[ad_1]

Bitcoin (BTC) price has reached a historic milestone, surpassing the $100,000 threshold for the first time and reaching a market capitalization of $2 trillion. This makes BTC more valuable than Saudi Aramco and approaching Alphabet’s capitalization.

With EMAs showing strong bullish momentum and key indicators pointing to the potential for further growth, BTC’s current uptrend appears likely to continue.

Bitcoin’s Current Trend Could Be Stronger

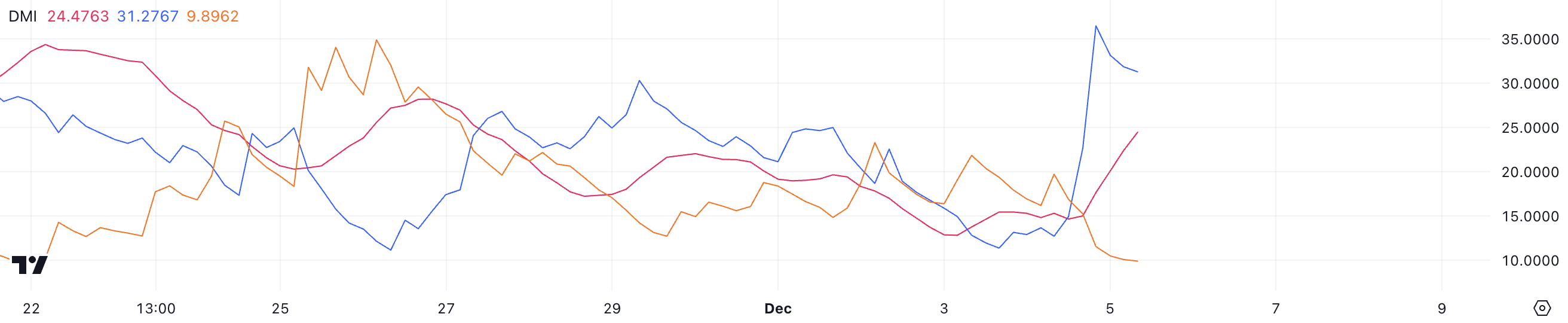

Bitcoin’s DMI chart shows that the ADX index increased from 15 to 24.4 in just one day, signaling a stronger uptrend. This increase suggests that BTC is transitioning from a weaker market condition to a clearly defined trend.

Combined with the uptrend as other indicators have shown, rising ADX reflects an accumulation of momentum that could fuel further price movement.

ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and below 25 signaling a sideways or consolidation market. Currently, BTC’s ADX is at 24.4, along with D+ of 31.2 and D- of 9.8, showing that buyers maintain significant strength.

Although the trend strength has not yet reached levels during the rally to $90K — when ADX exceeded 40 — the current upward trajectory suggests further upside potential if momentum continues to accumulate.

Bitcoin NUPL Shows Still Growth Potential

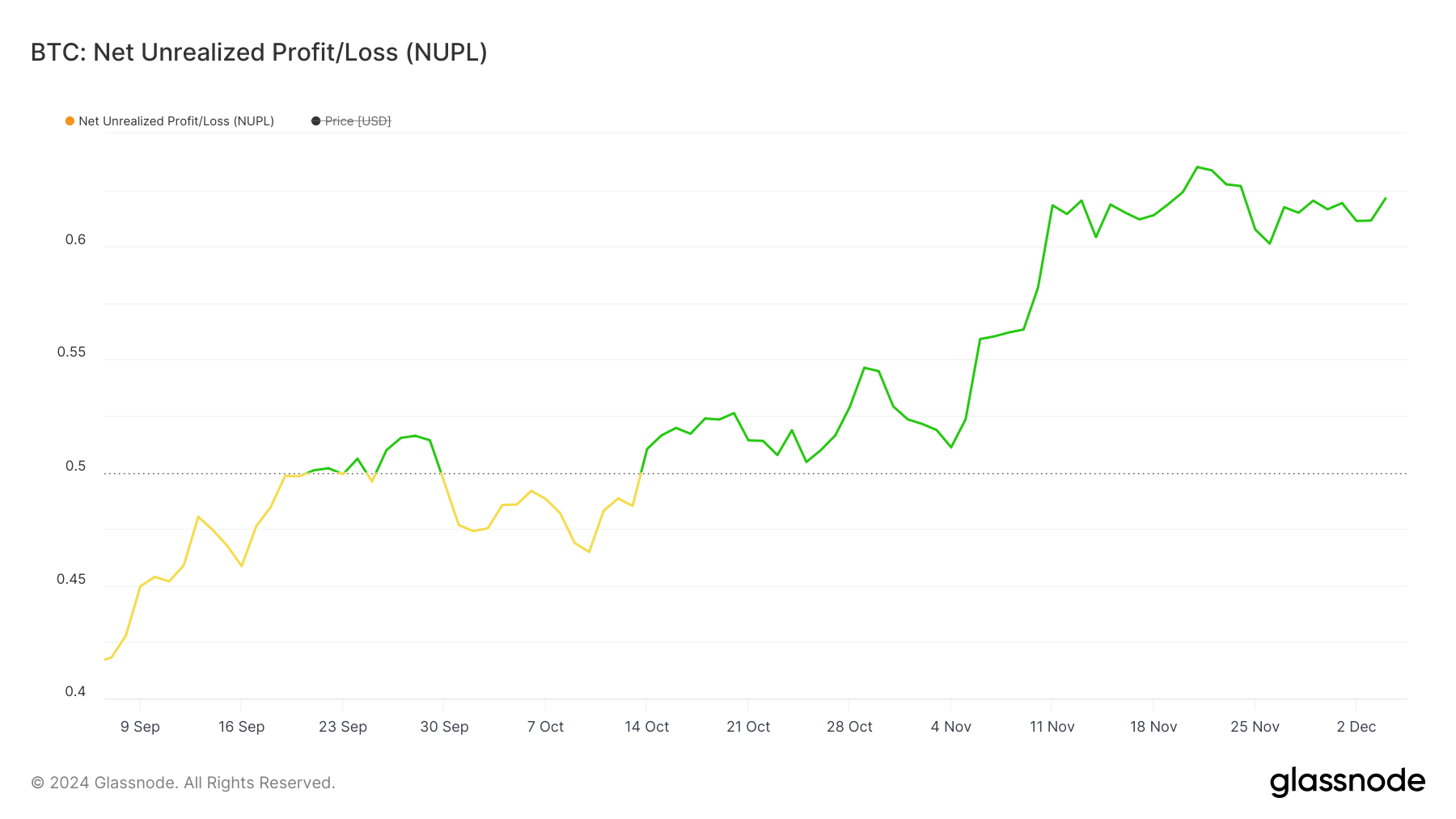

Bitcoin’s NUPL chart indicates the current NUPL is 0.62, down slightly from 0.63 a few days ago. NUPL (Net Unrealized Gain/Net Unrealized Loss) measures the ratio of market participants with profits to those with losses, providing insight into market sentiment.

Values between 0.5 and 0.7 are classified as the “Belief—Denial” stage, where optimism is increasing but has not yet peaked.

Even though BTC has increased 49.65% in the past 30 days, NUPL is still at 0.62 indicating that the market has not entered the “Exuberance” zone. This zone is usually reached when the NUPL reaches 0.7.

This suggests that despite bullish sentiment, Bitcoin price is still far from overbought. Historically, reaching the Euphoria phase often precedes significant price corrections, suggesting there is more room for growth before Bitcoin reaches that level.

BTC Price Prediction: Can Bitcoin Hit $110,000 in December?

