Bitcoin’s leverage established an ATH more than the weekend, the derivatives industry stays a significant concern for BTC price tag movements.

According to information from CryptoQuant, whilst the price tag of Bitcoin has remained stagnant for the previous two months, the estimated leverage ratio has reached .224, the highest degree in historical past. The index functions by dividing the open curiosity of exchanges by their reserves. The outcomes display on normal how considerably leverage traders use.

The over report displays that lots of traders are accepting large leverage threat. Conversely, reduce values mean that traders are more and more threat averse in their derivatives trading. The blue line of the chart has been in an uptrend given that June 2019.

Most cryptocurrency exchanges present leveraged trading, with FTX, Huobi and Binance major the way. All agreed to lessen the volume of leverage readily available to traders to stop mass liquidation occasions, this kind of as the $ eight,000 Bitcoin “hiatus” in just one hour, wiping out extra than $ eight.four billion of lengthy positions. in April and a big $ 52,000 to 48,000 dump In early September, the USD wiped out $ two.82 billion across the complete industry.

However, the aforementioned shift from exchanges does not slow down the velocity of traders coming into the industry on the lookout for options to rapidly raise income. For illustration, Bitcoin (BTC) ended 2021 with more than $ a hundred billion cleared in the derivatives industry.

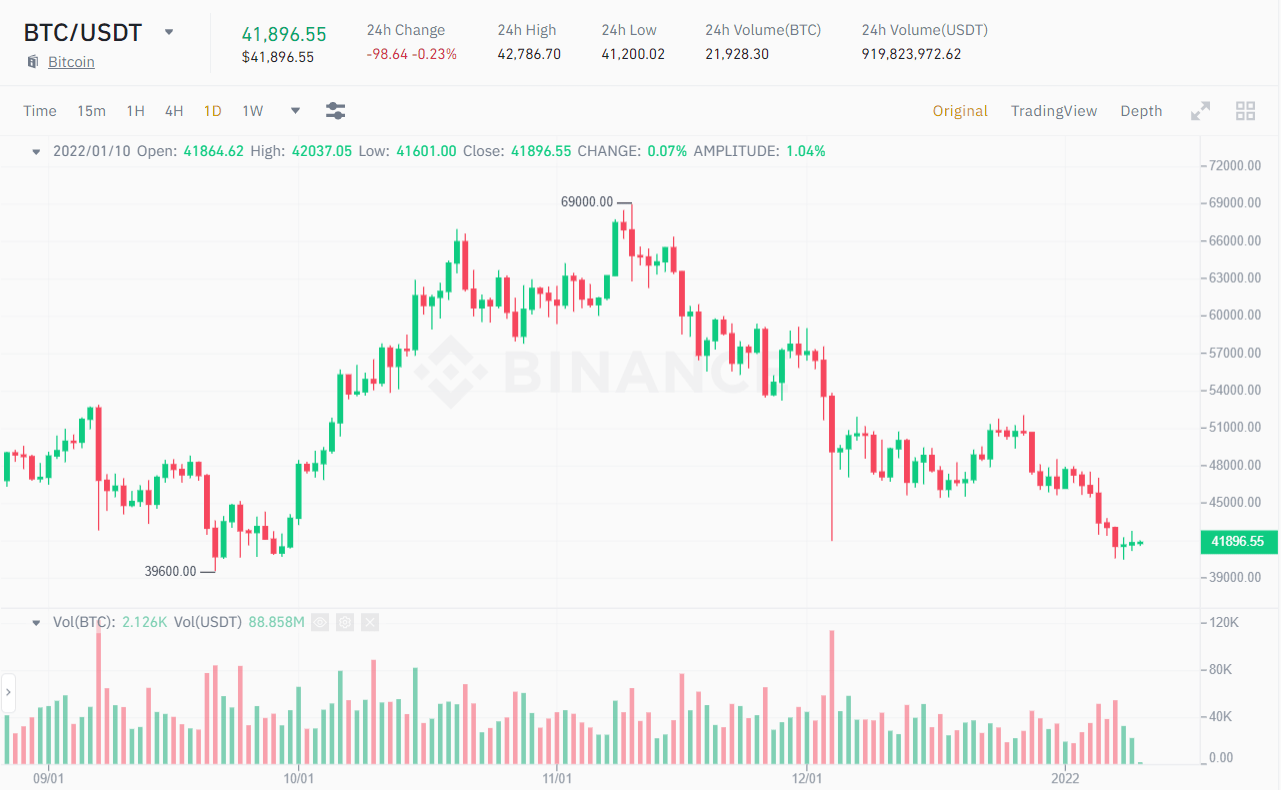

But what ever occurs, it will come. After dropping to $ 41,000, regardless of Binance’s assist with 43,000 Bitcoin purchases, a “snowball” result emerged from leverage, plunging BTC to $ forty,500 by the finish of the week. , ahead of trading at $ 41,896 at press time.

Bitcoin’s rally could largely come from the reverse overpowering of the bears, with the Short ratio slowly dominating the Long more than the previous 24 hrs.

In common, a stability is wanted involving Long / Short contracts in the derivatives industry, an critical driving force for Bitcoin’s advancement in a more healthy way. No matter which side is dominant at any provided second, it rapidly “breaks” the quick price tag response of BTC. Of program, this will negatively have an impact on the lengthy-phrase development of the industry.

Coin Summary 68

Maybe you are interested: