The cryptocurrency market place has witnessed a constructive modify just after the information that the US government will assistance the bailout of Silicon Valley Bank.

On the morning of March 13, the US Federal Reserve (Fed) held an impromptu closed-door meeting. The federal government then launched a Term Funding Program (BTFP) for troubled depository institutions, to meet the wants of all depositors.

@Federal Reserve Announces Bank Term Funding Program (BTFP) to assistance American organizations and households by making sure banking institutions have the capacity to meet the wants of all of their depositors: https://t.co/JIMjkooIDV

— Federal Reserve (@federalreserve) March 12, 2023

According to sources of Washington Postthe US federal government is looking at bailing out uninsured deposits at Silicon Valley Bank, in situation a buyout unit can not be located. America’s 16th biggest industrial financial institution collapsed this week.

With the approval of the Treasury secretary, the Fed announced it would deliver a $25 billion bailout for the ailing financial institution.

Sheet Bloomberg The FDIC and the Federal Reserve are looking at producing a exclusive fund to promise deposits at troubled banking institutions following the SVB bankruptcy. The supply explained regulators have been discussing the measure with financial institution leaders and hoped to set up a fund to reassure clients and decrease panic.

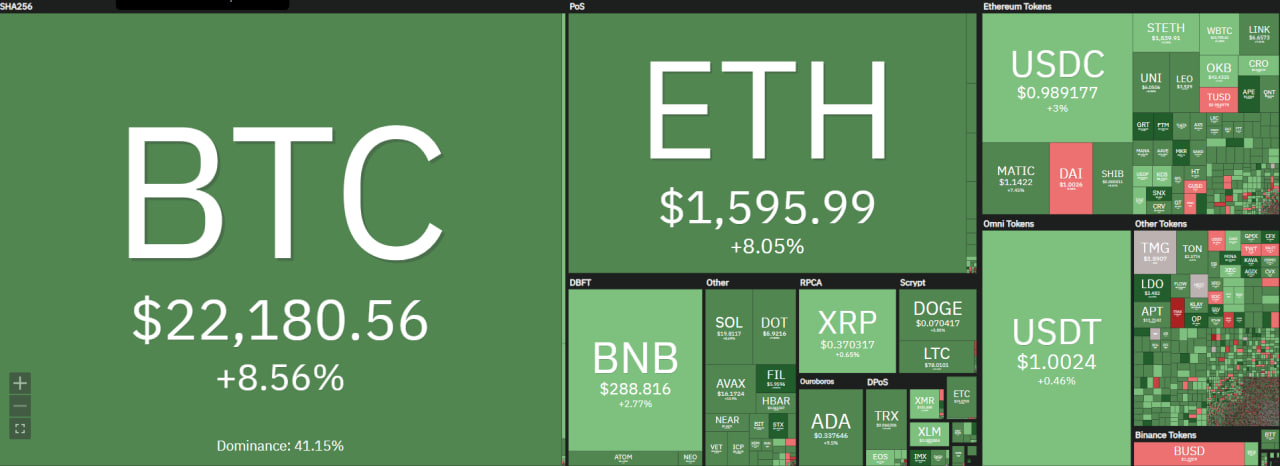

After the over information, the green shade has returned to the monetary market place and cryptocurrency business. BTC selling price surged to $22,600, just before falling somewhat to the present selling price zone.

Also, a quantity of stablecoins this kind of as BUSD, USDC, DAI…all recovered the peg. The struggling stablecoin, USDC, has also returned to $.99.

As reported by Coinlive, SVB, one particular of the world’s major lenders to tech startups in Silicon Valley and the biggest financial institution to shut down due to the fact the 2008 monetary crisis, due to the capital crunch and wave of investor flight.

Silicon Valley Bank was handed above to The Federal Deposit Insurance Corporation (FDIC) requires above, liquidates assets and repays depositors and creditors of the SVB. According to the company, only insured deposits of $250,000 or significantly less, clients can get one hundred% back on March 14th.

The FDIC is also aggressively marketing SVB’s assets and attempting to shell out off uninsured deposits to clients. Notably, most deposits with this financial institution are not FDIC insured.

Synthetic currency68

Maybe you are interested: