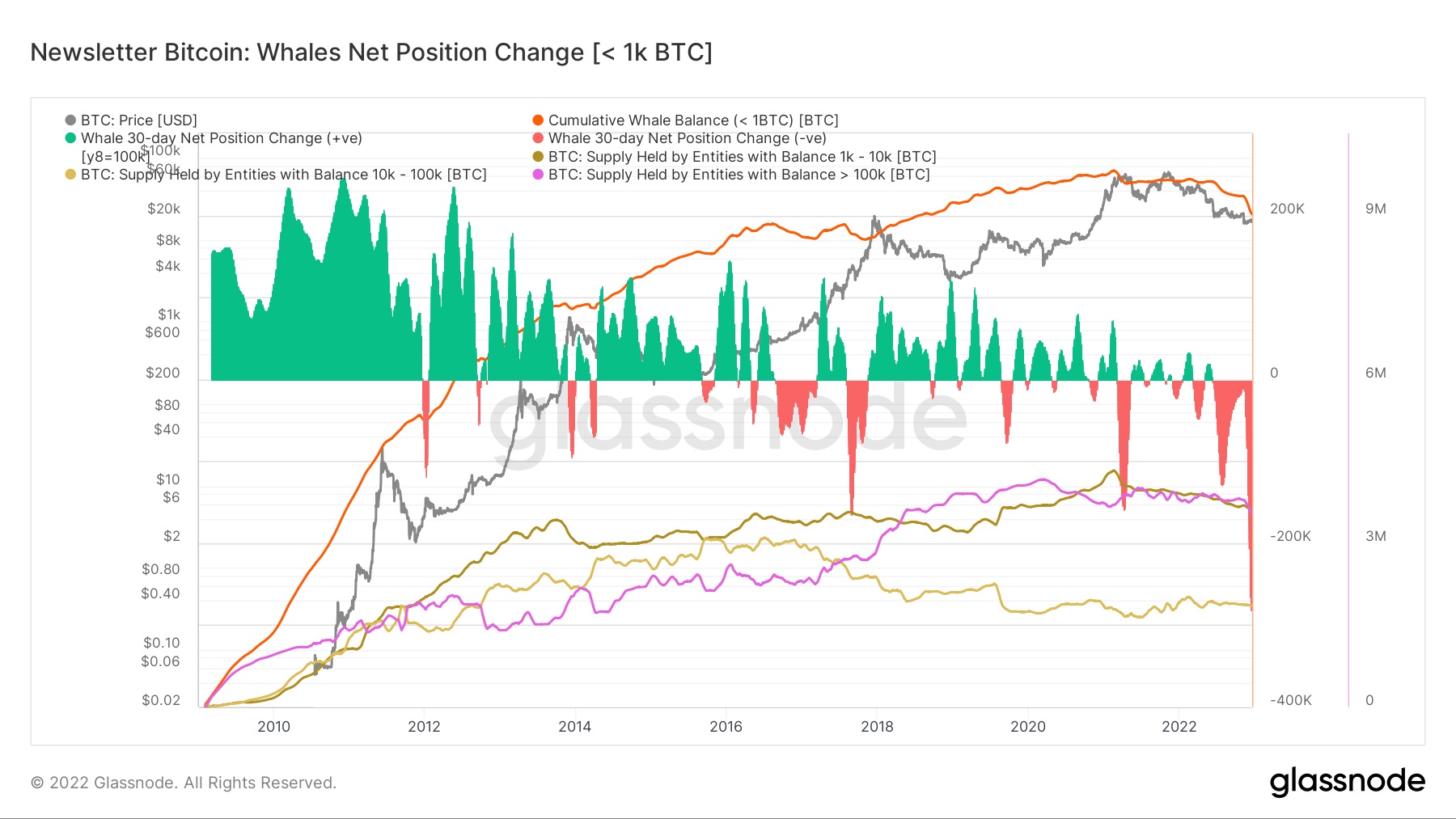

The Bitcoin “whales” that are recognized to hold the greatest sum of Bitcoin in the market place have offered the most BTC in the final thirty days in background.

According to information from the blockchain analytics platform Glass knotOver the previous month, Bitcoin whales have offered a complete of 280,000 BTC.

As of right now, Glassnode estimates that the whales at present hold all around 9 million BTC, which is a important portion of Bitcoin’s complete provide of 21 million BTC units. The distinct numbers are listed as follows:

- Whales holding one,000 to ten,000 BTC have three.six million BTC.

- Whales holding ten,000 to one hundred,000 BTC hold one.9 million BTC.

- Whales holding one hundred,000 BTC or far more hold three.six million BTC.

