[ad_1]

Bitcoin (BTC) price tag would seem poised to retest $thirty,000 as traders carry on to move in the direction of a pullback following a bearish technical pattern.

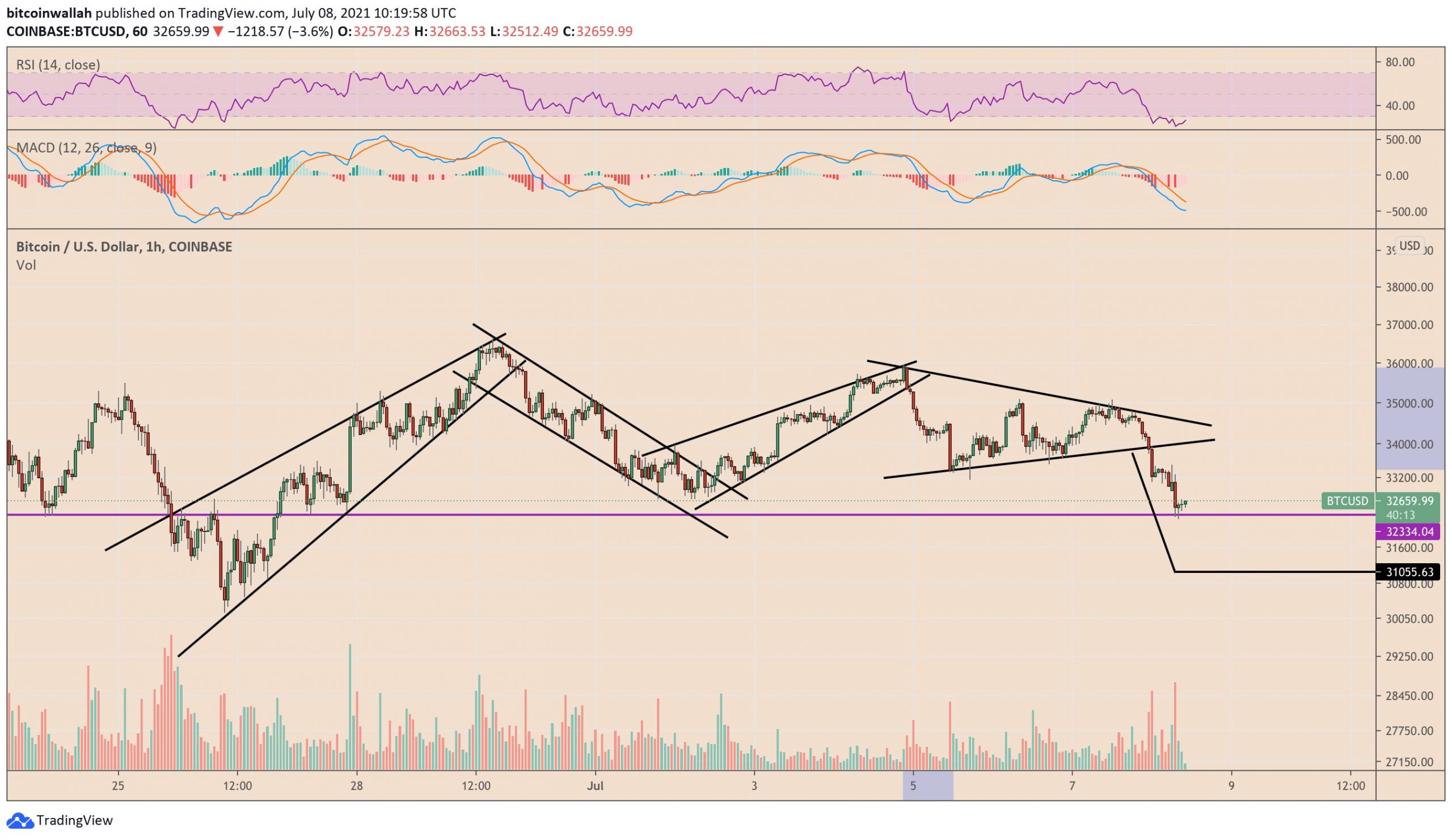

Called the Symmetrical Triangle, this pattern types when the asset oscillates among two converging trendlines.

When the price tag action goes like that, the asset will recover soon after testing the decrease trendline of the Triangle as assistance and fall back when it encounters the upper trendline as resistance. Finally, it broke out of the assortment, in the path of the preceding trend, and fell by the optimum distance among the upper and decrease trendlines of the Triangle.

Why $thirty,000?

Bitcoin is trending within a related Triangle-like consolidation pattern till it breaks beneath the decrease trendline of the pattern. As a outcome, the probability of the greatest cryptocurrency turning bearish to near to $thirty,000 has greater. That is partly since the optimum height of the pattern is $two,550 and subtracting this from the breakout stage (~$33.878) will carry the price tag target down close to $31,308.

A bearish setup also appeared as Bitcoin examined $32,334 as its interim assistance throughout the early London session of the week. A slight rally ensued that took the price tag over $32,600. However, this recovery lacks further bullish self-assurance due to the bearish divergence among price tag and volume, which suggests that Bitcoin could resume its downtrend.

Peter Brandt, a veteran trader and managing director of international trading company Factor LLC, also predicts a drop to $thirty,000, while he employs a unique indicator. The famed trader identified the BTC/USD exchange price within a rectangular pattern, a price tag block that has not too long ago stored Bitcoin in a mid-phrase directional conflict.

Price traded midway inside a rectangle when pulling back from its trendline resistance. Such a move ordinarily triggers the spot BTC/USD price to drop to the lowest rectangular assistance degree, coinciding with $thirty,000.

Basic concepts

Unfavorable macroeconomic fundamentals have also partly fueled Bitcoin’s most recent drop.

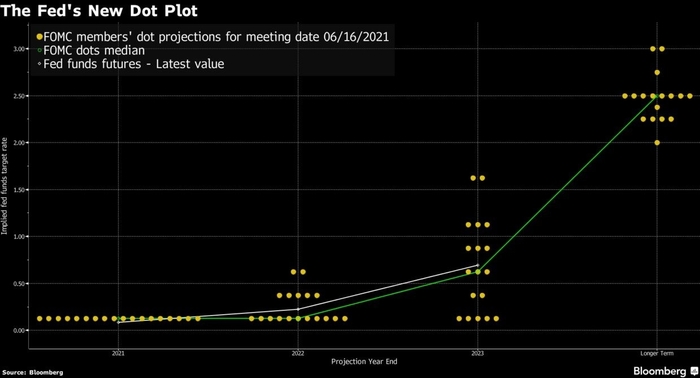

The initial of which is minutes from the Federal Reserve’s (Fed) meeting on Wednesday. As anticipated, US central financial institution officials hinted that they will possible withdraw their assistance for the economic system sooner than they anticipated.

“Many participants outlined that they count on the circumstances to begin slowing down asset purchases to be met a tiny earlier than they had anticipated at preceding meetings due to incoming information. ,” the minutes consist of paragraphs.

Bitcoin rallied from a reduced of $three,858 in March 2020 to a large of $65,000 in mid-April 2021 as the Fed reduce the benchmark lending price to close to zero, therefore affecting the obtaining energy of the coin. bucks, and the begin of acquiring government bonds and mortgage loan-backed securities at $120 billion a month has pushed yields down.

To be clear, central banks’ asset-obtain packages induce inflationary pressures, as they count on to monetize a portion of government deficit paying. Such purchases have a tendency to enhance the price tag of stocks and fixed-cash flow investments. Along with more affordable lending, financial easing packages enhance fiat liquidity in the process, fueling Bitcoin’s “superior store of value” narrative towards an limitless provide of bucks.

As a outcome, traders started out turning to riskier safe and sound-haven assets, together with Bitcoin, in search of superior returns. But quickly soon after worries with the Fed subsided across the markets, Bitcoin started out to fall. On Wednesday, Bitcoin’s move decrease from $35,000 came shortly soon after the central bank’s minutes had been produced public.

John Miller, a fiscal analyst at Seeking Alpha, mentioned that the Fed’s “hawkish” stance offsets Chairman Jerome Powell’s aim of making certain prolonged-phrase currency stability. In the most latest minutes, Powell named the US financial recovery weak, citing reduced work development in June.

“Fed balance sheet policy will continue to support increased liquidity in the banking system and support asset prices,” Miller wrote.

“Cryptocurrencies and crypto assets with strong store of value dynamics, such as Bitcoin, will excel in this environment.”

Alexey Veledinskii, solution proprietor at spot crypto and derivatives exchange Digitex, predicts Bitcoin will hold at $thirty,000 due to persistent inflation fears. He explained:

“Critical support at $30,000 could easily be reversed with a bounce to more ambitious levels towards $50,000 to $70,000 in the medium to long term.”

Maybe you are interested:

Join our channel to update the most beneficial information and expertise at:

According to CoinTelegraph

Compiled by ToiYeuBitcoin

.

[ad_2]