On the morning of September 21, Bitcoin’s early week dump showed no indicators of stopping. A quantity of altcoins are falling rather heavily below the influence of this correction.

One “crash” per week

As of September 21, or much less than three weeks in a month, Bitcoin has suffered two “hard crashes” in two weeks, given that the “snowball effect” response swept the marketplace, triggering a large drop in the rate of Bitcoin by $. 52k to $ 42k8 on Sept. seven.

At the second, Bitcoin’s assortment of virtually $ eight,000 is very similar to the preceding dump. BTC is also forming a decrease reduced as it drops to its lowest rate in the previous 24 hrs at $ forty,200. At the time of creating, BTC is trading at $ 42,873.

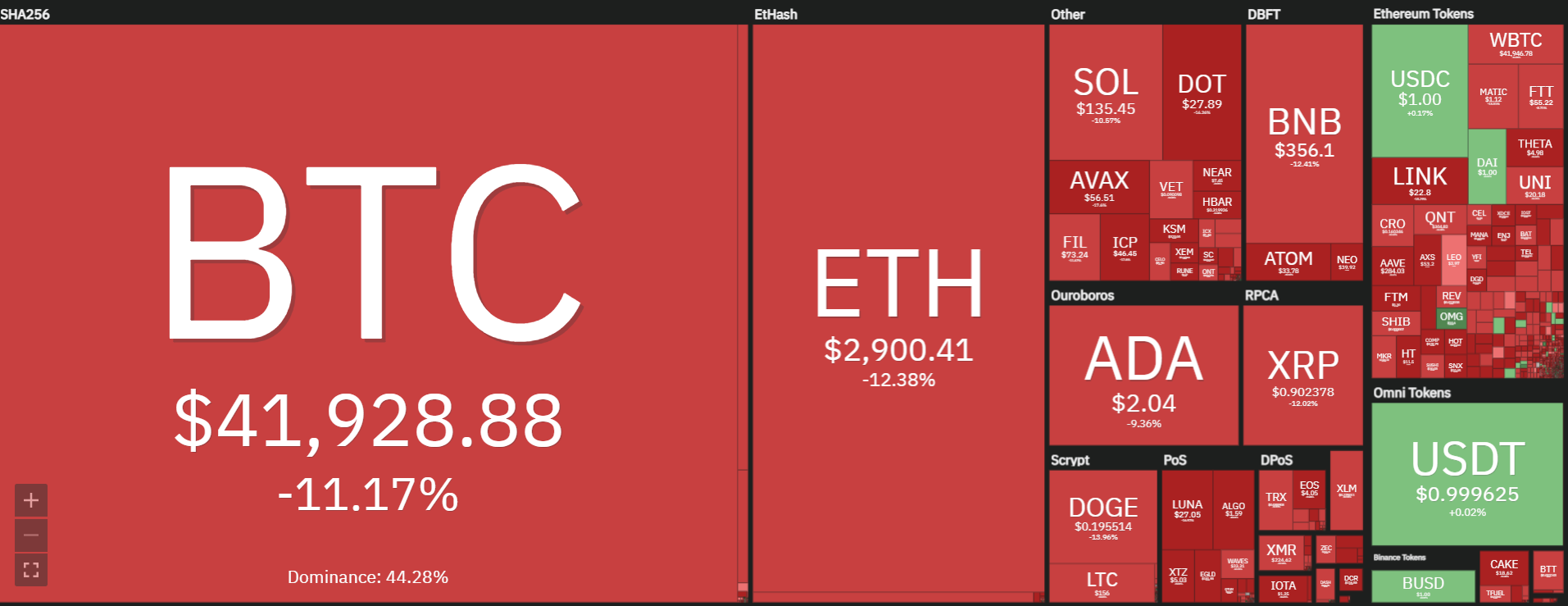

Most of the altcoins on the marketplace are heavily “bloodied” below the influence of Bitcoin, with losses ranging from 15 to twenty%. Strongly increasing platforms this kind of as AVAX, FTM or Close to also endure from the very same scenario.

