South Korean cryptocurrency exchange Bithumb programs to turn into the initially digital asset firm to checklist on the Korean Stock Exchange (Kosdaq).

Bithumb will carry out an IPO in 2025. Photo: Bloomberg

Bithumb will carry out an IPO in 2025. Photo: Bloomberg

This was reported by the nearby information company Everyday, Bithumb, one particular of the key cryptocurrency exchanges in Korea moreover Upbit, programs to have a public providing (IPO) on the Kosdaq stock market place, the Korean model of Nasdaq. The time of the IPO is anticipated to be all around the 2nd half of 2025.

While Bithumb declined to verify the IPO information and facts, it mentioned it had picked Samsung Securities – the securities and money solutions organization of South Korea’s biggest conglomerate Samsung – as the money sponsor for the give-for-sale course of action.

According to Edaily, Bithumb, South Korea’s 2nd biggest cryptocurrency exchange, is getting ready for an IPO on the Nasdaq in the United States in 2025 and has picked Samsung Securities as an underwriter. Bithumb’s market place share is all around ten% and Upbit is 85%. Bithumb was concerned in…

— Wu Blockchain (@WuBlockchain) November 12, 2023

The announcement also states that former Bithumb president Lee Jeong-hoon, who was acquitted of $one hundred million fraud in 2018, has returned to the exchange to get the place of director of record on the administrative board.

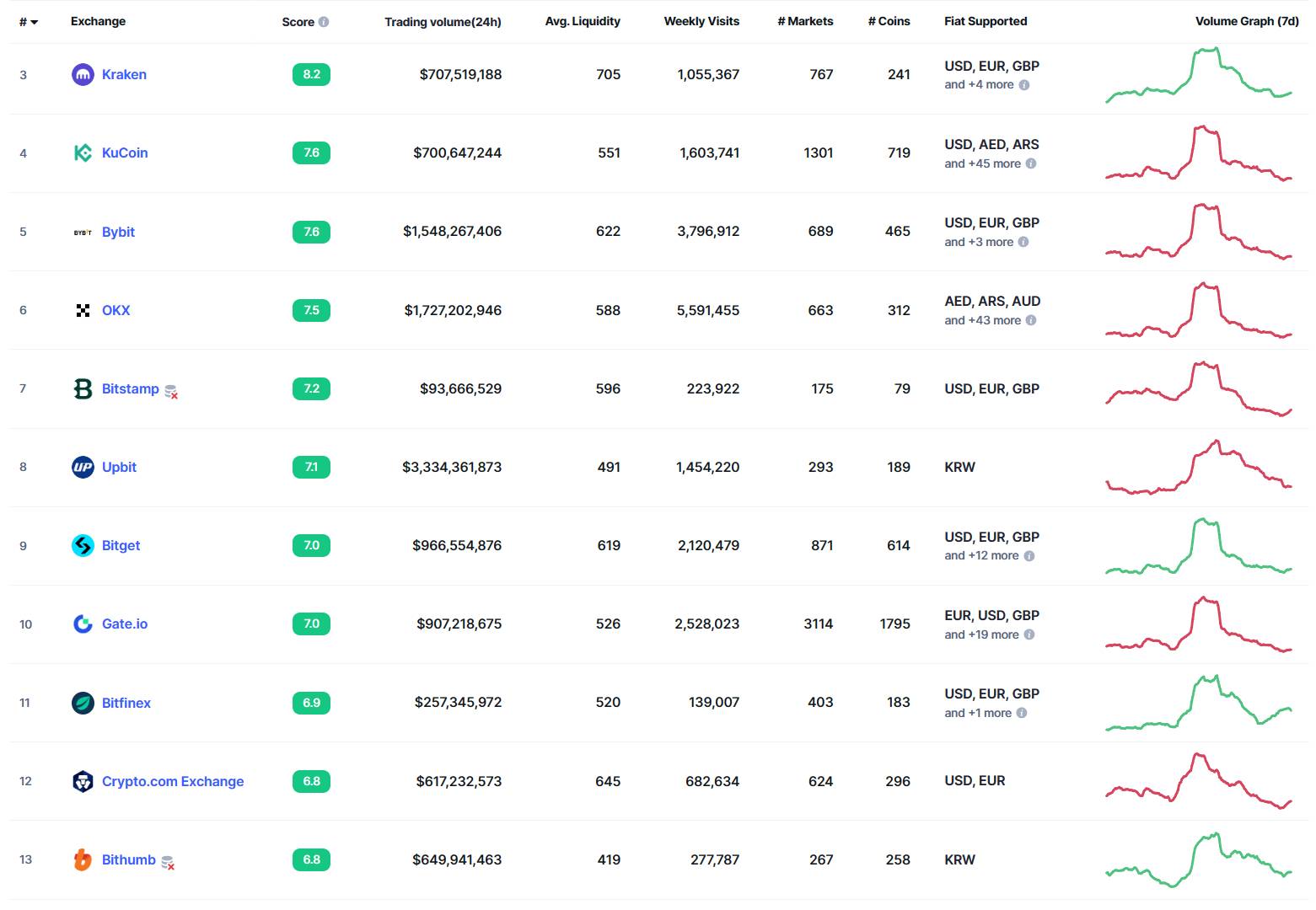

South Korean sources say Bithumb’s IPO move is the outcome of not wanting to cede market place share to competitor Upbit, the biggest cryptocurrency exchange in South Korea. According to CoinMarketCap information, Bithumb has a day-to-day trading volume of more than $600 million, taking 2nd location to Upbit’s figure of more than $three billion.

The Bithumb exchange ranks 2nd in terms of trading volume, just behind Upbit in the Korean market place. Photo: CoinMarketCap

The Bithumb exchange ranks 2nd in terms of trading volume, just behind Upbit in the Korean market place. Photo: CoinMarketCap

As reported by Coinlive, Bithumb is at present one particular of the 5 biggest cryptocurrency exchanges and is “surviving” right after the country’s business crackdown in 2021. Despite becoming the 2nd alternative right after Upbit, Bithumb seems to have struggled more than the many years.

In 2022, Bithumb’s workplace was raided as component of Terraform Labs’ investigation following the historic collapse of the Terra ecosystem. The exchange has also been concerned in a variety of lawsuits, is mentioned to belong to Huobi in 2020, and was on FTX CEO Sam Bankman-Fried’s “shopping” checklist in advance of this “empire” collapsed.

Bithumb will be the third title additional to the checklist of cryptocurrency exchanges preparing to IPO in 2024, alongside latest stablecoin issuer USDC Circle. The pioneer in this regard is Coinbase in 2021, with an opening market place capitalization of virtually $one hundred billion.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!