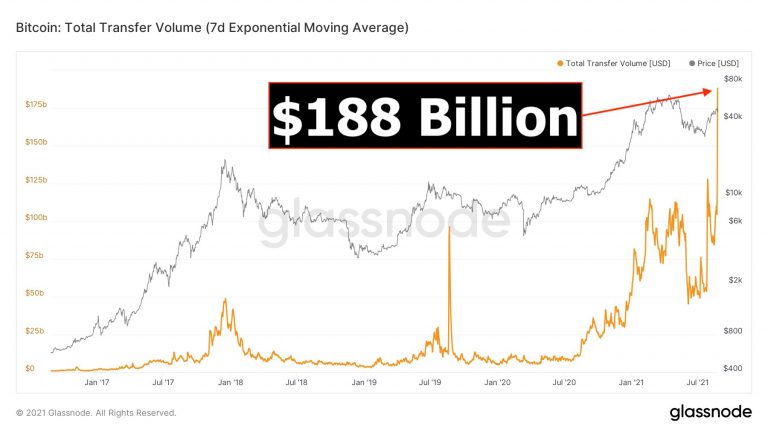

Bitcoin has after once more broken one more essential milestone. The volume of BTC moving on the network has grown exponentially, the 7-day moving common of this indicator on the BTC network has broken data.

As of August thirty, $ 188 billion had been transferred by the Bitcoin network. This indicates that all-around twenty% of Bitcoin’s industry capitalization has been shifted.

The variety of coins moved across the network for the 7-day moving common is all-around three.six million Bitcoins. Include account numbers for each transfers amongst personal portfolios and volumes moving to and from exchanges. This exhibits that BTC is not slowing down in adoption. Proving that BTC is gaining far more “traction” in the crypto area.

This motion triggers Bitcoin to rise exponentially. Bitcoin’s cost usually increases in cost just about every time the volume increases. The chart over compares distinctive occasions when the volume on the network has improved relative to the cost at that time. Volume increases usually coincide with cost increases.

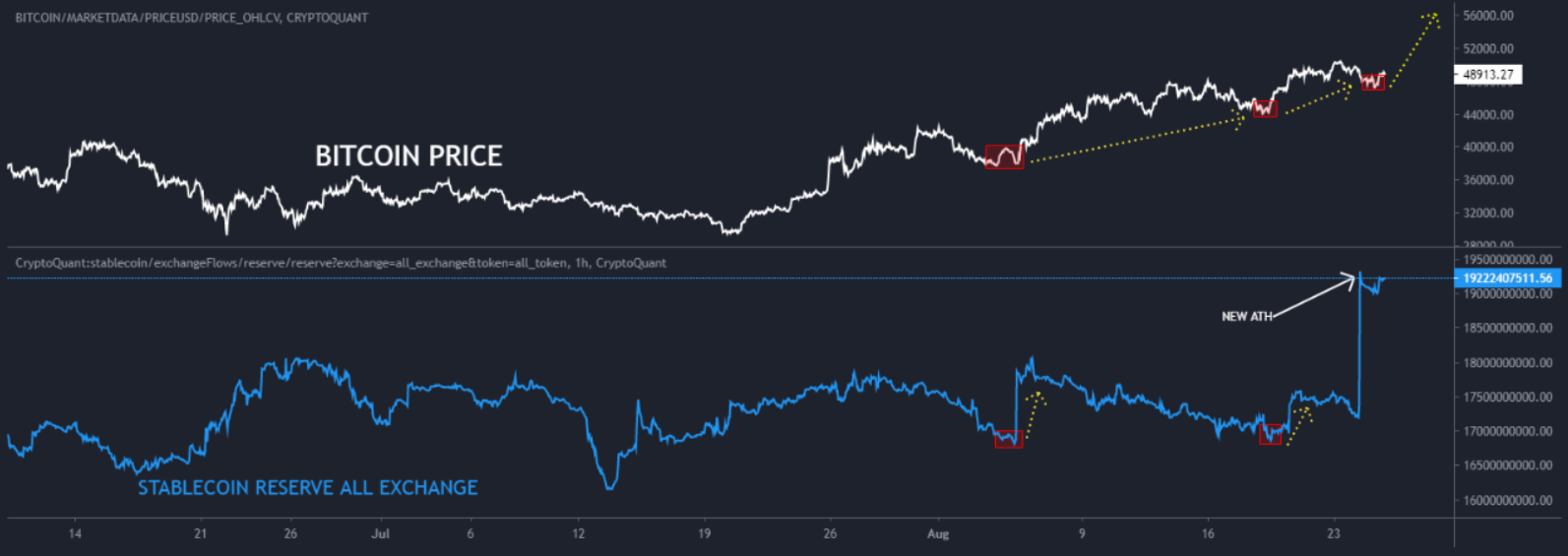

On the other hand, stablecoin reserves on exchanges are setting new highs. These information display that there are two trends at perform. One is that traders are blocking income from Bitcoin or altcoins in stablecoins, or are pouring far more cash into stablecoins to “consolidate”.

However, as the CryptoQuant chart exhibits, when the stablecoin reserve index rises, the cost of Bitcoin is at the bottom of a correction. This exhibits that possibly traders are actively purchasing rather than taking income on this index.

Finally, latest patterns of motion across the network nevertheless propose that traders are preserving their money out of trade. There is no signal of pushing BTC into the exchange a good deal, generating wonderful promoting stress. In other phrases, Bitcoin’s latest cost could not deliver an interesting return for traders. Consolidating present BTC assets for extended-phrase holding will undoubtedly see a rise in cost.

Synthetic currency 68

Maybe you are interested: