Bitcoin (BTC)’s latest rally has lastly broken via to a new broadly anticipated all-time large. With September remaining left behind and “Uptober” giving large hopes, quite a few analysts are more and more assured that this yr will perform out in the very same way as 2017.

In reality, a latest tweet from crypto analyst TechDev displays how closely the 2021 cost chart is monitoring 2017 and how it closed amazingly.

But is a continuing upward trajectory seriously that basic?

Follow the indicators

Several pieces of information indicate similarities in patterns amongst the two intervals. First, the relative power index, which traders use to recognize overbought and oversold markets, is following the very same path as 2017. In 2013 and 2017, every single cycle displays two peaks, so if occasions adhere to the program, we nonetheless have a deadline. rally.

TechDev’s ambitious prediction is that the $200,000 BTC cost is “pre-programmed”. South Korean trader Mignolet is also upbeat, saying in early October that the reduction in volume shifting from the spot industry to the derivatives industry is a constructive industry signal. Meanwhile, even in September, some had been specified that BTC would hit the $one hundred,000 mark even prior to the latest all-time large.

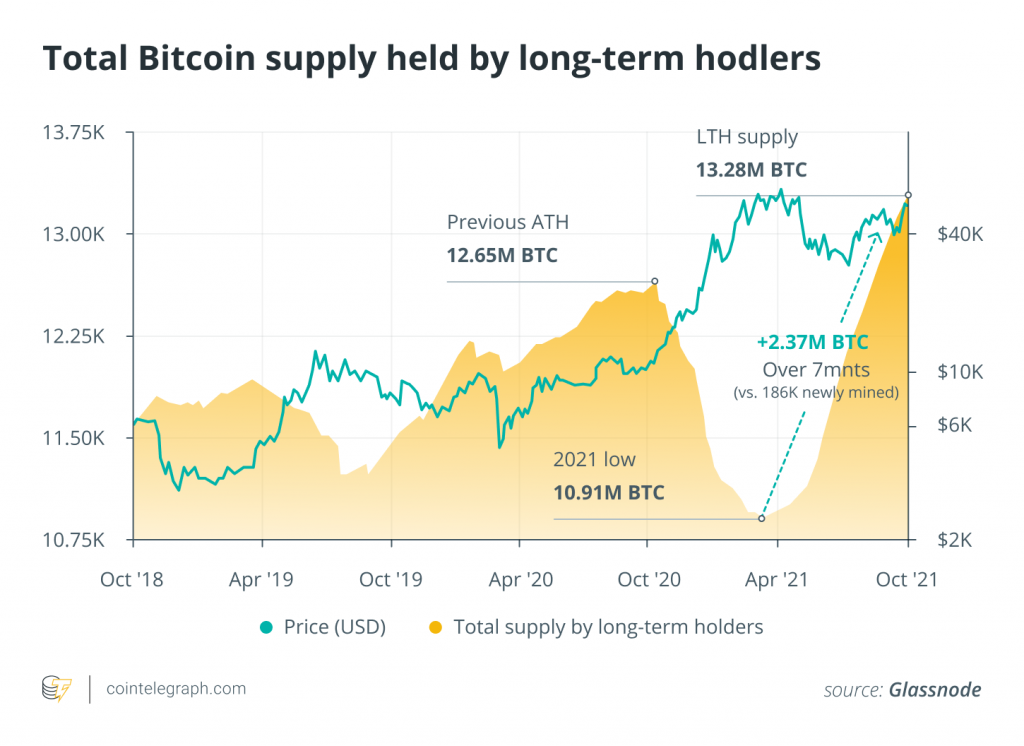

Online chain evaluation company Glassnode lately published a evaluation of prolonged-phrase offering patterns, giving far more credence to the argument for one more rally to come. The benefits show that coins held for longer than a statistically major time period of 155 days only start off getting into the industry when the cost breaks the prior all-time large. On-chain patterns now also present an accumulation trend.

Simply place, prolonged-phrase holders are making certain that the demand for BTC outstrips the provide.

However, not all people agrees that historical past is repeating itself. When we asked if he thinks 2021 is a mirror of 2017, Mati Greenspan, founder and CEO of Quantum Economics, advised Cointelegraph “Not at all,” incorporating:

“2017 started with Bitcoin surpassing $1,000 per coin and slowly rolling throughout the year, constantly breaking new highs, one peaking in December. This year, we have witnessed See mass euphoria at the start of the year and then a quiet extension of that momentum.”

Supporting this see, other indicators are displaying a far more tentative correlation. In 2017, BTC dominance plummeted in the to start with half of the yr prior to growing as it approached the $twenty,000 resistance degree. Early 2021 displays a related pattern and dominance has been growing due to the fact September. However, the route is not upward.

The very same can be stated of lively addresses, which at this level in 2017 had been on an just about vertical upward trajectory. While the uptrend right here is clearer than BTC dominance, even so, it is nonetheless in a softer trend.

Could it simply just be that 2021 is much less frenetic for approaching personal traders than 2017?

It looks probably. For illustration, net transfers to and from exchanges have some similarities to the patterns of the final bull run. But in standard, markets are working in a far more measured vogue.

Micha Benoliel, co-founder and CEO of the Internet-of-Things Nodle, factors out that there are macro-degree variations amongst 2017 and now that could account for these model variations. . Speaking to Cointelegraph, he stated the circumstance was totally various:

“The COVID crisis has affected many of our economies, and the level of money being printed by central banks to support our economy has reached new highs. The rate of inflation is increasing, and so Bitcoin is a safe position to hedge against what is happening.”

So what can be anticipated from BTC?

Regardless of regardless of whether the current mirrors the previous by any measure, analysts had been generally bullish on Bitcoin’s cost even prior to this week’s stellar cost action.

TechDev’s $200,000 prediction is on the greater finish of most forecasts, even though analyst Filbfilb puts it at $72,000 in November.

And then there is the persistently dependable PlanB. The creator of the stock-to-movement model for Bitcoin has fixed the month-to-month closing cost of the most latest two months in the a single % selection and has predicted an October near of $63,000 and $98,000 for the month. eleven. He also advises BTC to hit $135,000 in December – not like him shown, based mostly on his well-known stock-movement model. If that is one hundred% correct, BTC has hit the $one hundred,000 mark, in accordance to him.

Instead, it looks that the crowd can count on the analyst to reveal information of the new cost and/or on-chain information designs that are driving these terrifyingly correct month-to-month cost predictions.

How prolonged can it final?

The 2017 bull run peaked in December as optimism ran out close to $twenty,000. Although a lesser breakout in early January features new hope, it has been downhill ever due to the fact.

It should really also be mentioned that the final main BTC bull run prior to that was in 2013 when the cost peak appeared a handful of weeks earlier in late November and early December. Again, the large was followed by a rally. one more in early January.

If historical past repeats itself, December could mark a time when the industry will enter a new phase of this halving cycle. PlanB believes it will final longer, based mostly on his undisclosed chain model.

Of program, indicators and designs can not consider into account breaking information or other industry occasions that could influence rates. So far this yr, Bitcoin has weathered several regulatory blows from the Chinese government and the antics of Elon Musk, along with its push to grow to be legal tender in El Salvador and obtain wider recognition. from the economic sector and institutions. The sluggish economic system and investor curiosity in the cryptocurrency’s industry-beating yields have also aided keep sound assistance.

Related: Cryptocurrency Breaks Wall Street’s ETF Barrier: A Watershed Moment or a Stop?

While Bitcoin exchange-traded fund (ETF) information pushes the industry into epic bull territory ideal now, there is no promise that constructive sentiment will carry on to drive the industry. There is an ongoing narrative of probable US regulatory intervention and an more and more heated vitality crisis that looks probably to influence mining profitability – these or other financial elements. Other macroeconomics might bring about the industry to deviate.

Steven Gregory, CEO of Currency.com, believes that the recent ETF hype generates a related, if not dissimilar, feeling to 2017, telling Cointelegraph that when the to start with Bitcoin futures contract was extra to the CBOE There was a good deal of pleasure: “Initially, there was a strong upward price movement, but looking back, it was like the end of a bull cycle for BTC. But he cautions against preparing for the cold of a new crypto winter, further explaining:

“There may be some similarities here between the 2017 bull cycle and this 2021 cycle; however, adoption is much greater, open interest is higher, and the utility of cryptocurrencies is unrecognizable beyond 2017.”

While that isn’t going to promise benefits, it seems like optimism is overwhelmingly robust at the minute. Whichever way it plays out, 2021 is set to go down in the crypto historical past books as a single of the most action-packed many years in the colorful historical past of the field.

.