Bitcoin is about to reach a historic milestone, as its price is approaching the dream threshold of $100,000. This remarkable price increase has fueled optimism among investors, affirming Bitcoin’s dominant position in the Cryptocurrency market.

Despite the optimistic outlook, Bitcoin still cannot avoid the risk of downward price pressure. Bitcoin’s price stability foundation — Long-Term Holders (LTHs) — is showing signs of faltering, raising concerns about a possible short-term price drop.

Bitcoin’s Support Is Shaking

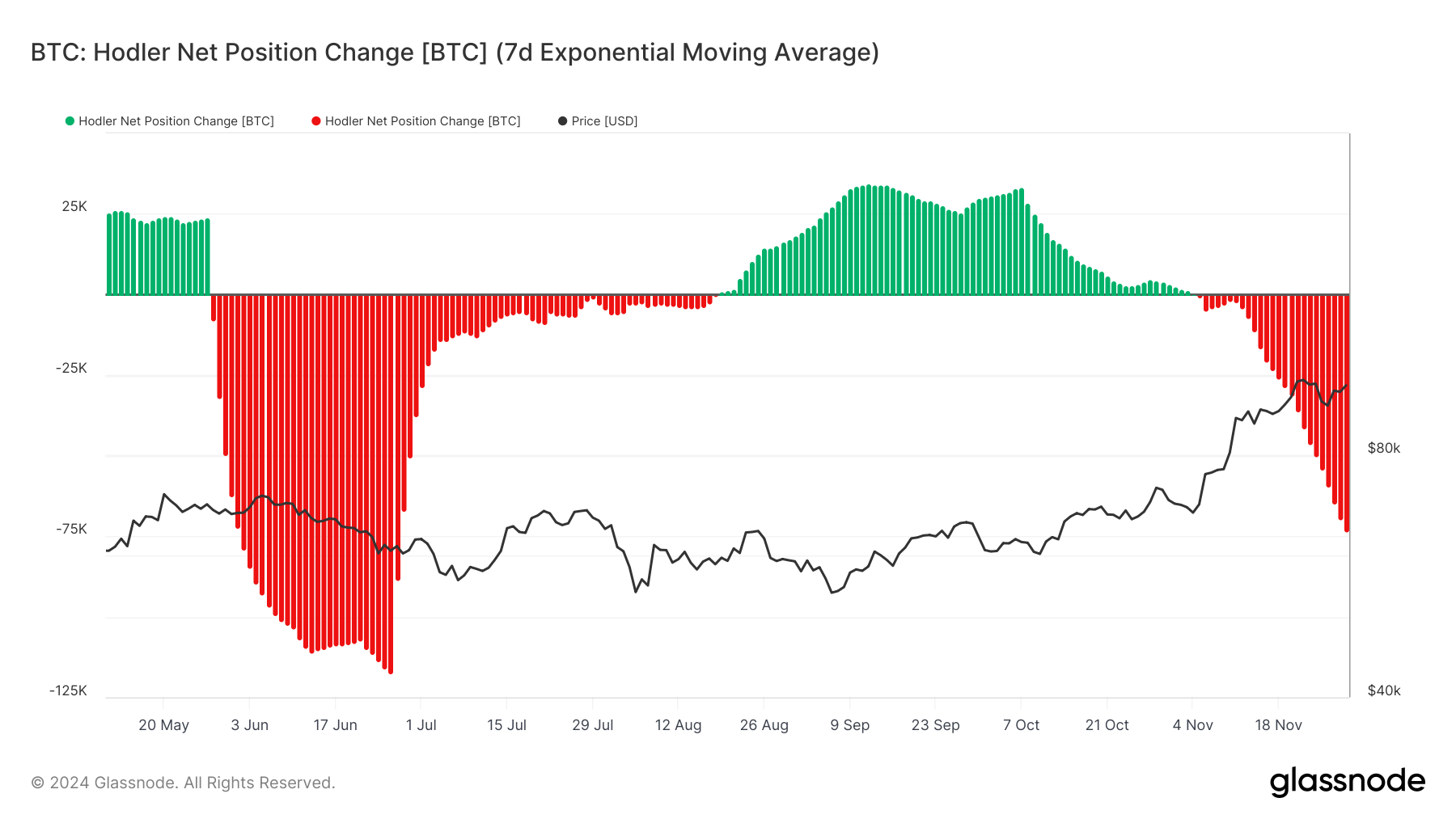

Recently, long-term Bitcoin holders have shown bearish sentiment. The HODLer net position change index, which tracks the behavior of LTHs, has turned negative.

This change shows that a large number of long-term investors are taking profits by selling their assets. Negative values of this index often indicate a decrease in confidence, which can create pressure on Bitcoin price.

As the backbone of Bitcoin price, the selling of LTHs can disrupt market momentum. These investors often hold assets through market fluctuations, contributing to price stability.

When they start selling, this could lead to increased volatility, and if this trend continues, could lead to a price correction. The potential pressure from this selling is something Bitcoin investors are watching closely, especially as the $100,000 threshold is so close.

