Although Bitcoin’s cost motion is dealing with some complications, traders have proven a good move by constantly withdrawing BTC from exchanges.

According to Santiment’s information, just as Bitcoin cost was underneath a good deal of stress on its way to recovery due to data on US inflation and the likelihood of banning the use of cryptocurrencies as a implies of payment from Russia, the quantity of BTC accumulated. .traders have enhanced considerably.

As of February twelve, the provide of Bitcoin on exchanges has dropped to just ten.87%, the lowest fee recorded because December 2018 (the former winter time period of cryptocurrencies). This trend suggests how constrained a huge promote-off will be in the close to potential. Up to 90% of the provide of BTC is now mined.

😮 With a further set of dramatic drops, #BitcoinSupply on exchanges has now dropped to just ten.87%, the lowest percentage noticed because December 2018. Overall, this continued trend of coins moving off exchanges limits the chance of major marketing. 👍 https://t.co/So7mmK1tHg pic.twitter.com/vKwkinUuCl

– Santiment (@santimentfeed) February 12, 2022

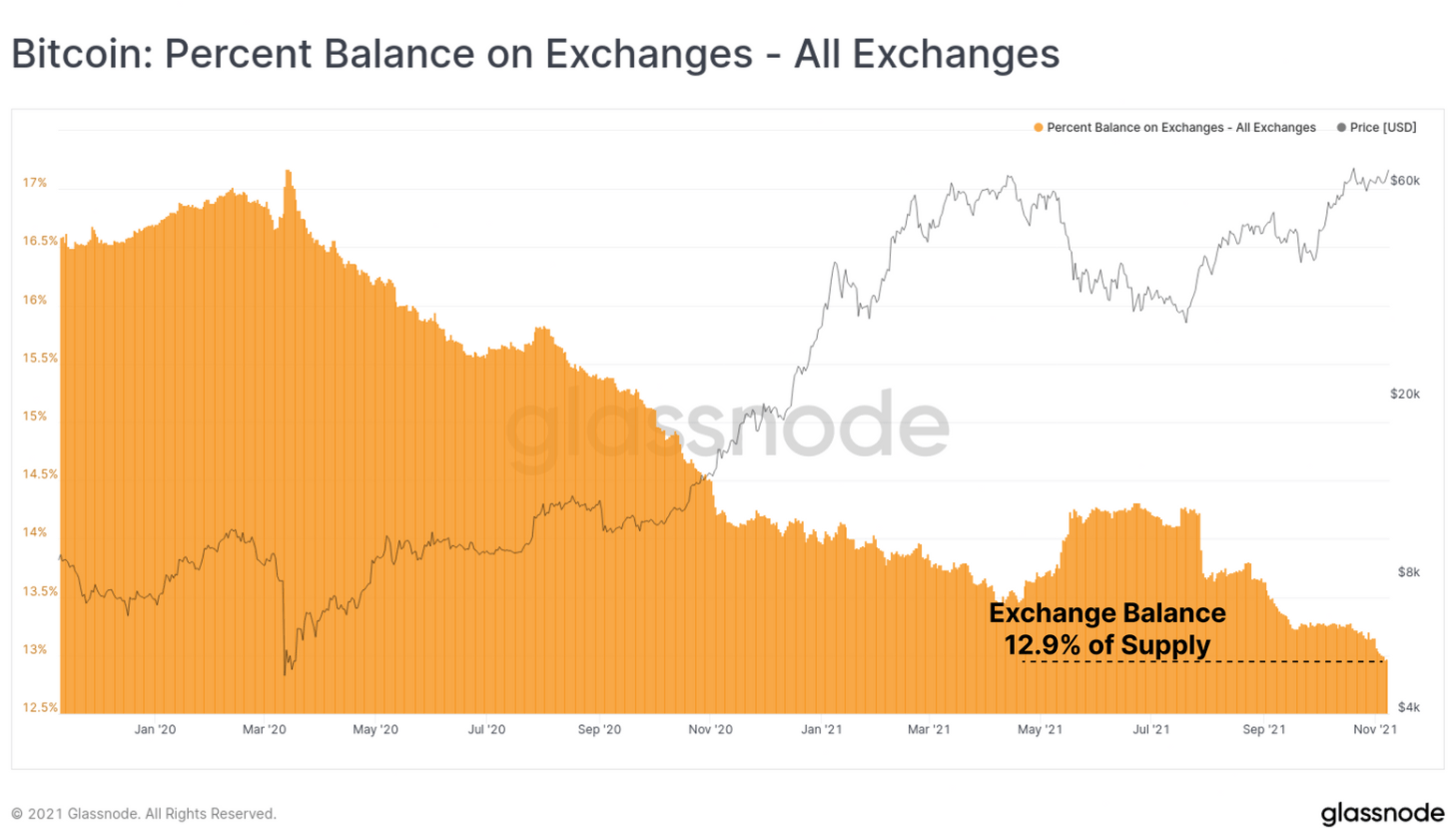

An fascinating obtaining that may perhaps bolster investor self-assurance is that in early November, Bitcoin’s provide index on exchanges hit twelve.9%, reduce than lately reported information. The instant effects came soon after Bitcoin rebounded sharply and set its ATH at $ 69,000.

However, industry curiosity seems to be leaning in the direction of negotiations on the Russian invasion of Ukraine. Experts in the United States and most other Western nations say that Russia is extra very likely to start out a war towards Ukraine to protect against it from joining NATO and as a result has concentrated huge numbers of fight units close to the border. with Ukraine in various strategic positions.

Both of them #cryptocurrencies And #action markets have been very likely Friday from hike in talks #war. The middle #Russia & #Ukraine they have warned the planet and spikes on this subject will carry on to coincide with enhanced volatility. https://t.co/5OmVV7xRbz pic.twitter.com/D8qYWM6rdm

– Santiment (@santimentfeed) February 12, 2022

The over volatility impacts not only Bitcoin but classic economic markets in standard. Additionally, the Fed’s closed-door emergency meeting on the evening of February 14 on the difficulty of curiosity fee hikes, which was due to get area in March, also had a rather huge effect on investor sentiment. , regardless of the circumstance staying eased by the European Central Bank (ECB) by means of the move to maintain curiosity charges unchanged and all of a sudden reduce curiosity charges to sustain development momentum from China.

Synthetic currency 68

Maybe you are interested: