2025 seems to be a very optimistic year for many investors in the cryptocurrency market. However, on day one, Bitcoin (BTC) faced massive selling pressure, raising concerns about the leading cryptocurrency’s ability to surpass $95,000.

This article from TinTucBitcoin will analyze Bitcoin’s short-term price outlook using key indicators.

Bitcoin Investors Doubt About Long-Term Uptrend

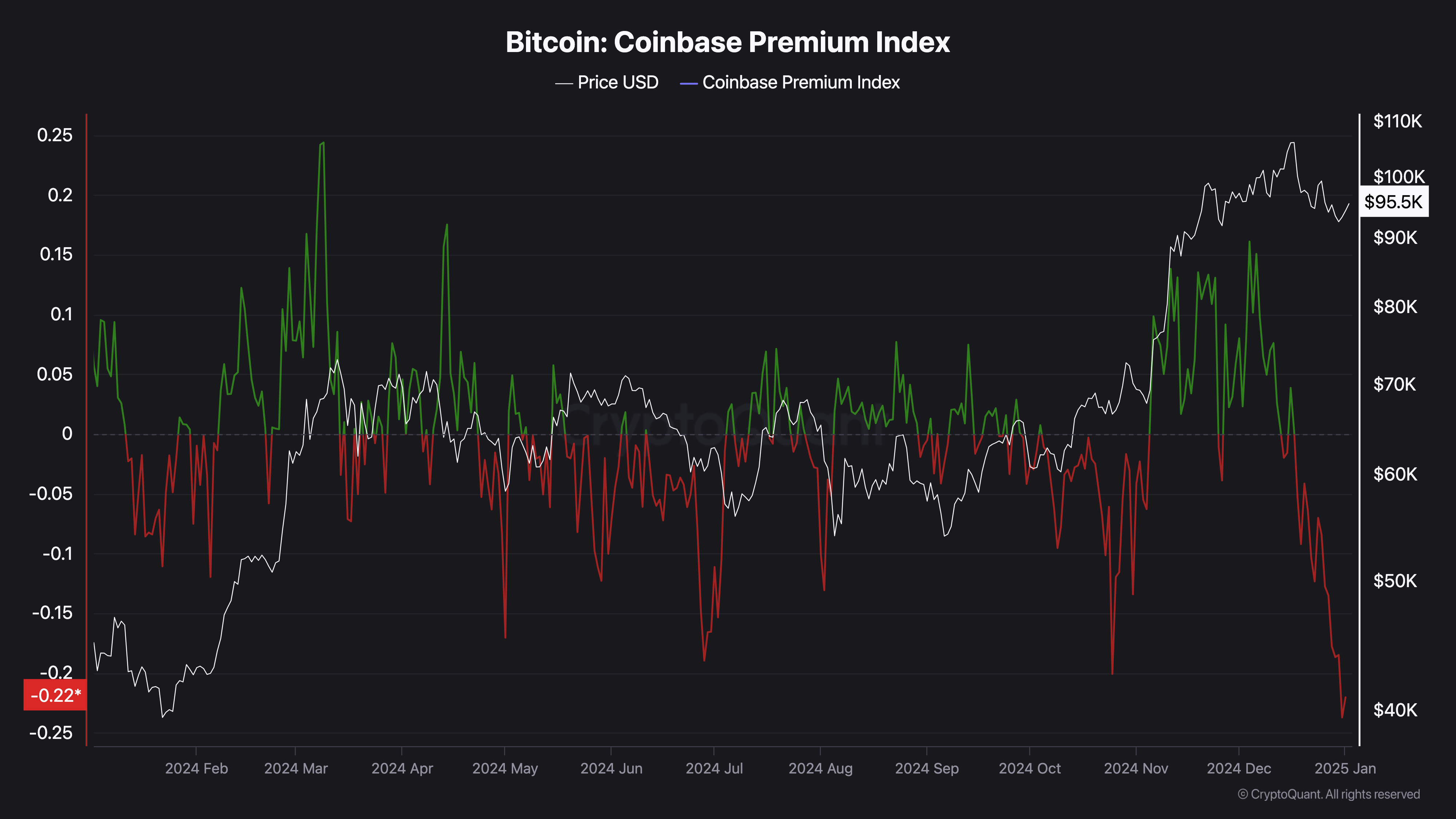

After the US election in November 2024, Bitcoin’s Coinbase Premium Index increased to 0.14. This index measures buying pressure in the United States; High values like those in November indicate strong selling pressure. However, the index fell to -0.22, its lowest level in the past 12 months, suggesting that Bitcoin investors in the United States are selling their assets.

