- Legal ruling could reshape US trade strategy.

- Economic risks loom with potential market shifts.

- Public discourse on executive trade powers intensifies.

Lede

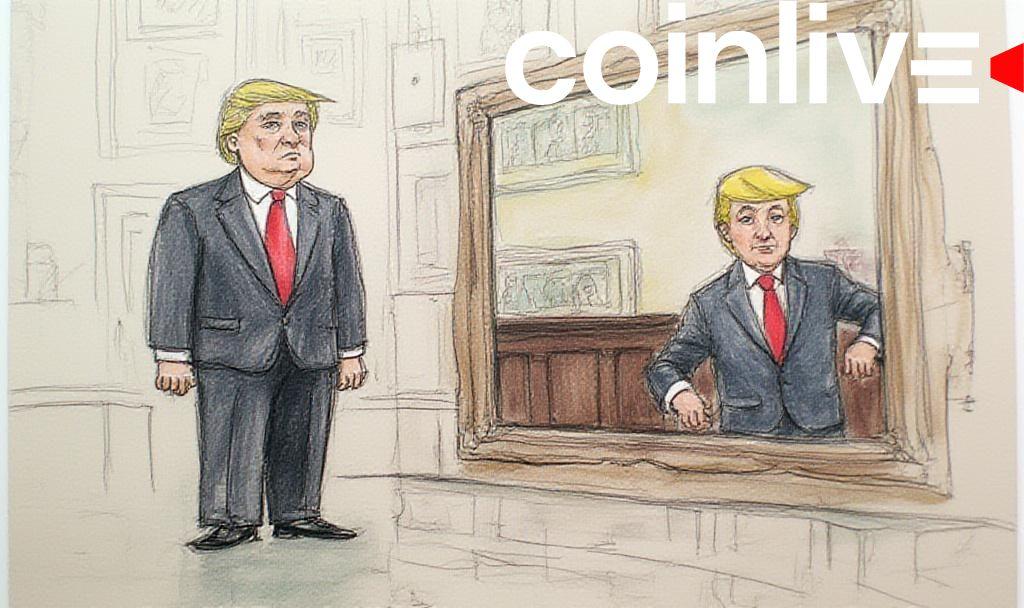

President Donald Trump has voiced concerns over the legal decision about his tariffs, which he called “Liberation Day” tariffs, stressing the economic risks if ruled against, hinting at potential future challenges for the US.

Nut Graph

The ruling’s significance lies in its potential to redefine executive power on trade, causing widespread market uncertainty. Immediate impacts include shifts in consumer prices and global trade dynamics.

The United States Court of International Trade initially struck down the tariffs, impacting businesses and potentially the broader economy. President Trump implemented these measures using the International Emergency Economic Powers Act, aiming to safeguard national interests.

Statements from Key Figures

Key figures in this situation include President Trump, with a statement highlighting the stakes:

“If the Courts somehow rule against us on Tariffs, which is not expected, that would allow other Countries to hold our Nation hostage with their anti-American Tariffs that they would use against us. This would mean the Economic ruination of the United States of America!” — Donald Trump, President, United States

The appellate court has temporarily reinstated the tariffs. Disputed tariffs could influence trade partners while affecting domestic and global economic policies.

Market and Business Reactions

The temporary reinstatement has caused uncertainty, with some markets reacting negatively. Businesses are wary of potential price increases and supply chain disruptions. Industries dependent on foreign goods and materials may face difficulties adjusting to new tariff systems.

Political and Financial Implications

Political tensions could rise as Congress may scrutinize the President’s use of tariffs as a negotiating tool and examine its long-term viability. Intergovernmental relations with key trade allies remain strained, possibly affecting diplomatic negotiations.

Financial implications are evident, with potential impacts on job markets and pricing. Expert analysis suggests future economic adjustments may be necessary. These decisions could have ramifications on domestic inflation and technological investments.