Key Points:

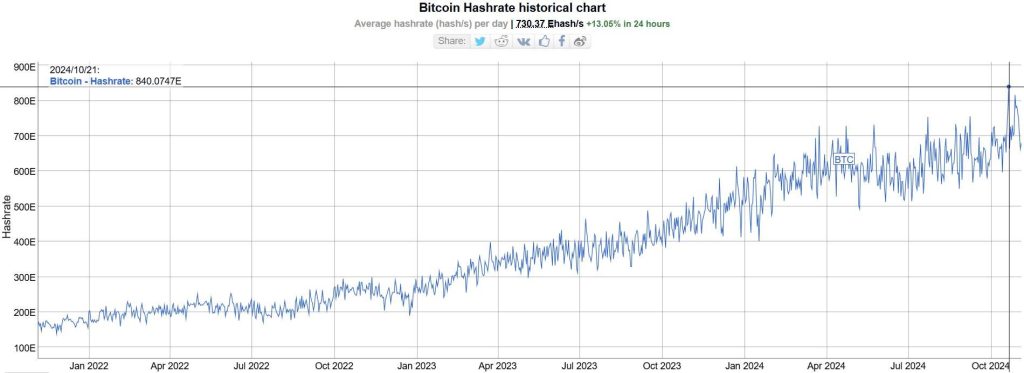

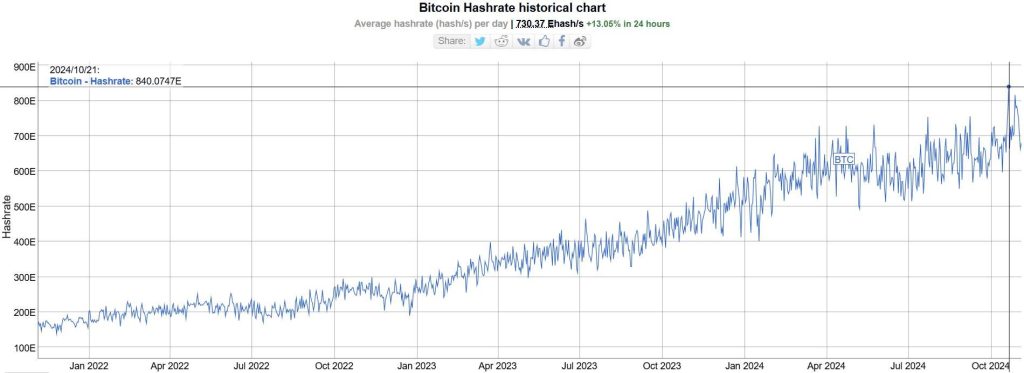

- Bitcoin mining difficulty surpasses 100T for the first time with an average hashrate peaking at 840 EH/s.

- High mining difficulty inadvertently puts greater selling pressure on smaller miners.

New ATH for Bitcoin’s average hashrate, combined with Bitcoin mining difficulty surpassing 100 trillion hashes, is adding selling pressure on small miners.

Bitcoin Mining Difficulty Reaches All-Time High

According to data from blockchain tracking tool Mempool, the Bitcoin (BTC) mining difficulty has reached an all-time high of 101.65 trillion (T) hash, equivalent to a 17.6% increase in the past 6 months since the last record.

Along with the mining difficulty, the Bitcoin network hashrate also set a new record when it exceeded 800 EH/s, with times “jumping” to 840.07 EH/s on October 21, 2024.

Increased Difficulty Places Strain on Smaller Miners

The Bitcoin mining algorithm difficulty is a concept that refers to a self-adjusting mechanism of the world’s largest cryptocurrency network. Accordingly, the mining algorithm will be changed every 2,016 blocks (about 2 weeks) to maintain the block generation time around the target of 10 minutes. If the hashrate increases, indicating that more miners are operating, the system will increase the difficulty, and vice versa.

This year, Bitcoin’s hashrate and mining difficulty has continuously set new records, especially after the 4th halving event, which caused the reward to be “halved” to 3.125 BTC, making the mining process even more difficult. The higher the difficulty, the greater the pressure on the mining industry to produce a block.

This inadvertently increases selling pressure on smaller miners. Because coin mining is an extremely competitive and capital-intensive industry, small or private companies that are limited in cash compared to their publicly traded rivals may be forced to sell the amount of Bitcoin they mine to fund operations.

As of November 5th, data from MacroMicro shows that the cost to mine 1 Bitcoin has increased to $82,386, while the price of Bitcoin fluctuates around $68,800. This causes miners to lose an average of more than $13,000 for every BTC mined.

Currently, miners mine about 450 Bitcoins per day. On average, they have to sell 100% of the total amount of Bitcoin mined, meaning that every day, there is selling pressure equivalent to about 31 million USD.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: Coincu