[ad_1]

China’s continued tightening of Bitcoin mining and trading, coupled with destructive technical indicators, has induced Bitcoin’s worth to drop to a 6-month low.

June 22 after Bitcoin (BTC) worth dropped to a 6-month low at $28,805. A drop under the important thing $30,000 degree might be a uncommon “promotion,” however information reveals institutional buyers are persevering with their longest run of gross sales since February 2018.

Data from exchanges Binance and TradingView reveals that the June 21 drop under $32,000 and a restoration above $33,000 was only a precursor to the transfer on June 22, when Bitcoin plummeted, hitting a low of 28,805 USD earlier than recovering to 32,000 USD on the time of writing.

Ethereum (ETH) was additionally affected, falling as a lot as 15% to a low of $1,700 after bulls failed to carry the $1,900 degree. Unless a major impetus emerges for the market to show round, the present pattern continues to be destructive as bulls dominate with $2.5 billion value of Bitcoin choices expiring on Tuesday. June twenty fifth.

The information suggests the image might be much more bleak

While the value motion on June 21 could shock many, many indicators recommend bearish momentum and the chance that costs will proceed to fall.

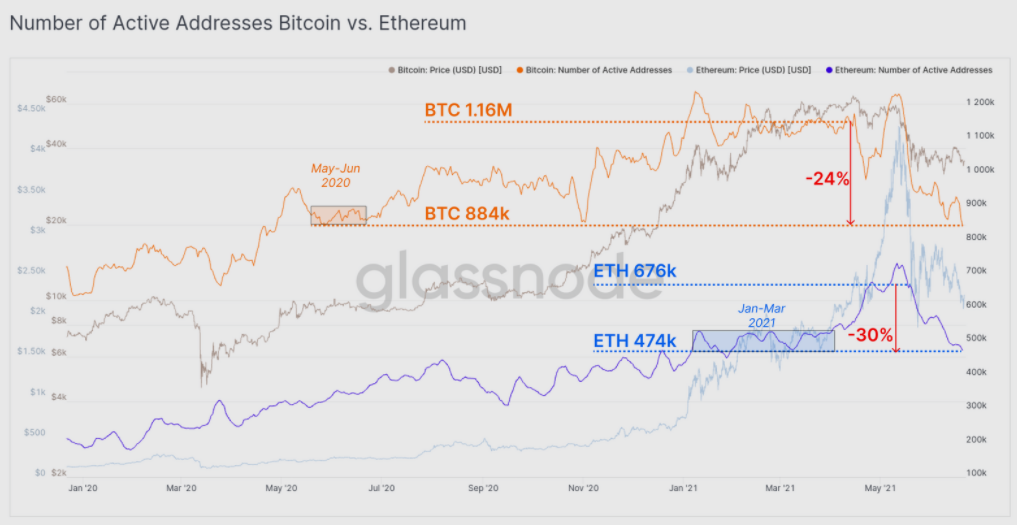

According to the data from Glassnode, the variety of energetic addresses on each Bitcoin and Ethereum has dropped considerably from the highs in May, with energetic BTC addresses down 24% whereas energetic Ethereum addresses down 30%.

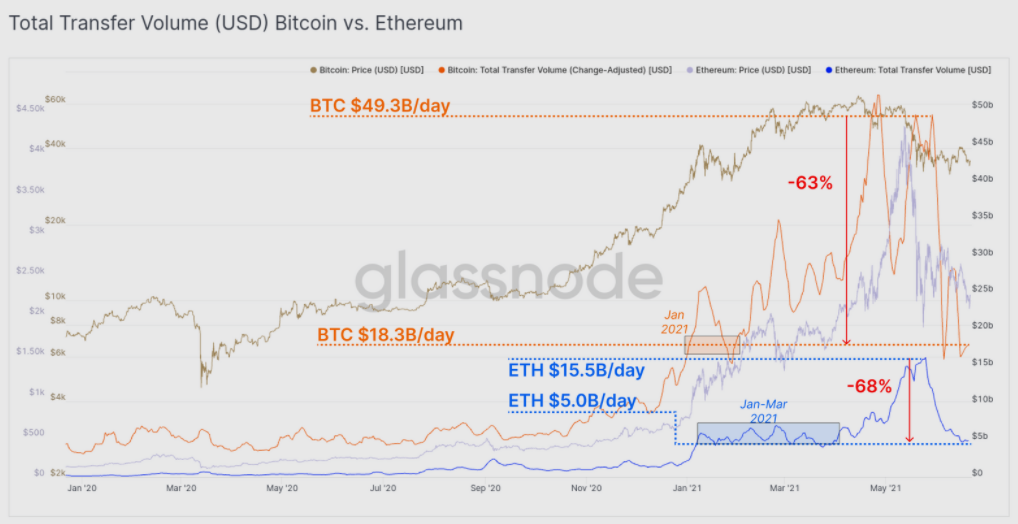

It was these indicators that triggered the chain of destructive dominoes to hit the market, with payouts down 63% to $18.3 billion per day on Bitcoin and 68% all the way down to $5 billion per day on Ethereum.

The drop in exercise and worth traded on-chain might be interpreted as common market melancholy as buyers who had peaked in April and May should now resolve in the event that they Do you need to “cut your losses” to keep away from the chance of dropping more cash, or preserve holding on to the inventory within the hope that the market will finally flip round.

The disaster originated in China

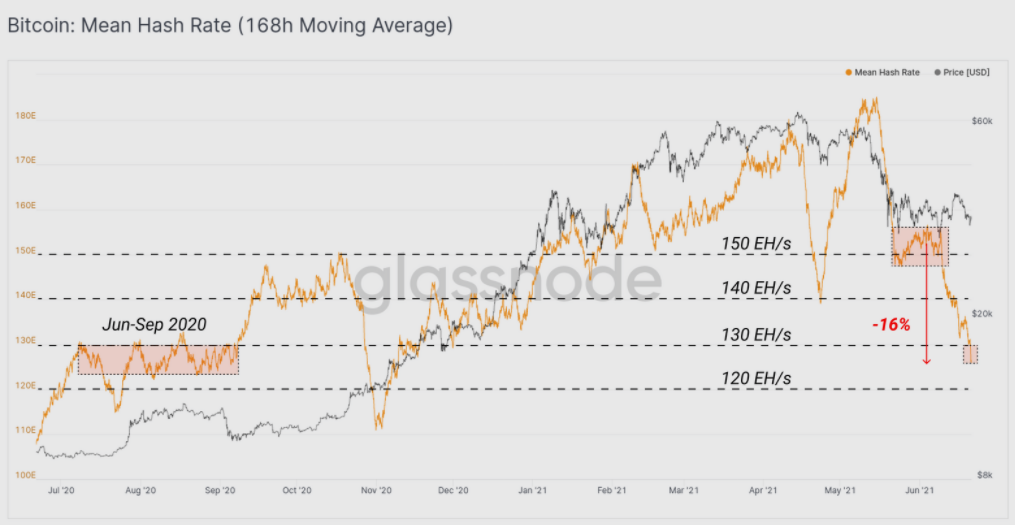

Another main motive for the latest weeks-long capital market downturn is China’s crackdown on cryptocurrency mining operations within the nation. This has resulted in a major drop in hashrate to the lows final recorded in September 2020.

While the closure of a lot of Chinese miners and the ensuing drop in hashrate is a destructive pattern within the short-term, Delphi Digital has said that “in the medium to long term, this is what matters.” This must be thought-about a wholesome growth for the Bitcoin network as the chance of hashrate centralization is tremendously diminished. “

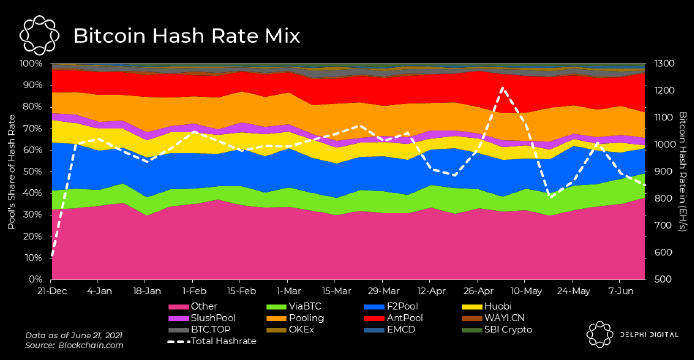

According to the Delphi Digital, The focus of hashrate within the arms of China-based miners has declined since China began uprooting miners, permitting different nations to extend their “market share from 30.81%” up 37.96% within the final 30 days”.

In addition to curbing mining, China additionally reiterated its ban on banks supporting companies that purchase and promote cryptocurrencies, which has led to panic amongst miners and buyers in China.

With China unlikely to vary its perspective in direction of cryptocurrencies anytime quickly, investor uncertainty and destructive worth motion are more likely to proceed within the short-term.

Synthetic

Maybe you have an interest:

.

[ad_2]