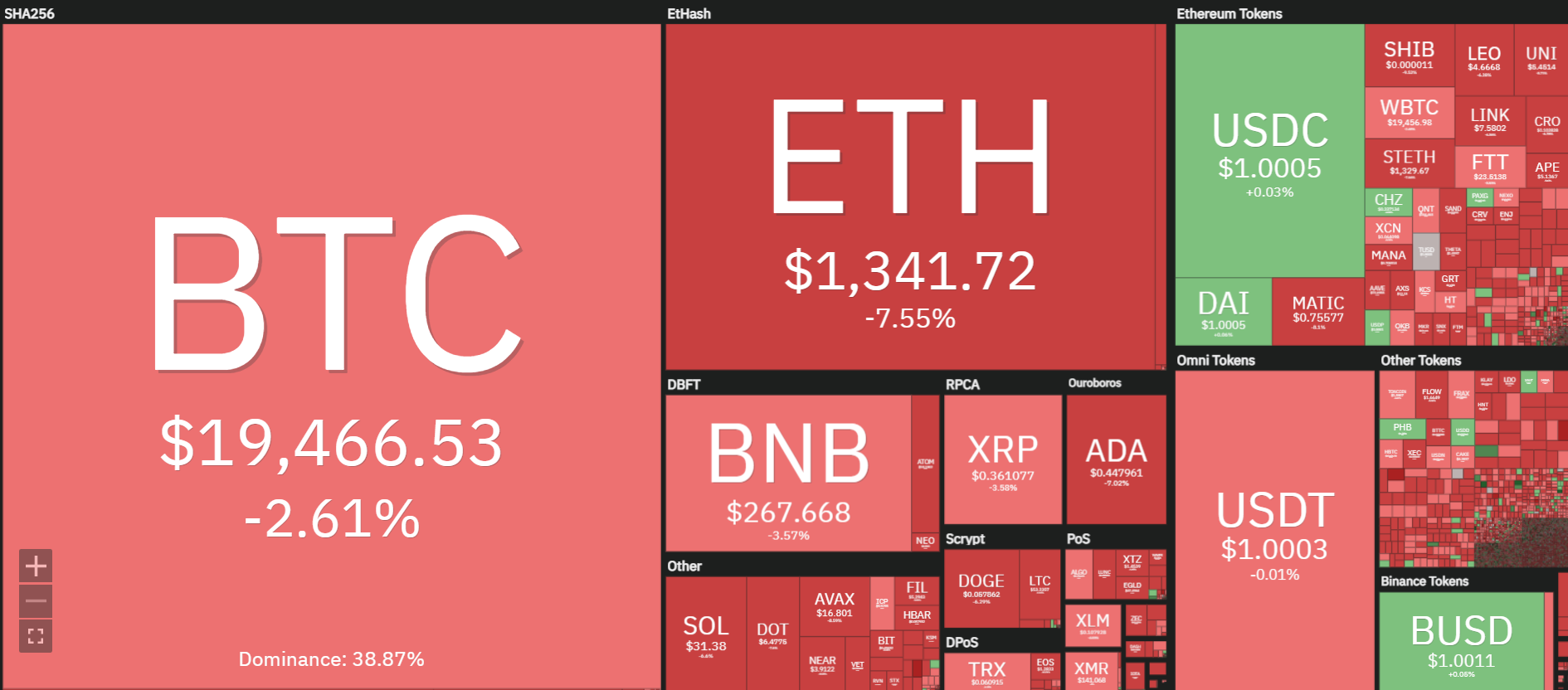

Bitcoin has continued to engulf the cryptocurrency market place in a “sea of fire”, but in contrast to the comparable image in late August, the situation is anticipated to be substantially worse this time about.

After obtaining continued “rollers” more than the previous two weeks, it rebounded sharply ahead of the US CPI announcement date, then dropped beneath the $ twenty,000 mark at the time of The Merge and recovered somewhat in the area of $ twenty,one hundred in the previous two weeks. more than the weekend, at dawn on September 19, Bitcoin out of the blue plunged to $ 19,300, creating all double-digit altcoins to “bleed”.

As of press time, BTC is struggling with a solid shock that is even now ongoing and is trading about $ 19,403.

The 2nd greatest cryptocurrency in the market place, Ethereum, also knowledgeable a comparable decline, down practically ten% in the previous 24 hrs, even now unable to recover from the “crash” The Merge, a hugely common occasion amid traders. to increase the selling price of Ether, but the outcome was just the opposite. Currently, Ethereum is trading at USD 1331.89.