The enormous promoting stress just pointed out explains why the selling price of Bitcoin has continually struggled to recover, even as the unfavorable sentiment surrounding the FTX crisis is relatively subdued.

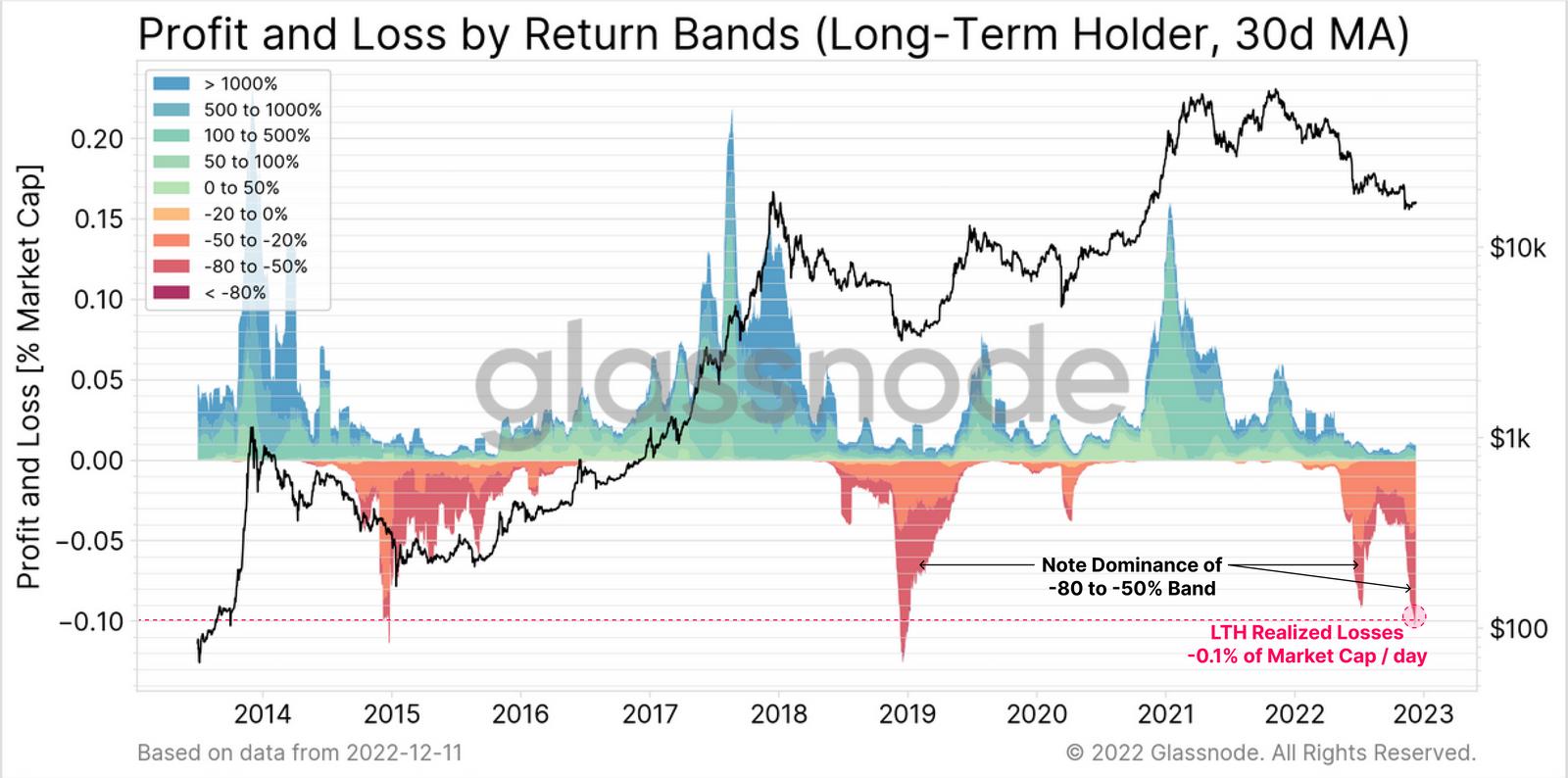

For a superior overview of why the whales have selected this second to disrupt the market place, let us do a tiny evaluation on the state of the marketplace above the previous two many years or so. First, the robust bull cycle of 2020-2021 generated a record complete yearly return recognized on the blockchain.

Over $455 billion in yearly income have been transferred by traders to on-chain Bitcoin, with the higher reached shortly soon after BTC’s ATH of 69,000 in November 2021.

