Bitcoin (BTC) remains in a downtrend, trading near key support at $90K amid a prolonged market sell-off. The price of BTC has dropped more than 8% in the past week, raising concerns about the possibility of further decline.

With reduced buying pressure and declining institutional participation, Bitcoin is at risk of falling below $90K in the near future. Here’s why.

Bitcoin faces difficulties as institutional trust declines

On the BTC/USD one-day chart, BTC trades below the red Super Trend indicator line. This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to indicate trend: blue for uptrend and red for downtrend.

When an asset price falls below its Super Trend indicator, this signals a bearish move and a reduction in buying pressure. Traders often consider this a sell signal or cautionary warning.

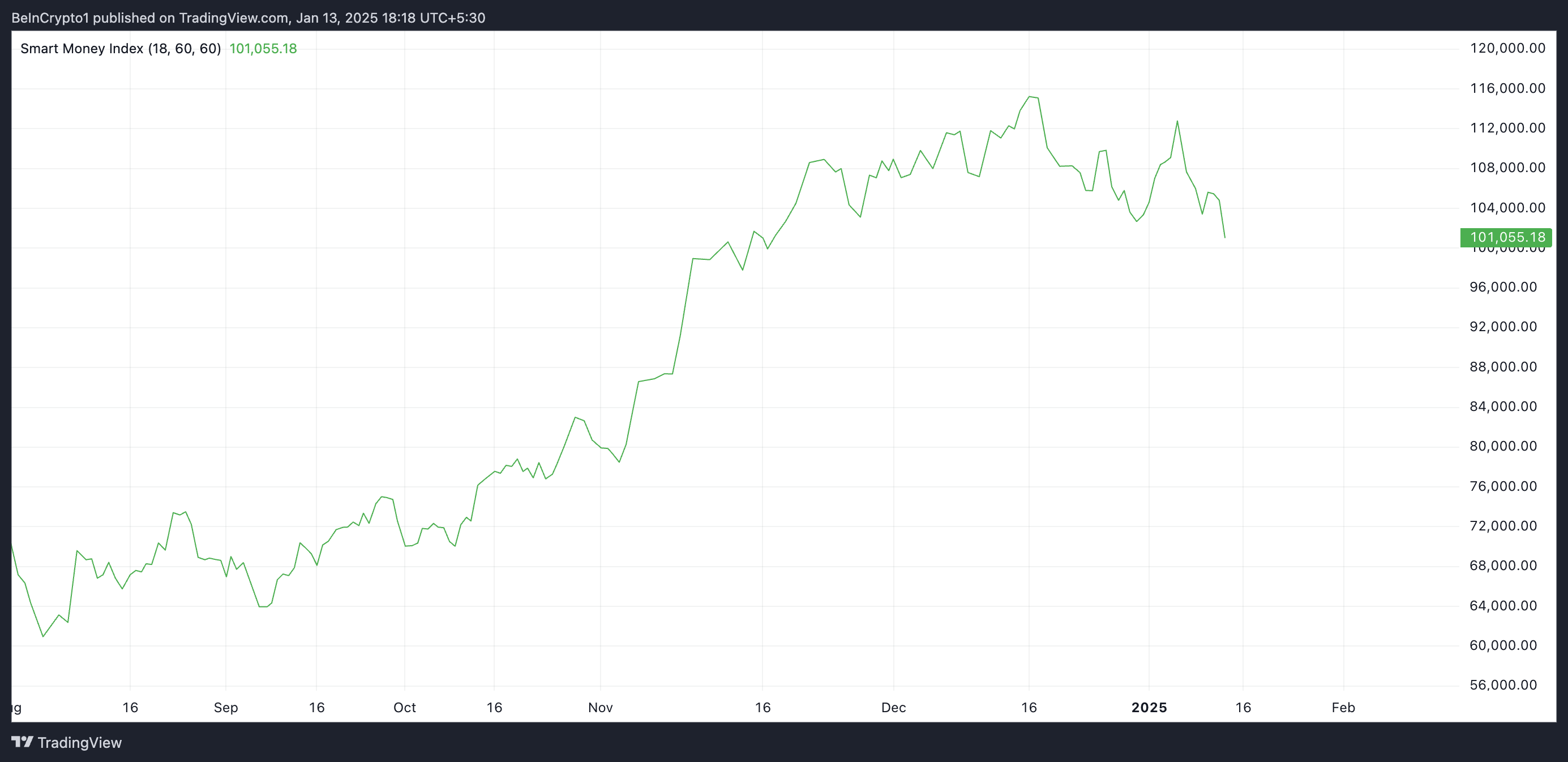

Additionally, BTC’s Smart Money Index (SMI) has been continuously decreasing since January 6. At the time of writing, the index reached 101,055, down 10% since then.

An asset’s SMI tracks the performance of professional or institutional investors by analyzing market behavior during the first and last hours of trading. When the index rises, it shows increased buying activity from these investors, signifying growing confidence in the asset.

Conversely, a decline in SMI indicates high selling activity and diminished confidence from these investors. This hints at a possible BTC price drop in the near future.

In one post Recently on X, veteran crypto trader Peter Brandt confirmed this bearish outlook. According to Brandt, an assessment of BTC’s price performance on the one-day chart has revealed the possibility of a head and shoulders (H&S) top forming.

An H&S pattern consists of three peaks: the central peak (head) is the highest, accompanied by two smaller peaks (shoulders). The line connecting the lowest points of these peaks is called the neckline.

According to Brandt, in BTC’s situation, one of three things could happen: the H&S pattern could complete and move towards its target, fail and create a bear trap, or transform into a larger pattern, more complicated.

BTC Price Prediction: Bearish Pattern appear

BTC’s waning demand suggests the possibility of confirmation of this trend and continued price decline. In this situation, the coin could fall below $90K USD, trading around $85,224.

Conversely, a change in market trend could push BTC price to $102,538.