Bitcoin price has dropped nearly 10% since reaching an intraday high of $102,735 on Tuesday. This decline has significantly affected miners, causing daily revenue on the Bitcoin network to bottom in the past 30 days. .

As buying pressure weakens, BTC risks falling below $90,000, which could increase losses for miners who are already facing difficult financial circumstances.

Bitcoin Miner Revenue Declines Amid Falling Prices

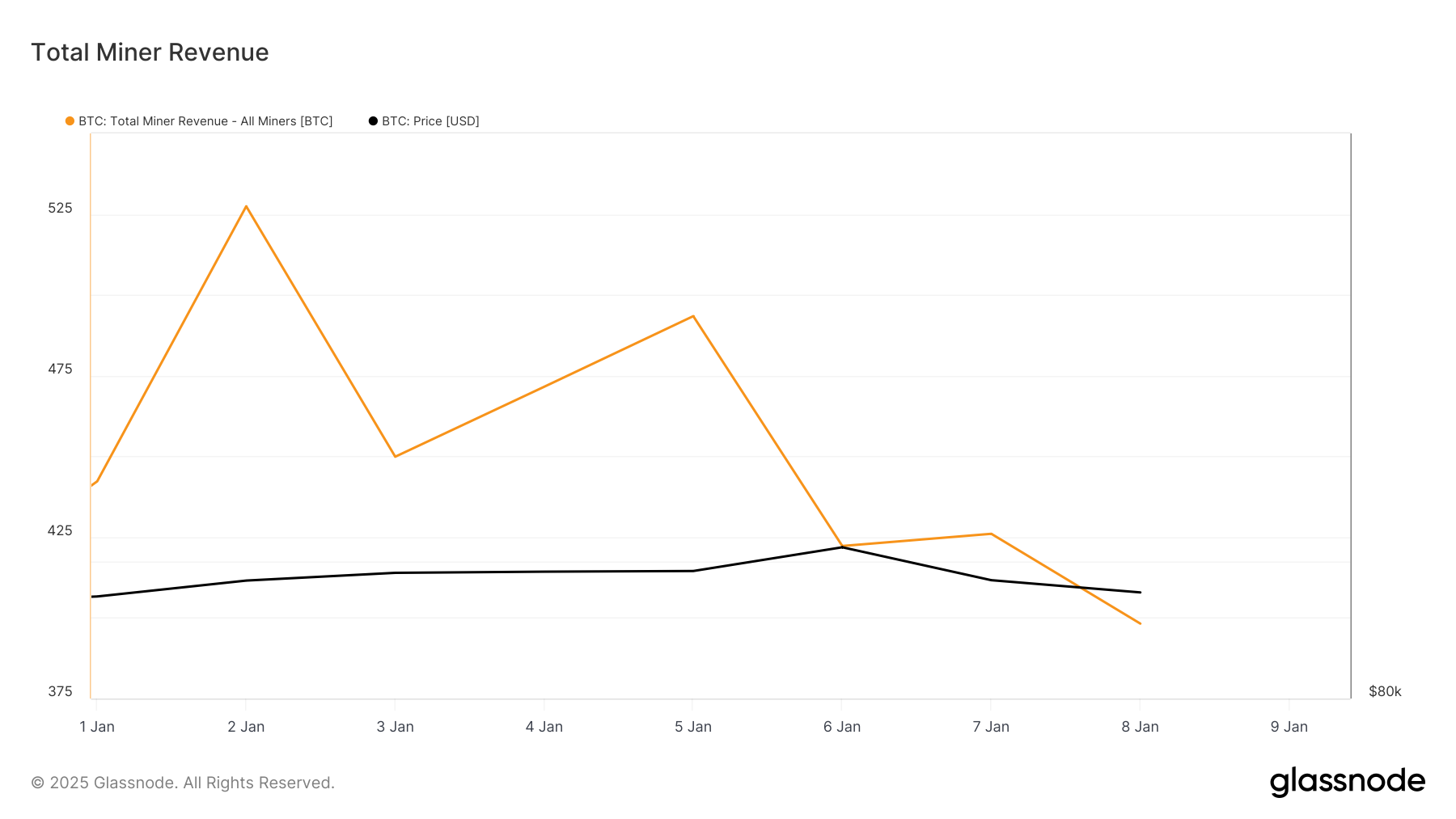

BTC miner revenue from transaction fees and block rewards has been steadily decreasing since January 2. According to data from Glassnode, there is currently only 398.20 BTC left, a decrease of 24% over the past week.

When Bitcoin miner revenue declines, this means miners earn less from validating transactions and securing the network. A decline typically occurs when the price of Bitcoin drops, reducing the value of the rewards paid to miners.

Over the past two days, Bitcoin has recorded significant drops. Against this backdrop, during Tuesday’s intraday trading session, the leading cryptocurrency traded at a high of $102,735. However, selling activity quickly increased, causing the price of this coin to trend down. At press time, BTC trades at $93,419.

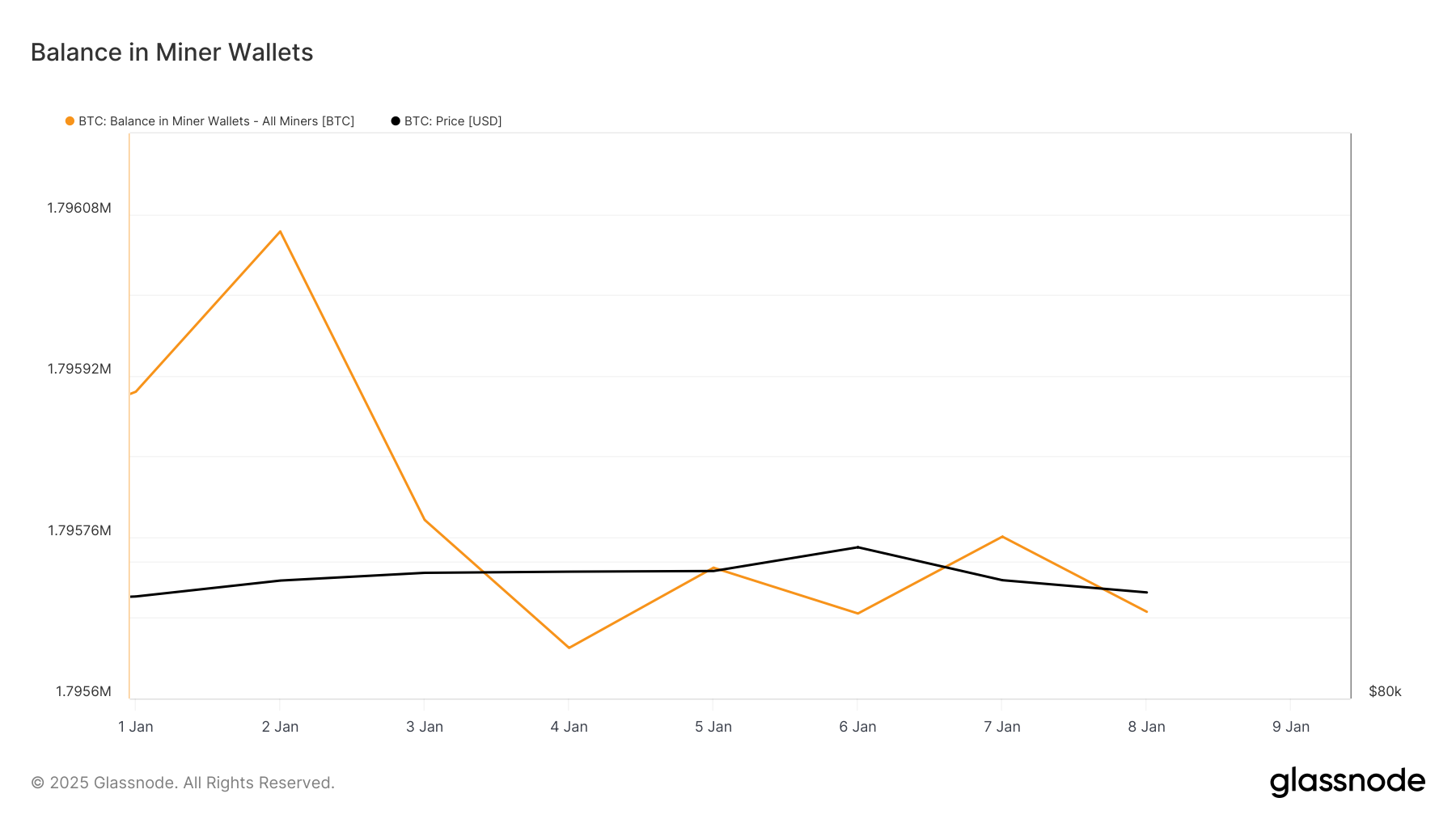

As more and more Bitcoin miners rush to sell to prevent further losses, the amount of BTC held in miners’ wallets has gradually decreased. Year-to-date, this number is 1.79 million BTC, down 0.005% since January 2.

BTC Price Prediction: Hold or Break $90,000?

On the BTC/USD daily chart, BTC trades just above support forming at $91,437. If the sell-off continues, the coin’s price could break this level and fall below $90,000 to trade at $85,224. In this scenario, Bitcoin miner revenue will decline further, forcing many miners to sell their coins to cover operating costs.

However, if market sentiment improves and demand increases, this could push the coin’s price to around $102,538, increasing revenue for BTC miners.