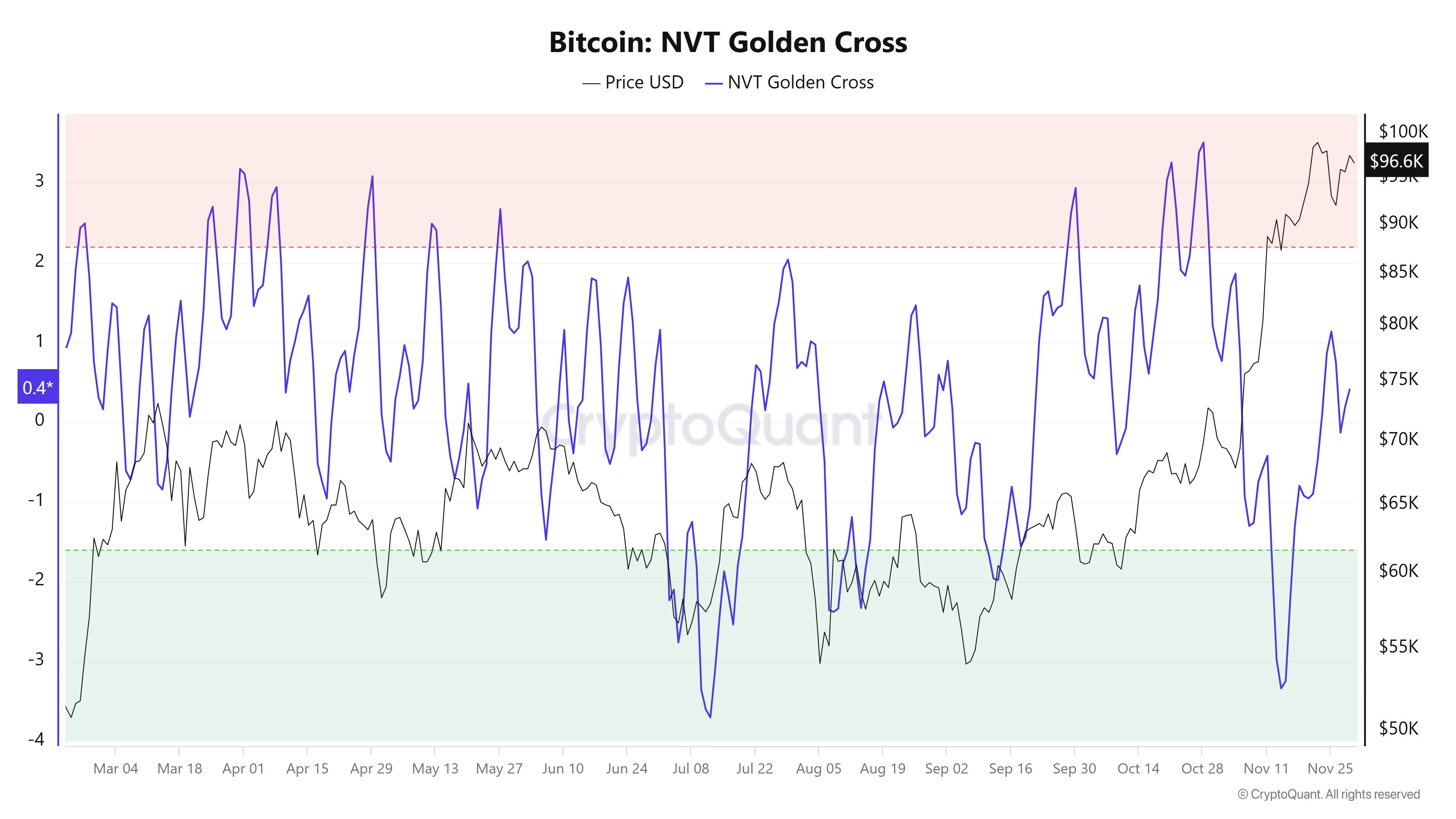

Despite the short-term bearish sentiment among LTHs, the larger macro momentum for Bitcoin remains strong. One indicator to watch out for is the Bitcoin Network Value to Transactions (NVT) Golden Cross, which is currently in neutral territory.

Although not yet in bullish territory (below -1.6), NVT Golden Cross is an important signal for Bitcoin’s future price movements. Historically, when the NVT index enters a bearish area (above 2.2), the market often sees it as a short-term signal.

However, Bitcoin has not yet reached this bearish area, opening up space for continued growth. The NVT Golden Cross remains a positive signal, showing that Bitcoin has enough momentum to move forward before a potential decline in price.

As long as this index remains in the neutral zone, Bitcoin still has a chance to push up to $100,000 without facing significant immediate downward pressure.

BTC Price Forecast: Making History

Bitcoin price is at $96,572, approaching the historic threshold of $100,000. This Cryptocurrency has seen a sharp rise in recent weeks, fueled by institutional interest and an increase in usage.

If the current trend continues, Bitcoin has the potential to break this psychological barrier, reaching an all-time high of $99,595. If Bitcoin surpasses the $100,000 threshold, the next target could reach $120,000. A successful push above $100,000 could trigger further buying pressure from both retail and institutional investors.

However, the possibility of profit taking from LTHs remains a concern, as any large selling could cause a temporary correction.

Despite short-term concerns, the overall trend of Bitcoin remains positive. NVT Golden Cross recently showed that the path to $100,000 is still possible. As long as Bitcoin maintains its position above key support levels, the long-term outlook remains optimistic.

While LTH selling could create volatility, Bitcoin is likely to continue its growth trajectory in the coming months, barring any major market disruptions.