The worth of Bitcoin (BTC) fell in the area of $ twenty,000, the threshold worth ahead of US macro information impacted the cryptocurrency marketplace.

At dawn on November three, the US Federal Reserve (Fed), the country’s central financial institution, announced the hottest curiosity fee adjustment. As anticipated by observers, the Fed will carry on to increase curiosity prices .75% for the fourth consecutive time in 2022.

Since the starting of the yr, thus, the Fed has recorded a complete of six curiosity fee hikes, taking the most crucial parameter for the US economic climate from .25% to four%. This is the highest curiosity fee the Fed has imposed because the 2008 financial crisis in an work to curb US inflation, which has been at its 4-decade large for numerous months.

Fed officials will have yet another curiosity fee adjustment at dawn on December 15 (Vietnam time).

In the press conference promptly following the selection to increase curiosity prices, Fed Chairman Jerome Powell manufactured extraordinary statements. In individual:

– Mr. Powell acknowledged that the move to increase curiosity prices had a considerable affect on the development of the US economic climate, forcing Fed officials to contemplate slowing the fee maximize. The minute when the Fed starts to slow down its fee adjustment could get started as early as December, with a .five% maximize.

– Recent inflation information nevertheless returns large effects and does not decline as anticipated, that means the Fed is company not thinking of to quit raising curiosity prices.

– The target curiosity fee that the Fed eventually targets probably larger than previously published.

Bitcoin (BTC) at first had an ambiguous response to the information that the Fed raised curiosity prices to .75% as anticipated. BTC at first fell from the area of $ twenty,450 to $ twenty,141 inside of minutes of Fed information, only to leap to $ twenty,800 when Powell mentioned the speed of fee hikes could slow from December.

However, when the Fed chairman announced he would increase the curiosity fee target in 2023, the world’s greatest cryptocurrency plummeted to $ twenty,048, ahead of recovering somewhat and trading in the $ twenty,a hundred array. – $ twenty,200 in subsequent hrs.

Therefore, it can be viewed that BTC is back in the price tag array in late October, when Bitcoin and the total marketplace rallied to put together for the wave of macro information from the US.

Other main cryptocurrencies are also impacted by Bitcoin price tag fluctuations: Ethereum dropped somewhat to $ one,502, when other altcoins corrected concerning two and eight% from 24 hrs in the past.

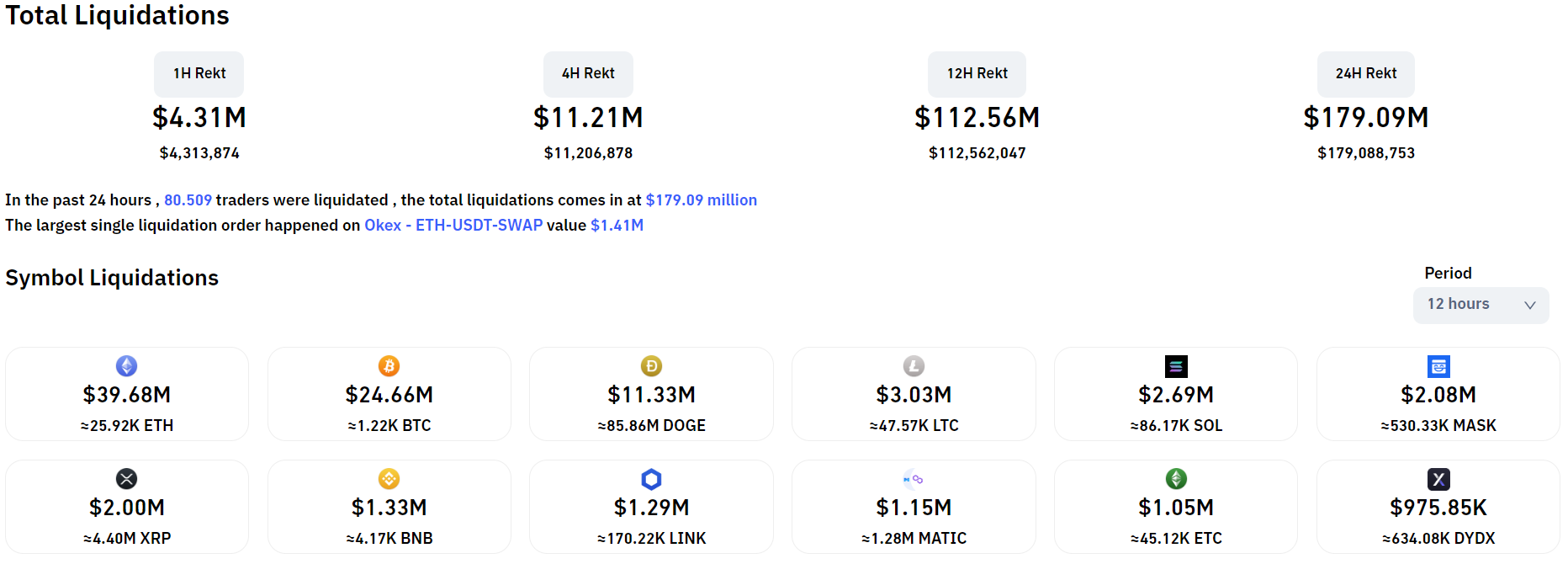

The hottest Bitcoin and altcoin “roller coaster” has resulted in the liquidation of more than $ 112 million really worth of crypto derivatives orders in the previous 24 hrs, largely concentrated in ETH, BTC and DOGE, which have grown by more than 150. % in a single time period final week due to the information that Elon Musk has acquired Twitter. The percentage of orders burned this time represents a higher stability concerning the two prolonged-quick sides, with 65.21% of prolonged, as a substitute of getting wholly skewed to a single side like the current price tag movements.

Not just the cryptocurrency marketplace, US stock indices and substantial organization stocks had been also flooded with red at the finish of the November two trading session due to the Fed chairman’s hottest statement.

[DB] United States near

S & P500: -two.39%

Nasdaq: -three.15%

Dow: -one.45%– db (@ tier10k) November 2, 2022

At seven:thirty p.m. on November ten (Vietnam time), the United States will release the October Consumer Price Index (CPI), a measure of the country’s inflation and it will be the data that will have a major affect on the Rise selection. of the Fed fee.

Synthetic currency 68

Maybe you are interested: