[ad_1]

It could be a boon for Bitcoin investors as Glassnode analysis shows BTC inflows are skyrocketing across exchanges.

According to Coindesk, at a time when the Bitcoin price is down around 50% from its all-time high, bullish traders are still holding out hope for the digital asset’s potential. A new data point shows that the market is nearing a bottom but crypto inflows are still skyrocketing from exchanges.

Large cash flow poured into Bitcoin and cryptocurrency exchanges

While it is too early to predict whether this inflow will be sustained, the data could indicate that some investors are satisfied with the current price and have no intention of selling off bitcoin. BTC) on exchanges.

Following the logic of the cryptocurrency market, traders can move their funds to wallets, custody or cold storage while waiting for the bitcoin price to recover.

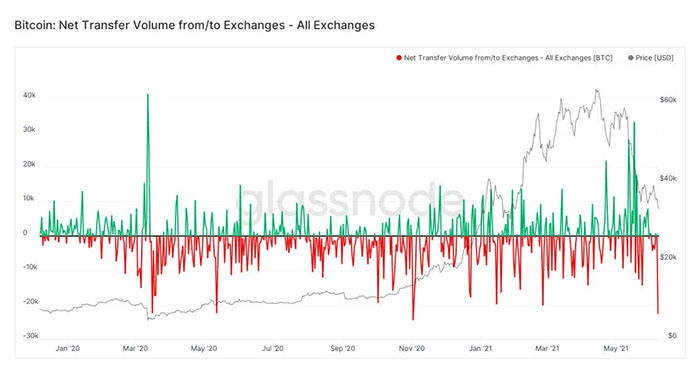

According to data provider Glassnode, crypto exchanges registered a net inflow of 22,550 BTC on June 7. That is the largest net loss in a day since November 2, 2020 to now (7 months). Blockchain analytics firms track flows from 13-bit crypto exchanges, including Binance, Coinbase, and Kraken.

Petr Kozyakov, co-founder and CEO of global payments network Mercuryo, told CoinDesk: “The outflow can be multifaceted, such as with HODLing and digital currency usage. digitalization in decentralized finance”. HODL is the cryptocurrency market slang for buying and holding assets.

The number of bitcoins held in exchange wallets has fallen to a recent 3-week low of 2.54 million (from 2.56 million previously).

Investors typically move funds from exchanges to wallets, taking supply from the market as they intend to buy and hold based on anticipation of price spikes.

“Investors appear to be storing their assets in hardware wallets in anticipation that the current price drop will balance out the new price levels heading towards, eventually reaching all-time highs. earlier era,” said Kozyakov.

Some investors directly manage bitcoins and tokenize coins on the ethereum blockchain to earn additional profits. Tokenization refers to locking bitcoins on ethereum and issuing an equal number of tokens tied to the bitcoin price. The tokens can then be deposited into decentralized finance (DeFi) lending and lending protocols.

“With bitcoin in DeFi, investors can maximize their earnings amid a sharp drop in prices. This is a better option for many people who do not want their assets to sit idle,” added Kozyakov.

Data from the DeFi website Pulse shows that the total number of bitcoins locked in smart contracts has increased from 94,000 in April 2021 to around 174,000 today. Such tokenization of bitcoins on other networks is also a cause of the decrease in the supply of bitcoins in the market.

Bitcoin investors need to be careful

The influx of money into bitcoin on exchanges paints a more ideal scenario of the cryptocurrency’s bull run, but no one can be sure about the future of bitcoin. Quantum Economics (USA) analyst Jason Deane issued a warning and urged investors to approach with caution.

“The market is currently lacking direction, sentiment is mixed and many indicators are reporting lower demand, so this traditional bullish signal needs to be interpreted carefully and in the context of analytics. data, other markets,” said Deane.

Bitcoin is currently trading at over 30,000. The price has dropped 35% in May due to environmental concerns and the move to ban bitcoin mining from China. Although exchange cash flows have increased, demand from “whales” entities – those with sizable holdings whose actions could theoretically impact the market – remains strong. best level.

Maybe you are interested:

Join our channel to update the most useful news and knowledge at:

According to Vietnambiz

Compiled by ToiYeuBitcoin

[ad_2]