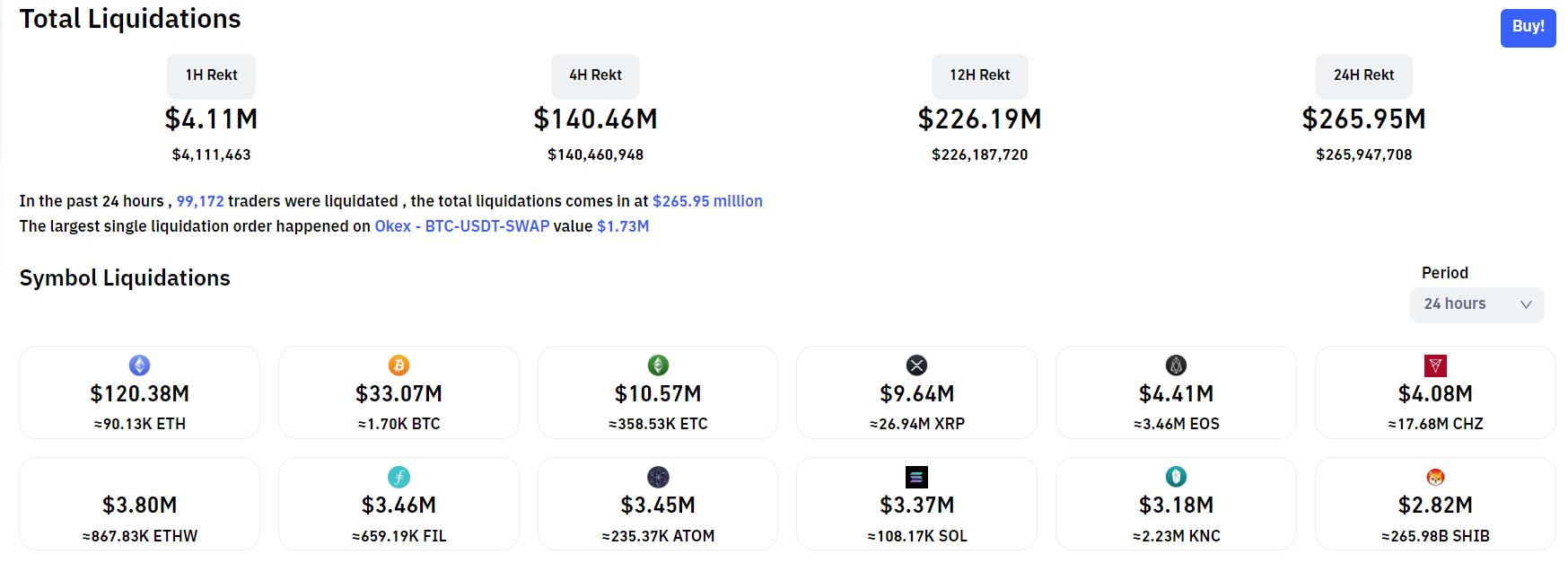

In the previous 24 hrs, there have been $ 265.95 million in liquidation of cryptocurrencies, of which practically 90% are prolonged orders with ETH accounting for the highest proportion, up to $ 120.38 million and Bitcoin in location. 2nd with only 33.07 million bucks.

It appears also clear why to clarify BTC’s most up-to-date slump, most of which stems from the macro aspects the Fed has produced in the previous.

The strain has continued given that Fed Chairman Jerome Powell’s Aug. 26 Jackson Hole speech, which stressed that the Fed will carry on to increase curiosity charges even if the move leads to some “pain”. incredibly optimistic, generating the investing local community a lot more frightened when the Fed officially hikes curiosity charges this week on September 21st.

On the other hand, in accordance to information from blockchain analytics company Glassnode on Sept. sixteen, there was 213,000 BTC, or a lot more than $ four.three billion, transferred to the exchanges. This is the highest variety of publicly traded BTCs in the previous yr, inadvertently generating better nervousness for traders about the feasible discharge strain.

216k #Bitcoin send to exchanges. I will not make the guidelines, but if they dump it, we’ll deliver down all the residents with Eaaaaas 😅 pic.twitter.com/ifS03BXSCJ

– KGV100000 (@ kgv10000) September 16, 2022

Also, final week, Glassnode’s stats chart displays that there is an equally massive spike in the volume of miners transferring BTC to the exchange. This signal slowly grew to become clearer immediately after a series of “big boys” in Bitcoin mining publicly launched BTC in early September 2022.

Miner to spot the trade movement this month. It does not actually seem excellent. It could indicate worst-situation planning and eventual collapse. #Bitcoin #btc #Miner #capitulation pic.twitter.com/PKtXenKLgk

– KGV100000 (@ kgv10000) September 18, 2022

However, this situation could be substantially worse. Because at the Jackson Hole Conference, Bitcoin fell to $ twenty,000, repeatedly testing the $ 19,500 help spot five-six instances ahead of hitting a bottom at $ 18,500 for about two weeks ahead of recovering once again.

At the time of final week’s CPI, BTC also failed to hold $ twenty,000 and examined the $ 19,500 help spot 3 instances at press time. And in contrast to Jackson Hole’s “threat” to increase curiosity charges indirectly, the Fed will now act immediately. Therefore, lots of industry experts feel that BTC will have a new lower in September 2022.

Synthetic currency 68

Maybe you are interested: