Bitcoin (BTC) price has skyrocketed 21.70% in the past seven days, continuously reaching historical highs. Currently, BTC is around 10% below the $100k mark, with the uptrend showing exceptional strength, as highlighted by technical tools such as the DMI and EMA lines.

Market sentiment is shifting to a stage of increasing confidence but has not yet reached a state of extreme excitement, there is still room for growth before a correction is possible. However, while the bullish momentum remains positive, traders should be cautious of the possibility of price declines as Bitcoin approaches this important milestone.

Bitcoin’s Current Trend Is Very Strong

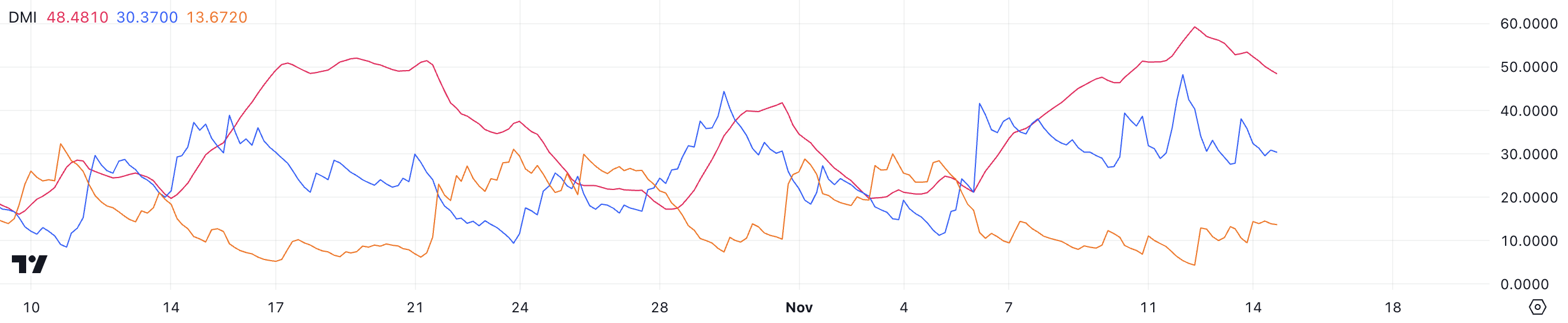

BTC’s DMI chart highlights Bitcoin’s strong uptrend. The Average Directional Index (ADX) is currently at 48, signaling significant trend strength. ADX is a measure of the strength of a trend—values above 25 indicate a strong trend, and anything above 40 is considered very strong.

A few days ago, ADX approached 60, showing that the uptrend was even stronger then.

Directional Movement Indicators (+DI and -DI) further clarify the direction of this trend. With +DI at 30.37, the data points to a dominant growth movement, while -DI at 13.67 suggests weaker selling pressure. This combination shows that buyers are now in a dominant position over sellers, reinforcing Bitcoin’s bullish momentum.

The difference between these values supports the overall strength of the current trend, suggesting that bullish forces are still dominating the market despite the recent boom.

Bitcoin NUPL Is Still Far From Euphoric

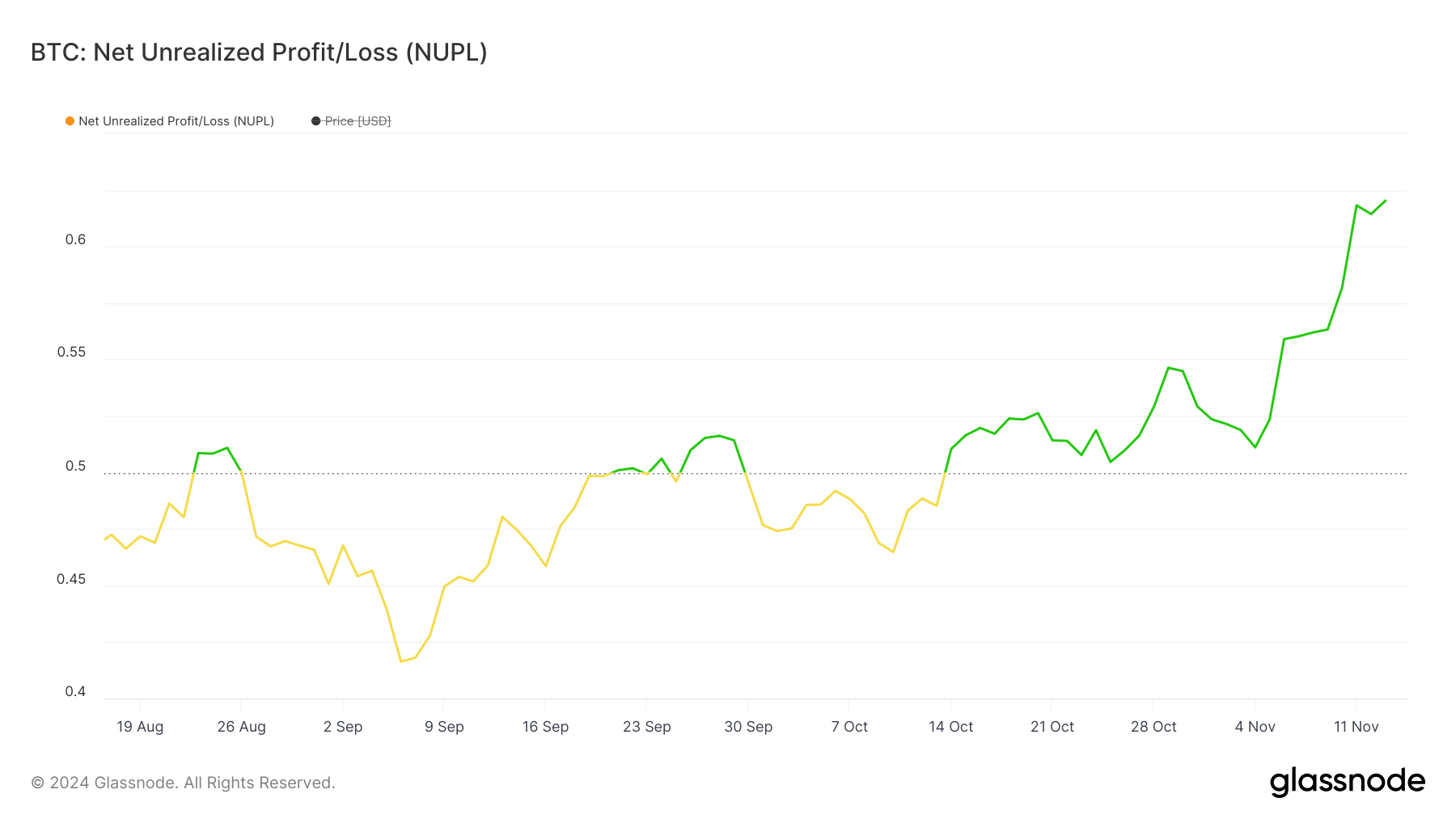

Bitcoin’s NUPL (Net Unrealized Profit/Loss) index is currently at 0.62, which is in the “Belief – Denial” phase. NUPL measures the total unrealized profits or losses of all Bitcoin holders, helping to identify broader sentiment within the market.

At 0.62, market sentiment has shifted from cautious confidence to growing confidence but has not yet reached extreme levels of optimism.

Despite being in the “Belief – Denial” stage, the NUPL level is still significantly below 0.7, the threshold for the “Excitement – Greed” stage. Historically, this period has often marked a time when Bitcoin faced sharp corrections as market sentiment turned to unsustainable levels of greed.

With the current NUPL value below this key threshold, BTC price could still increase before reaching levels typically associated with overheating.

BTC Price Forecast: Will BTC Hit 100 Thousand USD In November?

Bitcoin’s EMAs are currently showing a strong bullish setup, with price sitting above all of them and the short-term EMAs placed above the long-term one.

This arrangement is the classic sign of a well-supported uptrend, suggesting that upward momentum is suitable for further gains.

BTC price is also only about 10% below the historic $100K mark, and, with the current strength of the trend and supporting metrics like NUPL, reaching this mark seems feasible in the near future. However, a price correction is also always possible before a new high is established.

If the trend loses momentum, Bitcoin price could face a rebound, potentially testing key support levels at $85K USD and $78.4K USD.