- Bitcoin ETFs register $151M outflows, affecting market dynamics.

- Fidelity only fund with positive inflow.

- Institutional actions signal shifting investor priorities.

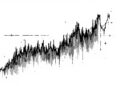

On November 24, 2025, Bitcoin spot ETFs experienced a significant net outflow of $151 million, with Fidelity’s FBTC being the sole fund to register a positive inflow.

These outflows impact Bitcoin’s market trend, highlighting shifting institutional investor sentiment and affecting liquidity conditions within the cryptocurrency sector.

Bitcoin spot ETFs faced an outflow of $151M on November 24, 2025, impacting market trends. Fidelity’s fund showed resilience, registering a $15.49M inflow.

Primary institutions like BlackRock and Ark Investment saw significant outflows. BlackRock had the largest single-day withdrawal with $149M. Leadership at these companies has yet to comment officially on the outflows, as Michael Saylor, Founder of MicroStrategy, notes:

MicroStrategy is an operating company with a $500 million software business and $7.7 billion in Bitcoin-backed securities

Immediate market reactions included Bitcoin price volatility and pressure on derivatives trading (on-chain derivatives trading available on Phemex). Some investors viewed these changes as profit-taking rather than a reversal of trends.

Fidelity’s positive inflows suggest a possible sector rotation. Regulatory clarity remains crucial for ongoing institutional engagement, affecting investor confidence and strategies. Explore a variety of cryptocurrency markets on Phemex

While Bitcoin saw outflows, Ethereum and Solana products gained traction among investors. This signals a shift in asset popularity, reflecting dynamic portfolio adjustments. Trade ETH with Phemex’s MOC feature

Analysis suggests that similar historical events led to increased volatility and short-term corrections. Continued ETF demand is viewed as necessary to stabilize the market, and on-chain data (Access on-chain data and analytics) indicates cautious investor sentiment.