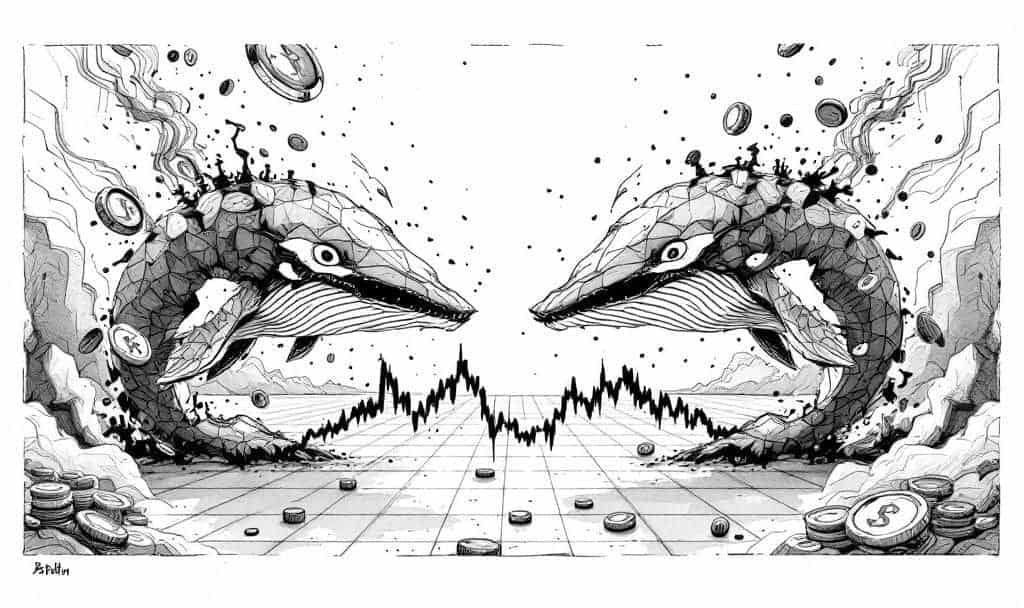

- Significant Bitcoin transfers by whales and miners affect market stability.

- Profit-taking dampens upward movement.

- Institutional accumulation offers price support.

Bitcoin whales and miners are moving massive sums, affecting Bitcoin’s price as institutional accumulation continues to support key psychological levels, according to CryptoQuant data.

These movements signal short-term volatility and influence the market dynamics, highlighting a cautious mix of profit-taking and potential support fluctuations.

Bitcoin whales and miners are engaging in significant transactions, influencing market behaviors. Data from CryptoQuant reveals these moves are affecting short-term volatility and maintaining BTC above critical psychological levels.

Whales and miners are the primary entities. Ki Young Ju, Charles Edwards, and Samson Mow offer insights. These leaders indicate whales are selling, impacting market dynamics, while institutional inflows provide stability.

Whales’ large sales are causing major sell pressure, while continued institutional buying and lower miner outflows provide support. The activity underscores the delicate balance between distribution and price stabilization.

The actions of whales and miners are resulting in fluctuations, with potential implications for BTC’s price trajectory. Supporting data suggests these moves may affect other cryptocurrencies like ETH due to market correlations.

The market faces volatility as whales reposition and miners hold more BTC. Previous cycles show similar profit-taking patterns that precede price corrections, evident in past bull market phases.

Current patterns suggest institutional actions, like ETF inflows, could control price movements. Data indicates that long-term stability may rely on substantial institutional support to counterbalance whale sales. As Ki Young Ju, Founder of CryptoQuant, stated,

“Bitcoin whales have sold off billions worth of BTC since prices crossed the $100,000 mark. This supply overhang is a classic sign of distribution, not yet capitulation, but it does dampen upward momentum if ETF inflows slow or MicroStrategy pauses buying.”