Glassnode information analyzed by CryptoSlate exhibits a major distinction in trend amongst the Bitcoin (BTC) and Ethereum (ETH) shrimp and crab pools.

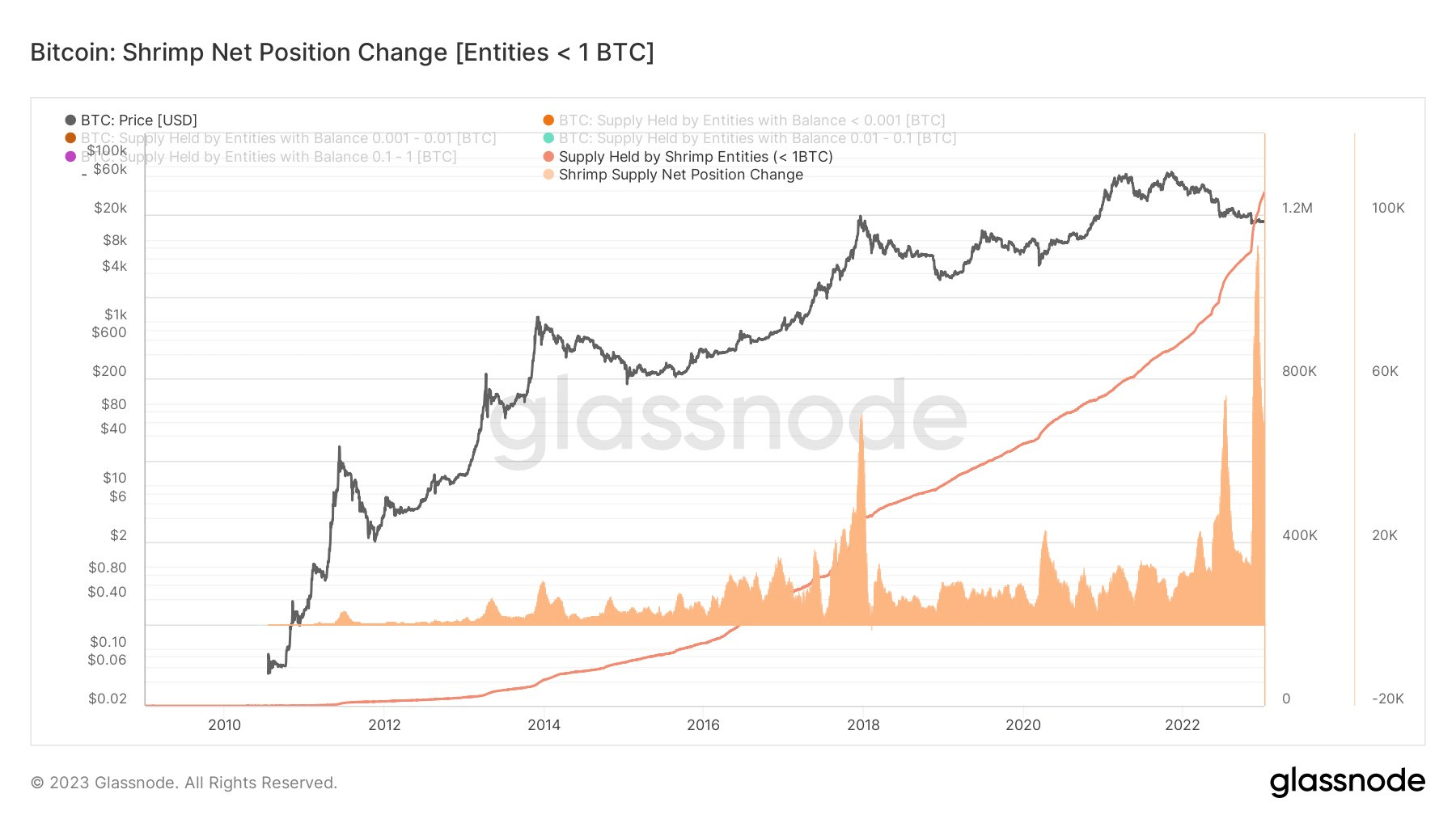

The core narrative of BTC fundamentals is the cause so a lot of traders feel in this asset — and obtain no matter the price tag. Proof of this can be noticed beneath as Shrimps (holders of a single BTC or significantly less) obtain BTC far more aggressively than ever, in accordance to Glassnode on-chain information.