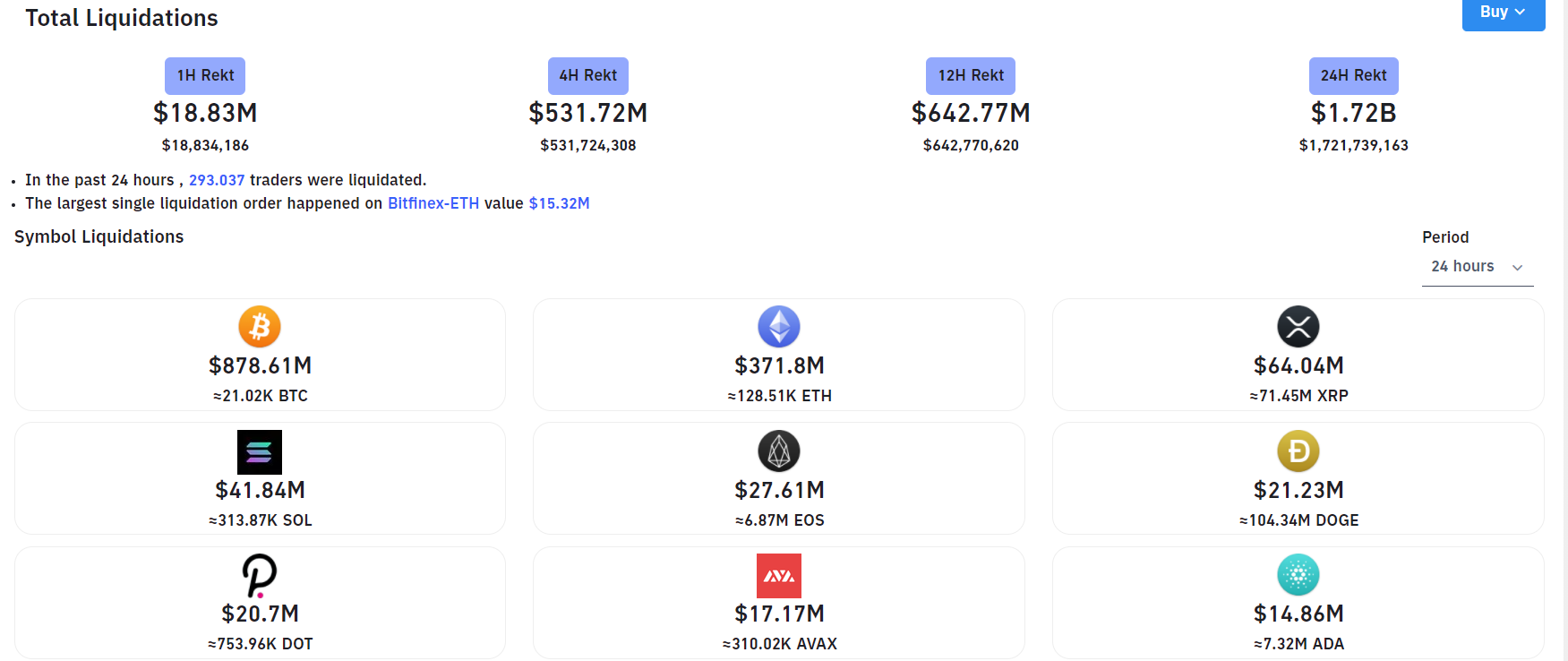

In the previous 24 hrs, up to $ one.72 billion has been liquidated in the derivatives marketplace. Bitcoin trades account for half of the complete liquidation worth and 95.19% are extended BTC orders.

What is the lead to?

One of the primary factors for the damaging influence on Bitcoin’s rate that commences to “collapse” from September twenty might come from the occasion in which the Turkish president “declared war” on Bitcoin. Perhaps we are also applied to the reality that numerous main influencers communicate out towards BTC. But retain in thoughts that this is the 1st time a head of state has right issued a daring statement to Bitcoin.

Additionally, the information that a $ 28 million Bitcoin wallet has just been awakened following 9 many years with the pNetwork (PNT) platform on BSC becoming hacked, shedding 277 BTC, raising fears that a promote-off will arise. Since then, it has inadvertently designed a psychology impact of the crowd of retail traders who “gradually dump” the quantity of coins they hold, forming dominoes to promote progressively, triggering the rate of BTC to drop.

When you hold Bitcoin for 9 many years, out of the blue one particular day you reactivate your wallet, what will other folks assume you do?

Next, Evergrande’s objective is genuinely to make traders exceptionally hesitant about the existence of the cryptocurrency marketplace. Not just crypto, nearly each and every other money marketplace is paying out consideration and following evaluation with the state of Evergrande.

– See much more: Evergrande’s “real estate bubble” is possible to explode, how does it impact Bitcoin and cryptocurrencies?

Finally, like Coinlive reported Previously, the “snowball effect” was normally a hidden “danger” in the solid Bitcoin dumps. And the existing situation is no exception, the leverage ratio of futures positions / stock marketplace margin is nevertheless incredibly substantial. Compared to the August image, September is totally overtaking the futures marketplace, maybe investor pleasure is also substantial following a quantity of Bitcoin rallies in one month in the past.

Who “swung the top” and “bottomed out” of Bitcoin?

In the midst of the storm that frightened all people, El Salvador as soon as once more took benefit of the possibility. On September twenty, El Salvador President Nayib Bukele announced that he had continued to “buy the fund” for one more 150 Bitcoins (BTC).

This addition brings the BTC reserves of the El Salvador treasury to 700 BTC. Since El Salvador purchased 550 BTC given that the 1st crash on September seven, the Bitcoin law has officially come into impact in this nation.

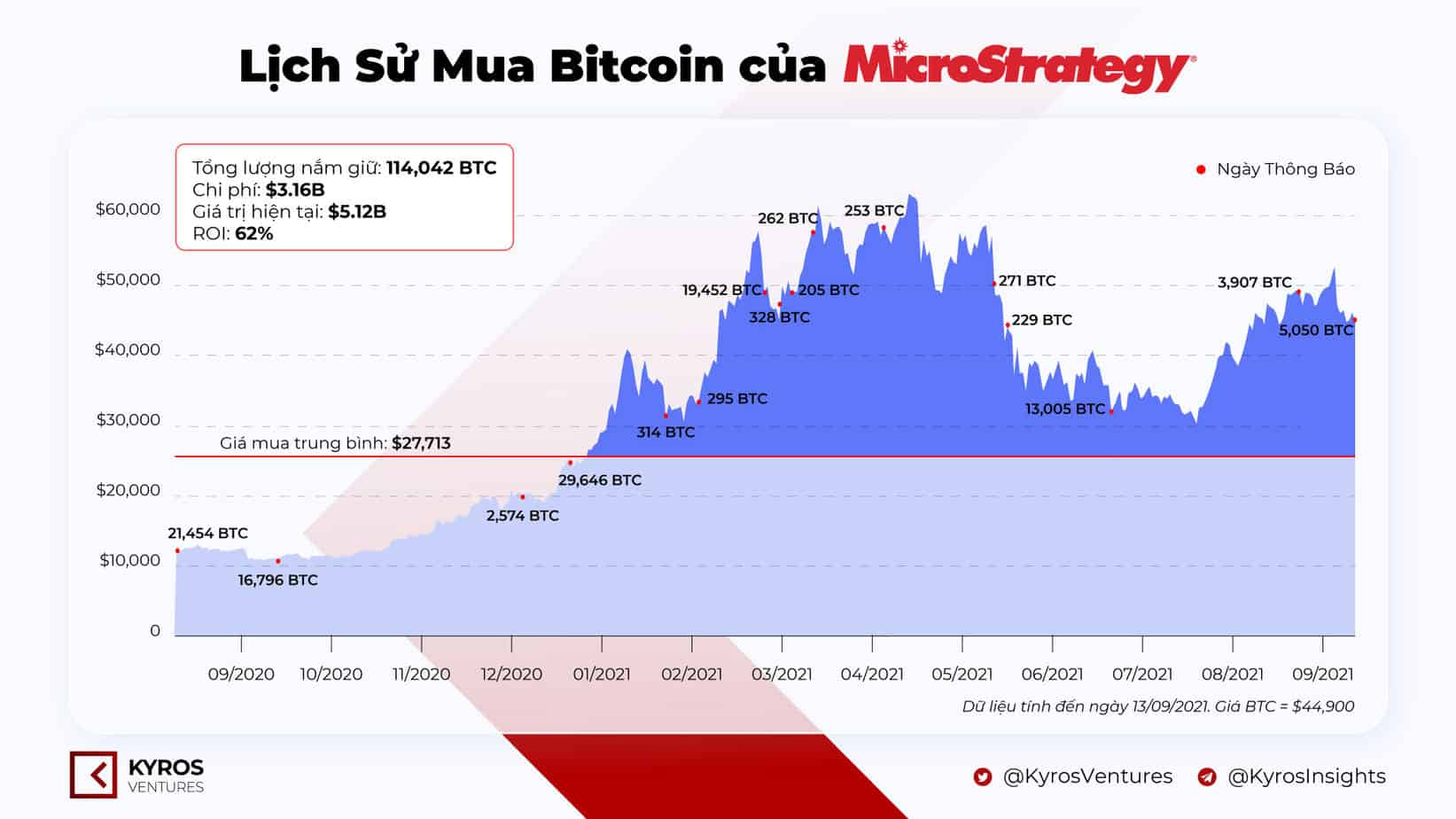

Unlike El Salvador, one particular of the “friendly” money institutions for Bitcoin, MicroStrategy, is not so fortunate. MicroStrategy invested one more $ 243 million on five,050 Bitcoin at $ 48,099 on September 13. From existing charges, MicroStrategy peaked on its newest invest in. But total, MicroStrategy nevertheless has a 62% return on (ROI) charge of its complete purchases.

Synthetic currency 68

Maybe you are interested: