The leading cryptocurrency, Bitcoin (BTC), has been on a relentless bull run, consistently setting new record highs over the past week. According to current data, the coin is trading at $85,662, up 5% in just the past 24 hours.

The market is expecting Bitcoin price to reach $90,000, but signs show that this milestone may be far away. This analysis focuses on two important factors that could slow down this price climb or even stop the cryptocurrency’s growth.

Bitcoin Sends Warning Signal

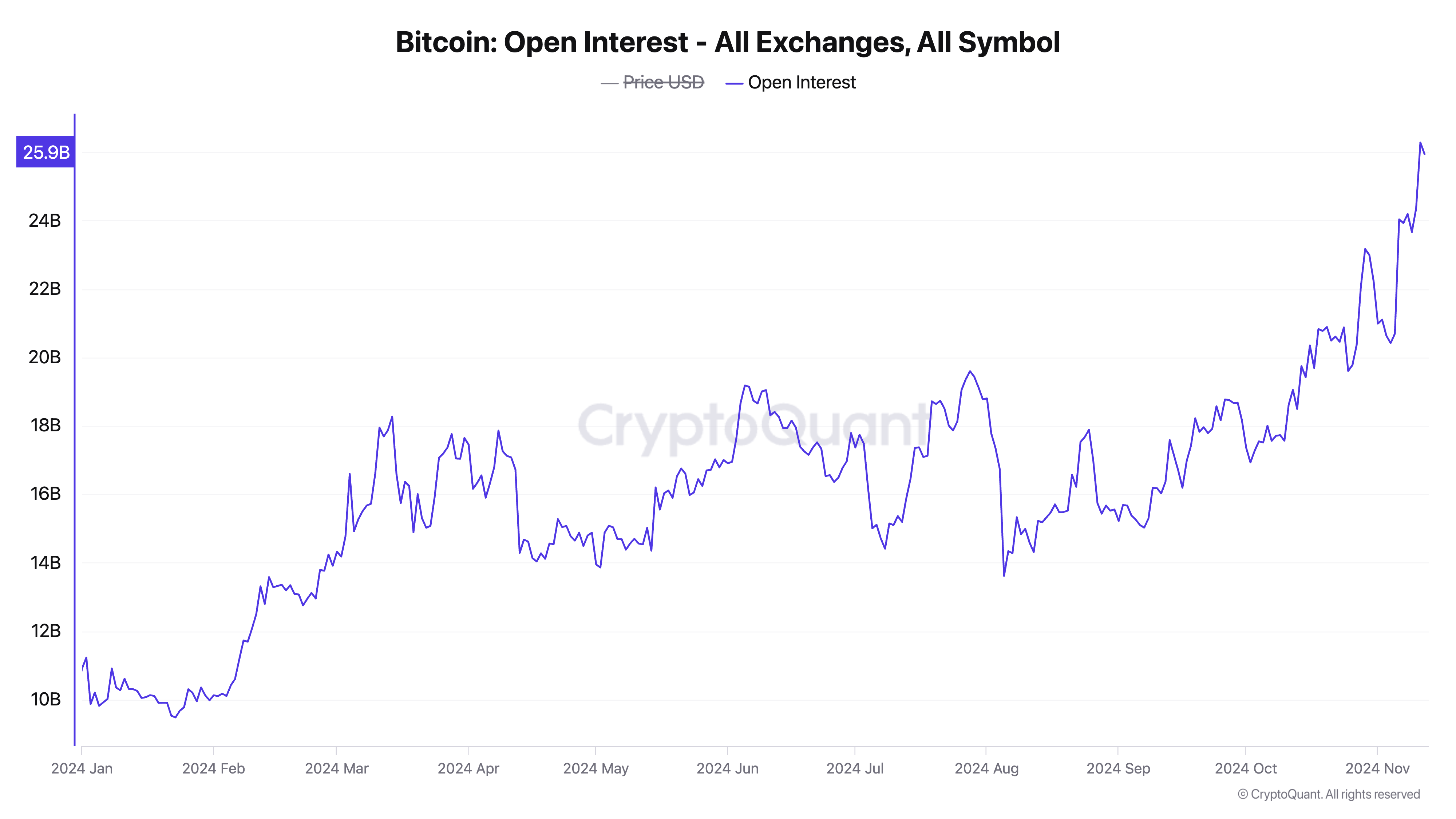

Bitcoin’s explosive open volume is the key factor that could hinder reaching the $90,000 price level in the short term. According to data from CryptoQuant, the past week saw the futures market increase by more than $16 billion in open volume. This is a significant increase in speculation. According to current data, BTC’s open volume is at $25 billion, the highest since August 2022.

Open volume tracks the total number of contracts (options and futures) that are outstanding. During the price increase, increasing open volume is an optimistic signal. However, when asset prices rise too quickly, high open volume can signal underlying instability.

Over the past week, the price of Bitcoin has increased by 25%. The accompanying increase in open volume suggests that more investors have taken speculative positions. This creates an environment vulnerable to mass liquidations if prices start to fall.

If currency prices reverse, even slightly, speculative positions can cause a chain reaction. When highly speculative traders are forced to close positions to avoid losses, accompanying short orders can increase downward pressure, causing currency prices to fall further and triggering additional liquidations.

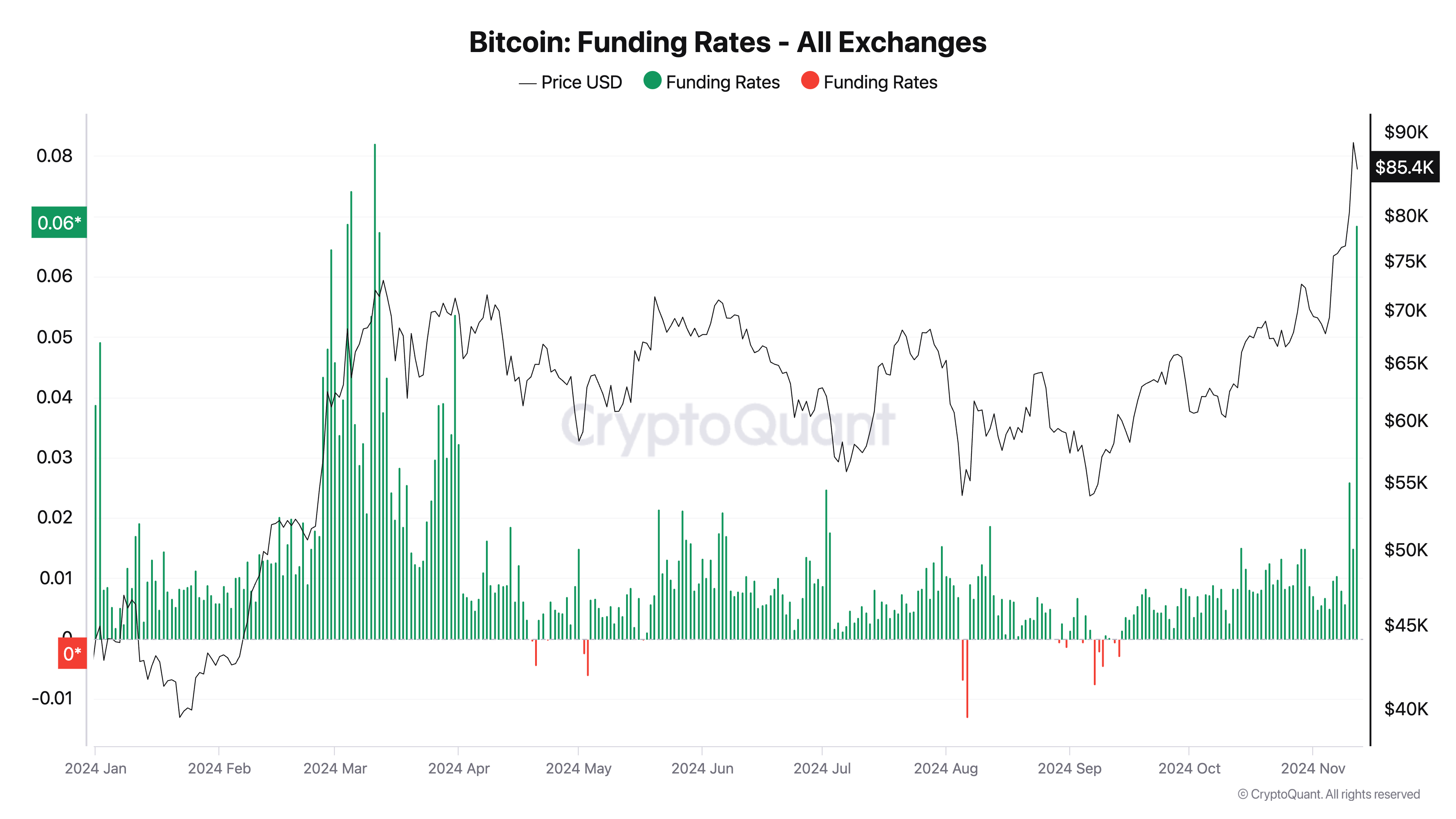

Furthermore, BTC’s rising funding rate is also a factor that could keep its price below $90,000 in the short term. This number is currently at 0.015%, the highest since late March when BTC went through a stronger correction.

In futures trading, a funding rate is a periodic fee paid between traders holding long and short positions, encouraging a balance between the two. However, when funding rates spike, it often signals that buyers dominate the market. This is a bearish signal, often preceding a price correction.

BTC Price Prediction: The Coin Is Overbought

As maintaining long positions becomes expensive, some traders may begin closing positions to avoid high funding costs, which could put pressure on asset prices. Additionally, if asset prices begin to decline, highly speculative long positions are at risk of being liquidated, creating a domino effect that could lead to a sharp price drop.

Bitcoin is showing RSI indicators that are overbought, confirming the mentioned bearish outlook. According to current data, the currency’s RSI is at 74.83.

The RSI measures the overbought and oversold market conditions for an asset. It fluctuates between 0 and 100, with values above 70 indicating the asset is overbought and may need a correction. Conversely, a value below 30 indicates the asset is oversold and could be preparing for a rebound.

At 74.83, BTC’s RSI indicates that it is overbought and could soon decline. If these factors hold true and Bitcoin experiences a short-term correction, it could drop to $81,215. If this level fails to hold, the coin’s price could continue to fall to $74,340.

However, if buying pressure increases, the coin could reclaim its current record high of $89,972 and surpass $90,000.