At the time of creating, BTC Shrimps holds a complete of one,200,000 BTC and has obtained all-around 90,000 BTC in the previous thirty days. Proof of this trend is noticed as BTC Shrimp accumulated 60,000 BTC in thirty days in December 2022.

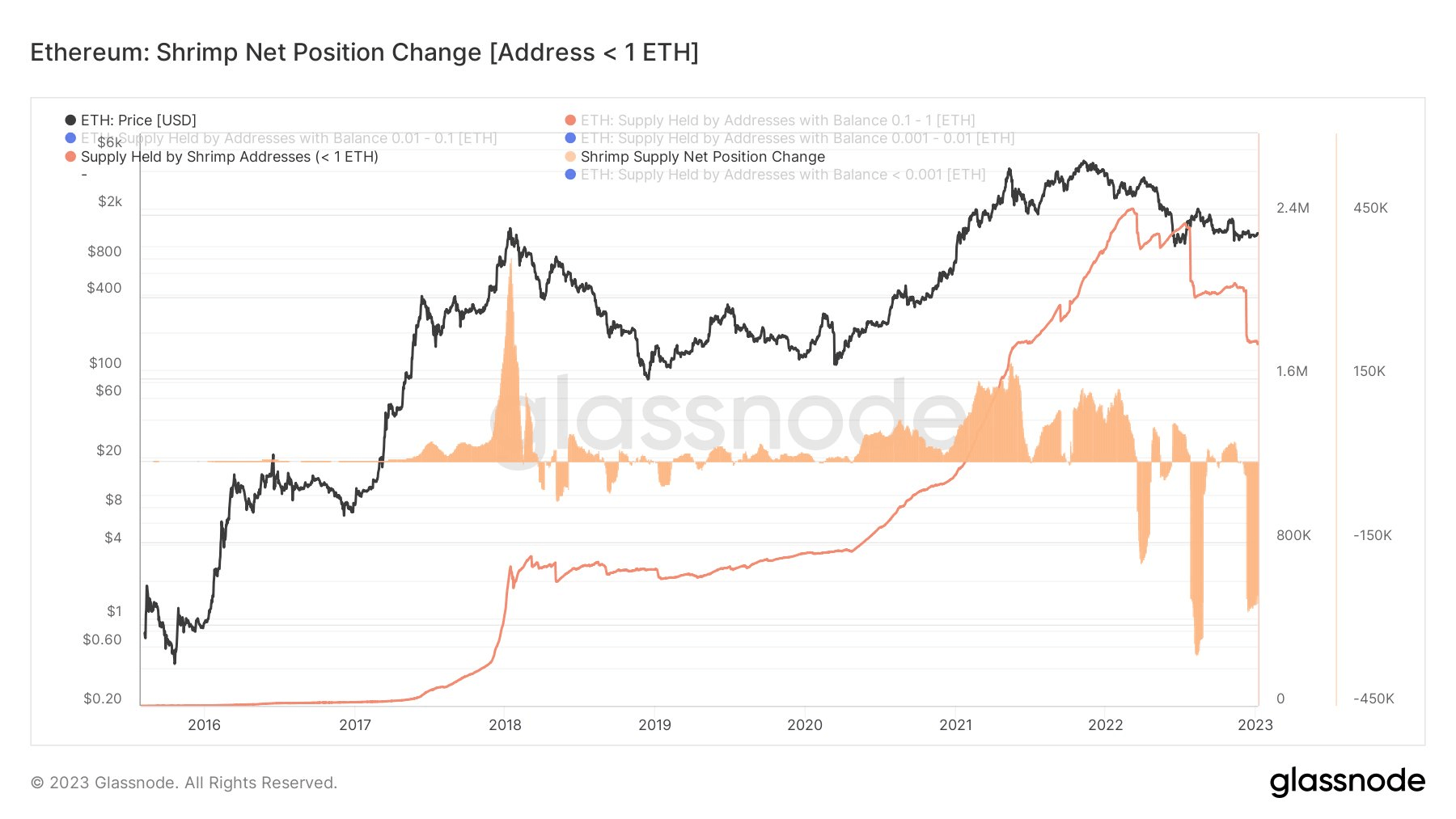

However, when in contrast to ETH Shrimps (holders of a single ETH or significantly less), the trend is reversed — seeing a promote-off of 300,000 ETH in excess of a thirty-day time period. The sentiment of ETH Shrimp is quite unique from that of BTC holders. when Tom grew to become a net vendor — holding somewhere around one,600,000 ETH at press time.

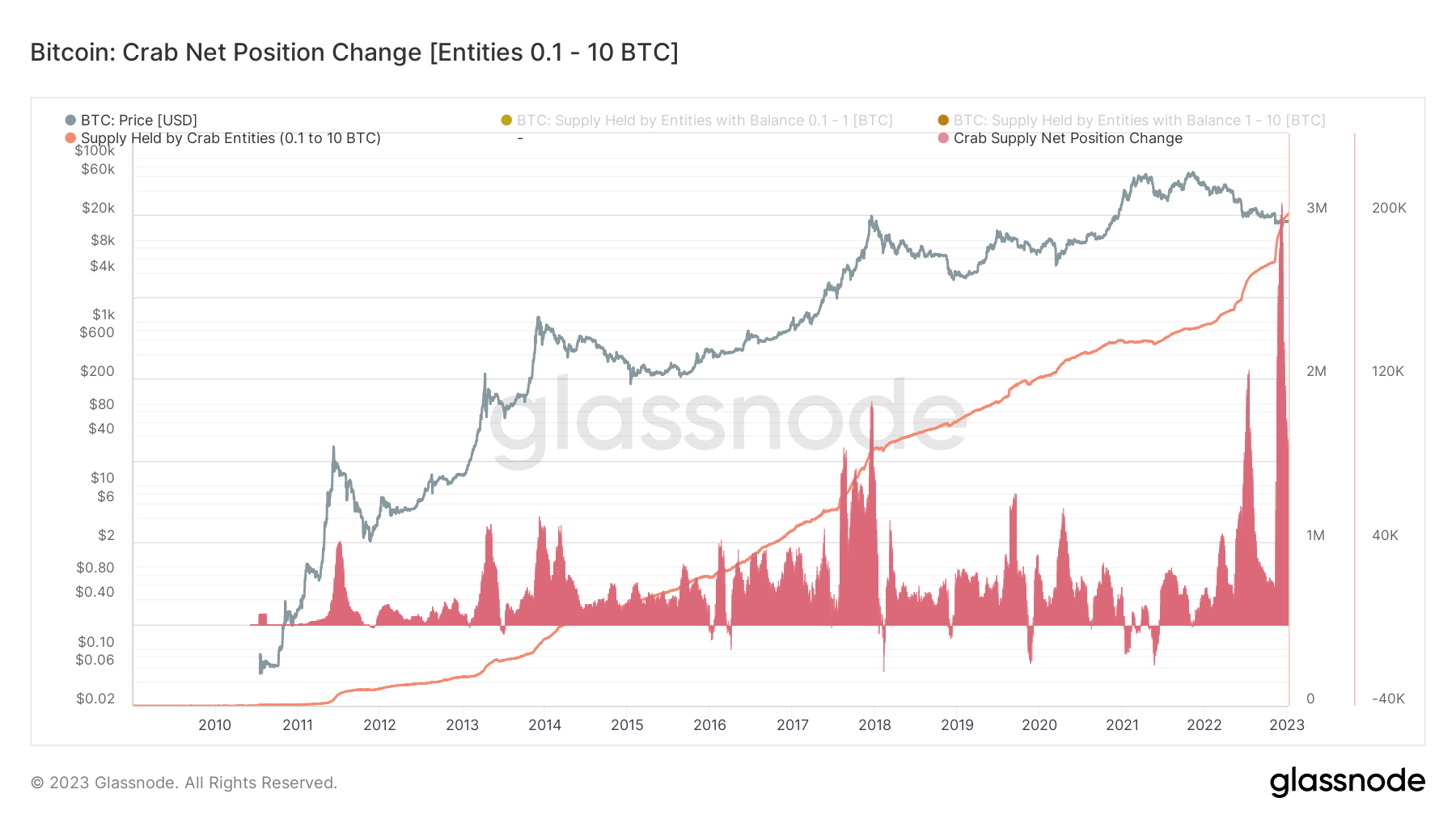

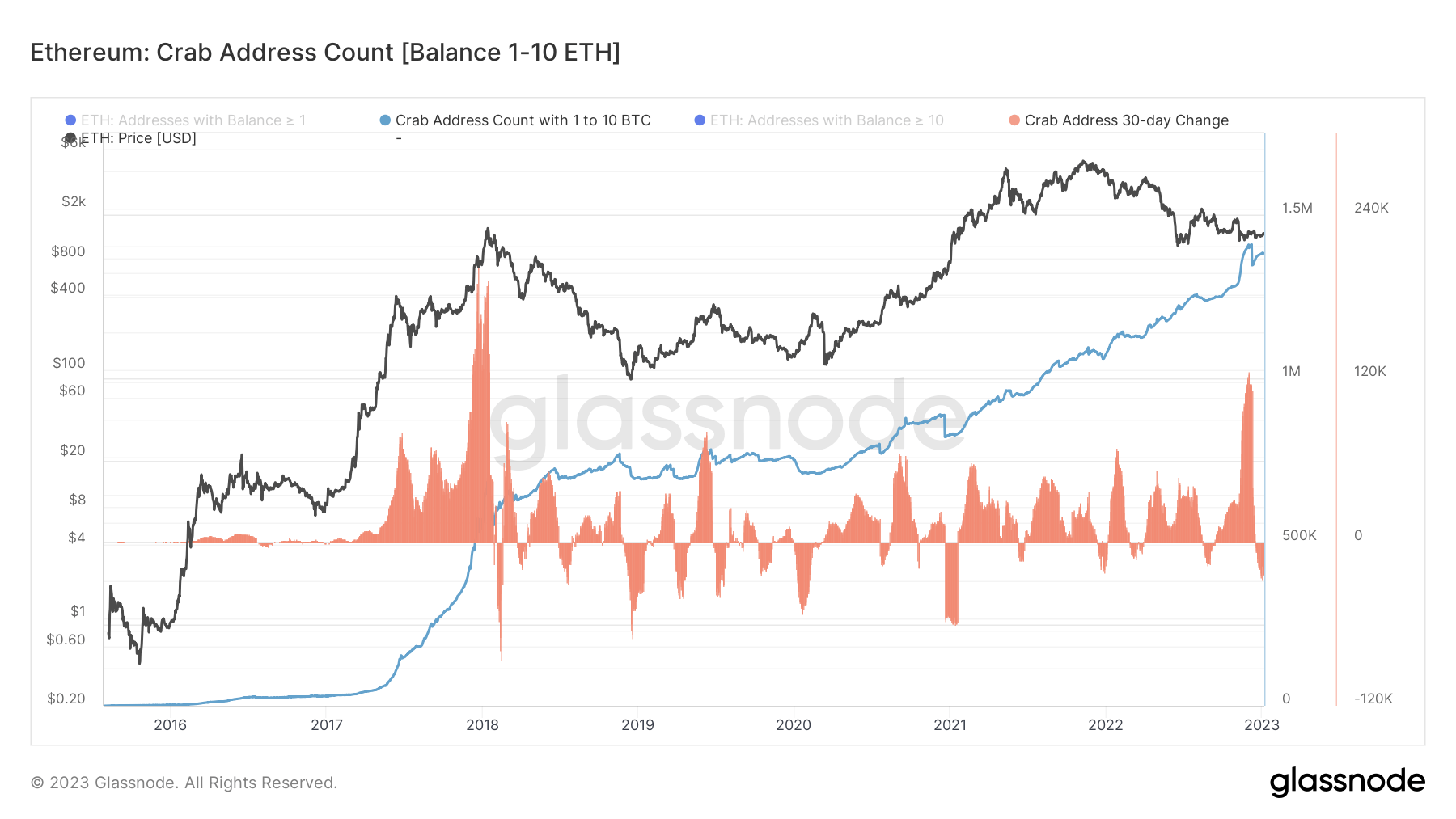

The distinction in industry trends amongst BTC and ETH is additional reinforced when observing and evaluating the respective groups of Crab.

The BTC Crab pool presently holds three,000,000 BTC and is accumulating BTC at a charge of all-around 200,000 BTC in thirty days — the quickest accumulation charge ever noticed for this pool.

The ETH Crab cohort displays the sentiment of the ETH Shrimp cohort — holding all-around one,500,000 ETH and retaining a net promote place with no major indicators of accumulation.

The stark divergence amongst bullish BTC sentiment and bearish ETH sentiment suggests that the BTC shrimp and crab pool stays price tag-insensitive — dollar-expense typical (DCA) customers are unchallenged.