Bitcoin (BTC) is foremost the crypto industry down and the dilemma is becoming aggravated by the dilemma involving Silvergate financial institution. This week, the crypto-centered financial institution explained it essential additional time to resolve technical and procedural difficulties connected to the processing of consumer crypto transactions.

Investor demand for cryptocurrencies is reducing due to Bitcoin’s weakness and Silvergate’s dilemma. This brings about the worth of other currencies to lower as properly.

The Bitcoin (BTC) selling price is foremost the crypto industry to a bear and this dilemma is exacerbated by the problem involving Silvergate Bank. This week, the crypto-centered financial institution announced that it requires additional time to file its yearly ten-K report and warned that it could not be operational for yet another twelve months. Reacting to this information, a number of crypto corporations announced to cut down or cancel their cooperation with Silvergate Bank.

Uncertainty about a bank’s potential along with its influence on the crypto sector can set off a disproportionate pressure response. However, if this instability is not widespread, the adverse influence could be constrained.

In addition, the superior information for the crypto industry is that the US stock industry is striving to recover. This demonstrates that traders carry on to include possibility to their portfolios at reduced charges. This problem could assistance restrict the decline in the selling price of Bitcoin and some other cryptocurrencies.

Failure to break by means of the $24,000 selling price degree can stimulate traders to withdraw their revenue. On March three, promoting improved and the selling price fell under the help at $22,800. If no new help is made, the selling price could carry on to fall in the coming days. In this hard time of the cryptocurrency industry, traders have to have to be cautious and prudent when choosing to invest in or promote.

Bitcoin selling price is even now hovering about $23,332 with a 10-day moving normal. However, the relative power index (RSI) has dipped under 44, indicating that the brief-phrase bullish momentum has turned to the promote side. The subsequent essential help to observe on the way down is $21,480.

Investors are anticipated to defend this degree by all suggests as a break and near under this help could open the door to a retest of the psychologically essential $twenty,000.

Or if the selling price rebounds from $21,480, the bulls will try to clear the overhead barrier at $22,800. If effective, that would recommend that the BTC/USDT pair could stay caught involving $21,480 and $25,250 for the subsequent handful of days.

Total industry capitalization impacted

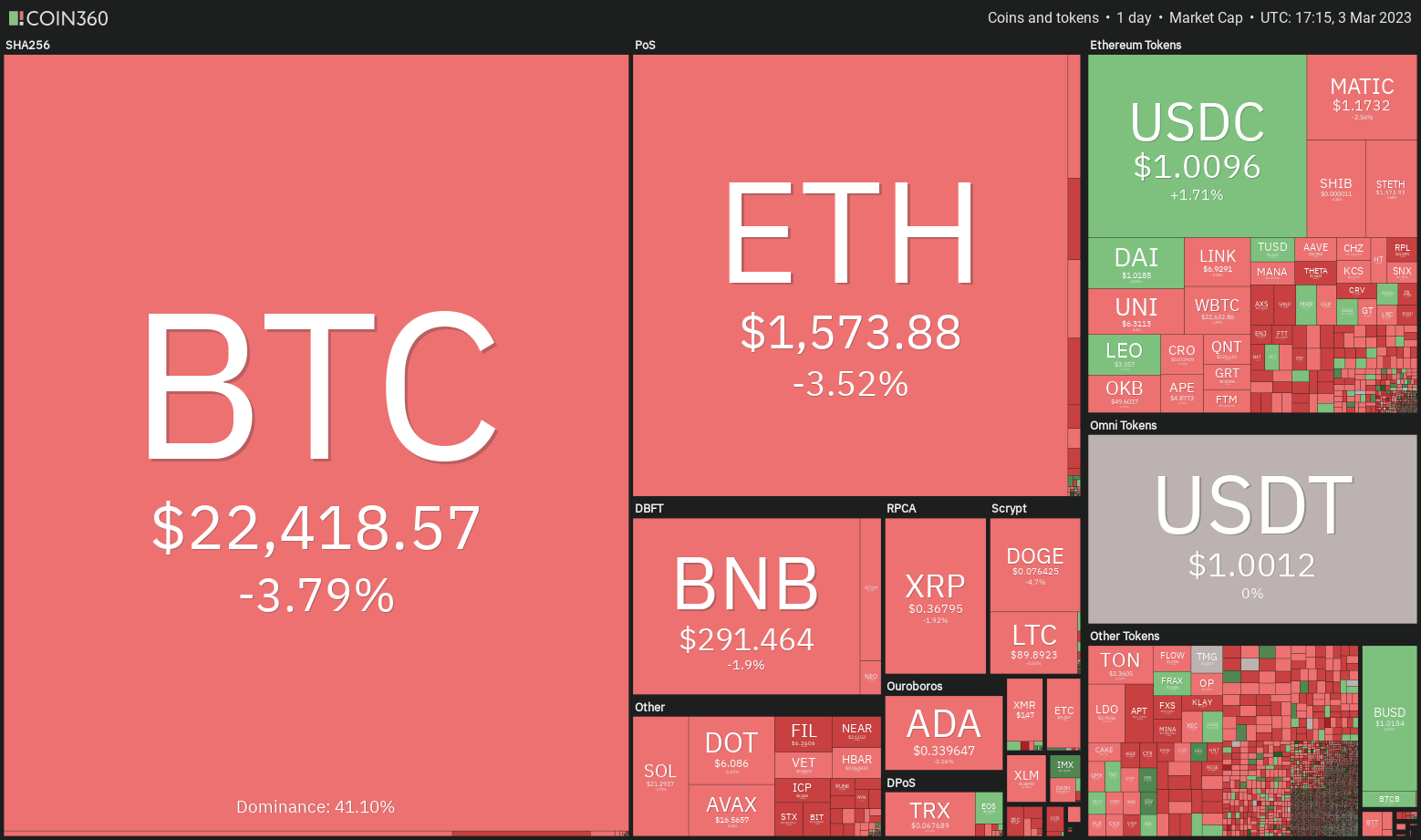

The complete crypto industry worth has fallen under US$one.025 billion as considerations above the liquidity of Silvergate Bank have triggered a considerable promote-off in BTC, ETH and other cryptocurrencies.

The crypto industry has seasoned a pretty secure February as the complete industry capitalization improved by only four%. However, concern of pressures is acquiring an influence on industry volatility in March.

Traders will absolutely miss the technical trend that has driven the complete crypto industry cap up above the previous 48 days. Unfortunately, not all trends final permanently and the six.three% selling price drop on March two was ample to break the ascending channel help degree.

The bring about of this decline comes from Silvergate Bank, a single of the main gamers in bringing cryptocurrencies in and out of the industry. The bank’s announcement of “extra losses” and an unsatisfactory capitalization fee could set off an outbreak of concern that the financial institution will be fired.

Silvergate gives monetary infrastructure companies to the world’s greatest cryptocurrency exchanges, institutional traders and cryptocurrency miners. Therefore, customers are encouraged to appear for choices or promote their positions to cut down dangers in the crypto business.

On March two, bankrupt crypto exchange FTX uncovered a “major shortfall” in digital assets and fiat currencies, contrary to preceding estimates that $five billion could be recovered. US in income and crypto assets in circulation. On February 28, former FTX Chief Technical Officer Nishad Singh confessed to wire fraud and wire and cargo fraud conspiracy.

With billions of bucks of consumer money missing from the exchange and its US affiliate, there is significantly less than $700 million in circulating assets. In complete, FTX recorded a deficit of US$eight.six billion across all wallets and accounts, whilst FTX US recorded a deficit of US$116 million.

In the crypto industry, general capitalization has fallen four% weekly due to the fact February 24 and was driven by Bitcoin’s four.five% selling price decline and Ethereum’s four.eight% drop. As anticipated, only six of the leading 80 cryptocurrencies have beneficial functionality in the previous seven days.

The selling price of EOS improved by 9% soon after the EOS Network Foundation announced the ultimate check occasion for the implementation of the Ethereum Virtual Machine on March 27.

Immutable X (IMX) cryptocurrency has improved by five% when the task has been “Unity Verified Solution”, which aids to integrate smoothly with the Unity SDK.

DYdX (DYDX) drops 14.five% in selling price as traders await the $17 million token unlock phase on March 14.

General Bitcoin News