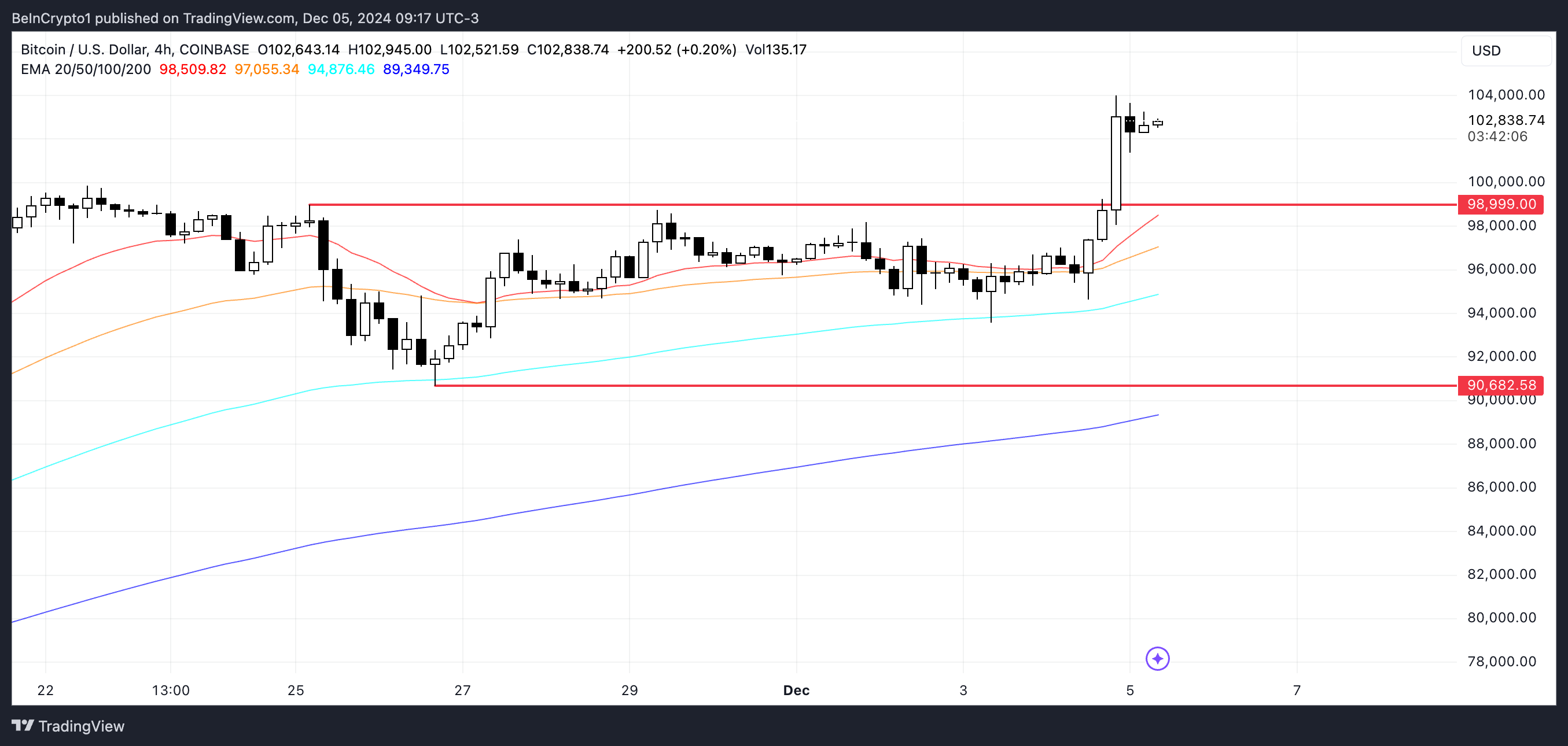

The BTC price chart shows that the EMAs are in a strong configuration, with the short-term lines above the long-term lines and the price trading above all of them.

This configuration shows strong bullish momentum. If the uptrend continues strong while NUPL remains below the euphoria zone, BTC could soon test $110,000, a threshold currently less than 7%.

However, ahead of a new rally, BTC price could retest the critical support at $99,000. If this level fails to hold, the price could fall further to $90,000 before attempting to reach new highs.

General Bitcoin News

[ad_2]