Bitcoin (BTC) is attempting to recover its $2 trillion market capitalization as bullish momentum gradually builds. Recent technical indicators such as the DMI and RSI suggest the uptrend is strengthening but also point to the need to maintain buying activity to continue upward pressure.

At the same time, BTC’s EMAs suggest the emergence of a golden cross that could push the price to test key resistance levels near $98,870 and beyond. However, failure to break these levels could result in a pullback, with key support zones at $90,700 and $88,000 coming into focus.

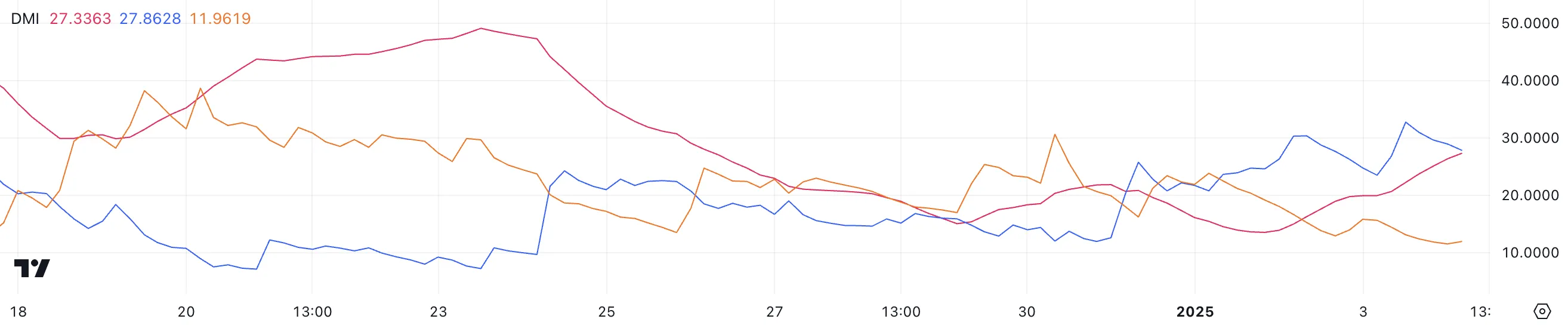

Bitcoin’s DMI shows that the uptrend has begun

Bitcoin’s DMI chart indicates that its current ADX is 27.3, up significantly from 13.6 three days ago. ADX, or average directional index, measures the strength of a trend on a scale of 0 to 100, with values above 25 representing a strong trend and below 20 indicating no clear trend.

Directional indicators provide further context, with +DI at 27.8, down slightly from 32.7 yesterday, and -DI at 11.9, down slightly from 13.1. This configuration emphasizes that buying pressure is still stronger than selling pressure, although the slight decline in +DI shows that the upward momentum is showing signs of abating.

In the short term, BTC price is likely to continue rising, but sustaining further gains may require continued buying to keep +DI high and ADX rising.

BTC’s RSI has remained above 50 since January 1

Bitcoin’s RSI is currently 60.47, maintaining its position above the neutral level of 50 since January 1. The Relative Strength Index (RSI) measures the speed and magnitude of price changes on a scale from 0 to 100, providing insight into overbought or oversold conditions.

Bitcoin’s RSI recently peaked at 66.6 before returning to its current level of 60.47. This decrease reflects a correction in buying pressure after a period of strong momentum.

Although the RSI remains in the positive zone above 50, the correction suggests that BTC price could correct or see milder upside movements if there is no new push pushing the RSI into the overbought zone. Current levels still allow for moderate upside while keeping the risk of overextension under control.

BTC Price Prediction: Bitcoin Needs to Break These Resistances to Rise to $110,000

BTC’s EMAs are showing signs of a strong uptrend as the short-term EMA crosses above the long-term EMA. This bullish crossover typically signals an increase in momentum, which could push Bitcoin price to test resistance at $98,870.

A successful break above this level could pave the way for further gains, potentially reaching $102,590 and even testing $110,000 for the first time, depending on the strength of the trend. This could take place days after Bitcoin celebrates its 16th birthday.

However, if BTC price fails to overcome resistance and the trend reverses, it could face downward pressure. In that case, BTC could retest the $90,700 support level, with a further drop to $88,000 possible if it continues to break.