However, Bitcoin price is trading at 95,318 USD, a slight increase of 2.06% in the past 24 hours. But if investors continue to sell BTC, this trend may change and the price of this cryptocurrency may decrease.

According to cryptocurrency analyst Burak Kesmeci, BTC price escalation may face many difficulties.

“Such trends could create a difficult environment for Bitcoin’s short-term price recovery unless there is a change in macroeconomic conditions or increased enthusiasm from institutional and individual investors. Human,” Kesmeci comment via CryptoQuant.

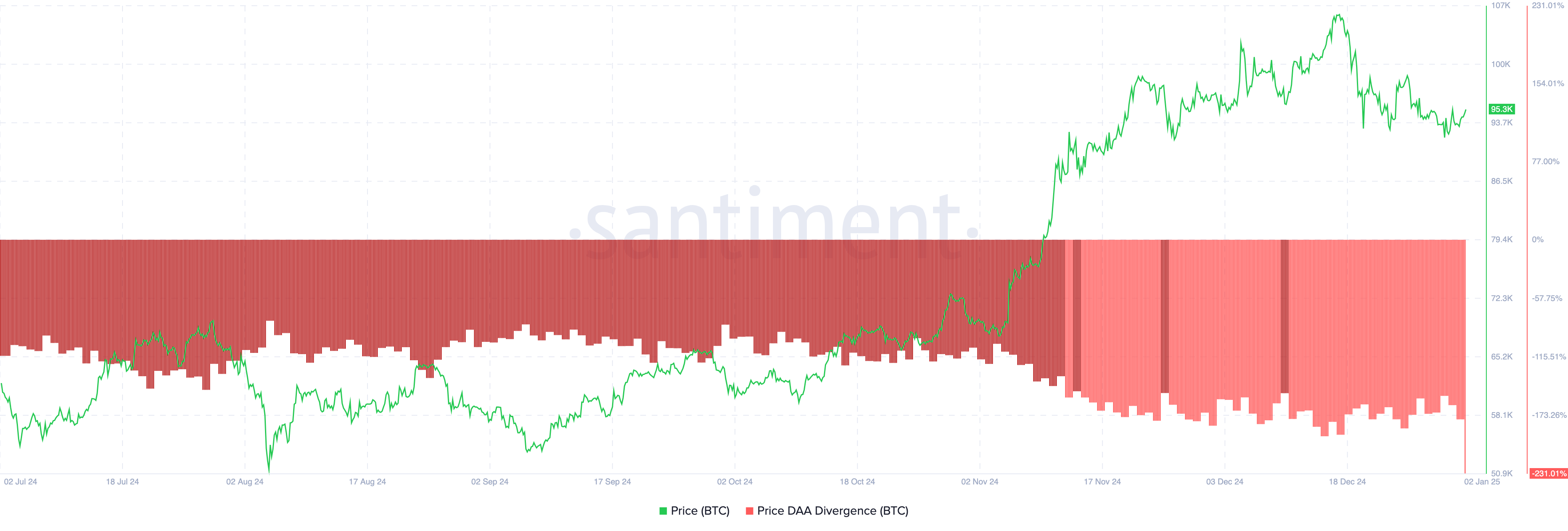

Another indicator that supports this view is price divergence – Daily Active Addresses (DAA). This index measures the relationship between user participation on the blockchain and price volatility.

When the index is positive, it shows that user engagement has improved, creating a bullish signal for the cryptocurrency. Conversely, if the index is negative, it does the opposite, indicating a bearish outlook.

As shown above, Bitcoin’s DAA price divergence dropped to 231%, indicating a downtrend. If this trend continues, the possibility of BTC trading below $95,000 may increase.

BTC Price Prediction: Still Likely Below 90,000 USD

Despite BTC’s recent rise, the Exponential Moving Average (EMA) indicator suggests that the recent price rally may not last. EMA is a technical indicator that measures trend direction relative to price.

When the EMA slopes above the price, the trend is down. But when the price goes above the indicator, the trend is up. As of press time, Bitcoin price is below the 20 EMA (blue), suggesting that the cryptocurrency’s value may continue to decline.

If the cryptocurrency fails to clear the 20 EMA and Bitcoin selling pressure increases, the price could drop to $85,851. However, if US investors increase buying pressure on Bitcoin, this trend could change. In that case, the cryptocurrency price could jump to $108,398.