Since then, the market place has speedily entered a bear phase and has repaid far more than $213 billion in real losses. This equates to 46.eight% of the revenue for the 2020-2021 bull time period, approximately the very same dimension as the 2018 bear market place, in which the market place gave back 47.9% of the reduction.

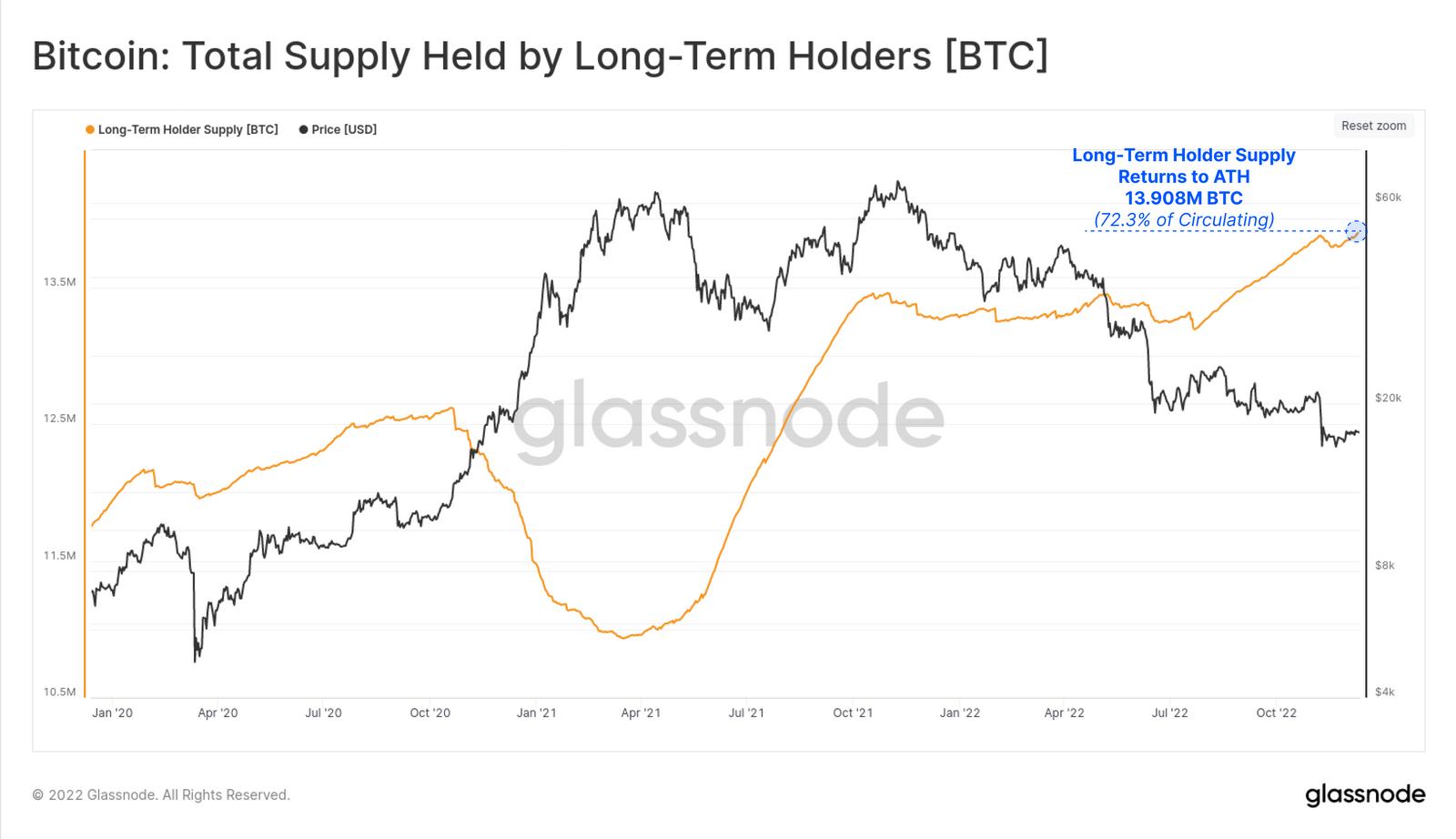

Even so, regardless of these enormous and quickly evolving losses, the complete provide of Bitcoin held by extended-phrase (LTH) traders, who are thought of whales, continues to expand, displaying that they nonetheless spot faith in BTC’s recovery.

Based on the chart beneath, it can be noticed that from May 2022 to the existing, it is extremely tricky for LTH-held BTC to get out of hand, regardless of the truth that the market place is frequently in the throes of a series of fluctuations. , elected as the collapse of LUNA/UST, Celsius – 3AC liquidity crisis and The hefty bankruptcy of FTX.

However, Bitcoin has not proven an amazing rebound, specially at the finish of the 12 months, nonetheless caught in the USD sixteen,000 – USD 17,000 selection. This is in truth a delicate second, in which the regular money markets seem to be to be “taking a break”, traders require liquidity to cover their costs to welcome the new 12 months. Therefore, it is fairly understandable that LTH’s reduction of persistence and sensible demand that led to the BTC dumping is also fairly understandable.

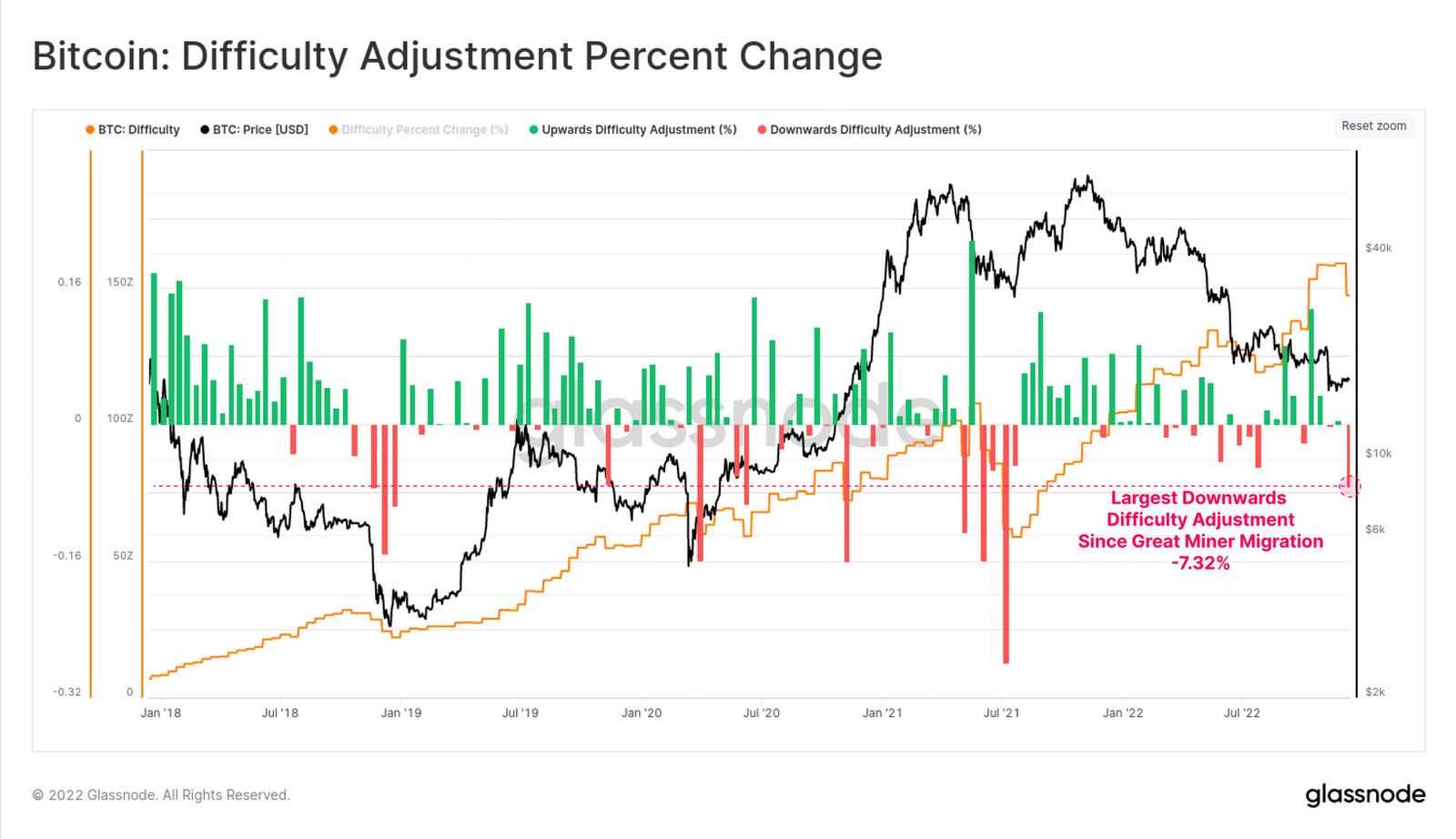

On the other hand, also recorded final November 2022greatest reduction in trouble given that China’s BTC mining ban in 2021. Record drop in trouble demonstrates substantial portion of lively miners shut down, due to strain Bitcoin mining income hits two-12 months lower.

Synthetic currency68

Maybe you are interested: