binance, the largest cryptocurrency exchange, registered a significant decline in Bitcoin inflows in June 2025. The exchange saw inflows of only 5,700 BTC, dramatically lower than the average since 2020.

Bitcoin’s inflow reduction to Binance indicates decreased immediate sell pressure, affecting market liquidity and signaling stability in Bitcoin’s price above $105,000.

Binance reported Bitcoin inflows of 5,700 BTC in June 2025, significantly below the monthly average since 2020. The decline highlights strong holding behavior among investors. Market analysts link low inflows with a stable Bitcoin price.

The Reduced Inflow Trends

The decrease in inflows historically coincides with periods of price stability. Binance leadership, now under CEO Richard Teng, acknowledged these statistics but has not provided further commentary. Binance’s organizational changes have not affected Bitcoin’s inflow patterns.

Market Impact

The reduced inflow influences market dynamics by removing sell pressure, indirectly bolstering Bitcoin’s stability. Although primarily affecting Bitcoin, no immediate regulatory impacts or market corrections are reported in correlation with the decrease.

Investor Behavior

Current conditions suggest Bitcoin holders maintain assets off exchanges, deterring liquidation risks. Analyst insights emphasize ongoing monitoring of inflow spikes, which may indicate distribution risks and potential market corrections.

The decrease indicates a holding phase and a lack of immediate sell pressure; monitor for sudden spikes in inflows as signs of renewed distribution risk.

Leadership Response

New executive leadership has yet to provide specific strategies concerning the inflow decrease. It presents opportunities and challenges for Binance as it navigates changing market dynamics. The ongoing trend of low inflows requires careful analysis amidst potential technological advancements in the cryptocurrency landscape.