Bitget Token (BGB) has skyrocketed significantly this month, jumping 430%, continuously setting new record highs throughout December.

This altcoin has seen outstanding growth, as its price continues to climb despite the looming risk of profit-taking. However, strong investor confidence appears to have reduced the likelihood of a major sell-off.

Bitget Token Owner Shows Optimism

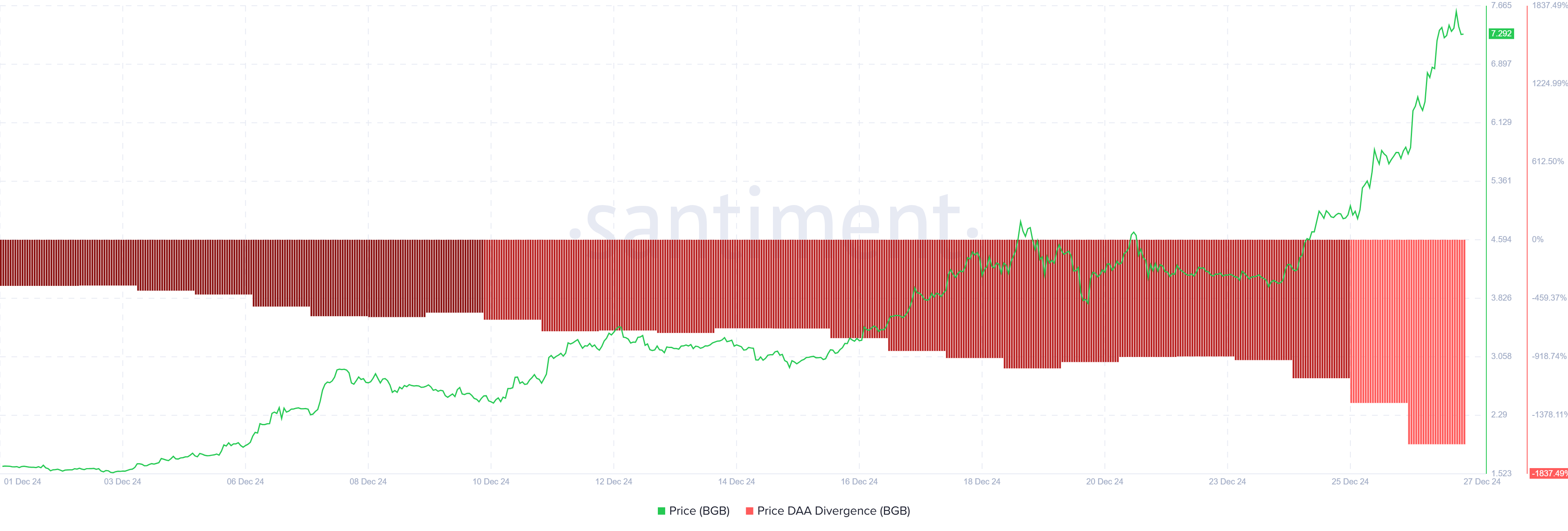

The DAA Price Divergence Indicator has consistently signaled sell for BGB over the past 48 hours, reflecting an increase in investors’ profits. With Bitget Token consistently profitable, some holders may be tempted to take profits, which could temporarily slow the uptrend.

Despite the sell signal, overall sentiment is still optimistic. BGB’s exceptional performance this month has attracted attention, but caution is warranted as this surge of growth makes the altcoin vulnerable to short-term selling pressure. Investors are closely watching these signals to spot a change in momentum.

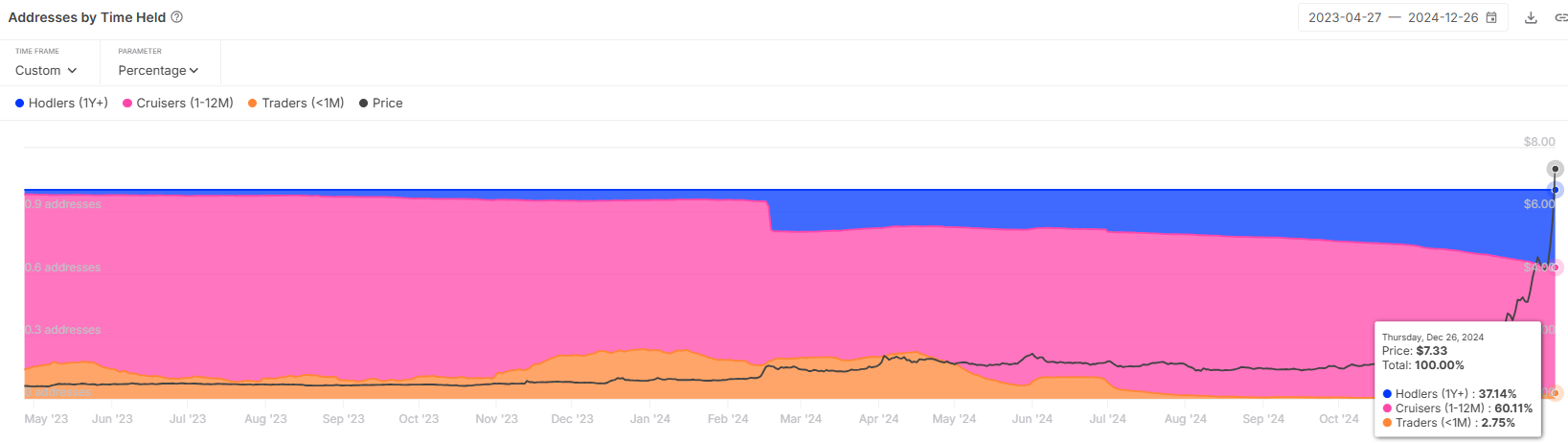

Bitget Token’s macro momentum shows strong support from long-term holders (HODLers). Over the past month, the proportion of supply held by long-term investors has increased by 11%. These investors, who often hold assets for more than a year, play a key role in maintaining price stability and market confidence.

This group of HODLers is growing, showing strong confidence in BGB’s long-term potential, effectively coping with risks from short-term selling. With a solid foundation supporting the Token, BGB can withstand short-term shocks caused by profit-taking, while maintaining an overall optimistic outlook.

BGB Price Forecast: Record Highs Continue

Bitget Token has increased 44% in the past 24 hours, reaching a new ATH of $8.49 in an intraday peak. This is BGB’s 4th ATH in just one week, testament to the incredible momentum and investor interest.

Over the course of December, BGB grew nearly 430%, placing itself on a path for continued growth. If this trend holds, the token could soon surpass the $10 mark, cementing its position as a standout in the crypto market.

However, the ability to take profits is still a concern. If selling pressure increases, BGB price could decline, potentially sliding to $4.90. This scenario would invalidate the bullish view, underscoring the importance of maintaining buying support to keep upward momentum.