Bitcoin dominance has been falling considering the fact that the amount a single cryptocurrency by marketplace capitalization has underperformed altcoins. The metric, which is applied to measure the proportion of the crypto marketplace capitalization formed by BTC, is trending up but seems to be transforming route and could indicate much more losses for the field.

Related studying | Bitcoin Bearish Signals: Coinbase Gets Massive Outflows

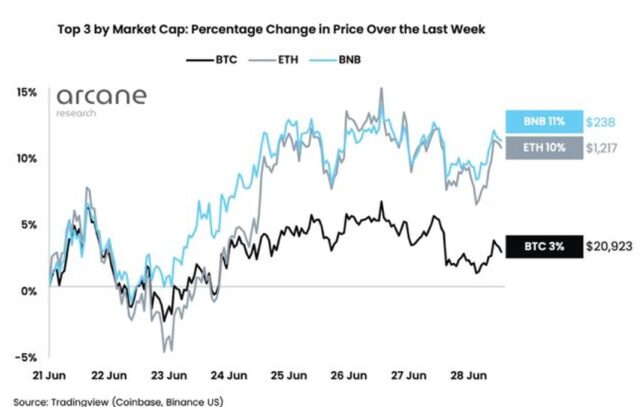

According to a report from Arcane Research, Bitcoin has been moving sideways along the $21,000 area with a three% return more than the previous week. At the time of creating, BTC rate trades at $twenty,300 and could be about to retest earlier assistance amounts.

During the exact same time period, Arcane Research notes, Ethereum (ETH) and Binance Coin (BNB) have posted returns of at least ten%. This represents ETH rate for the initial week in the green considering the fact that the start out of substantial field-broad marketing stress on March 28.

Meanwhile, as the rate of BTC moved in a narrow variety, US stocks posted some gains. The S&P 500 and Nasdaq a hundred have posted gains of as substantially as six% more than the previous week. The stock is starting up to flip bearish and could hint at even further losses in the crypto marketplace.

Regarding the components that influence the rate efficiency of BTC, Arcane Research wrote the following:

Bitcoin’s relative underperformance for each stocks and altcoins in this very correlated setting can be attributed to the expanding contagion related with the collapse of the UST and 3AC (…).

Consequences from these occasions have brought obstacles to centralized lending corporations. Many individuals have turn out to be forced sellers as they liquidate assets in an try to meet excellent debt obligations. Arcane Research additional:

The marketplace is having to pay shut consideration to how the present imbalance is resolved, putting a tight tie on the probability of seeing a substantial BTC rally.

Why Bitcoin Could Come Out Top Against Stocks

Bitcoin has evolved in tandem with common stocks, but cryptocurrencies could outperform them in the 2nd half of 2022. The downtrend is largely triggered by the components described over and by the adjust financial policy improvements from the United States Federal Reserve (Fed).

Related studying | Bitcoin Mining Facility Stopped After Severe Drop in Miner Profitability

Financial institutions are striving to slow inflation by raising curiosity charges. As deflationary stress sets in, which could translate into yet another bull run for Bitcoin in the coming months, follow to Senior Commodity Strategist Mike McGlone:

#Stocks as well scorching for mature Bitcoin? Risk assets surged in the initial 6 months of the 12 months, getting rid of inflation at a dizzying tempo, which could flip into a deflationary force prior to the pandemic flares up once more in the 2nd half of the 12 months. The key beneficiaries of this situation could be gold, Bitcoin and US Treasury prolonged-phrase bonds.