Bitwise asset management company is planning to launch a new ETF called “Bitcoin Standard Corporations ETF.”

Furthermore, Strive, an asset management company co-founded by Vivek Ramaswamy, has also applied for a new ETF called Bitcoin Bond ETF.

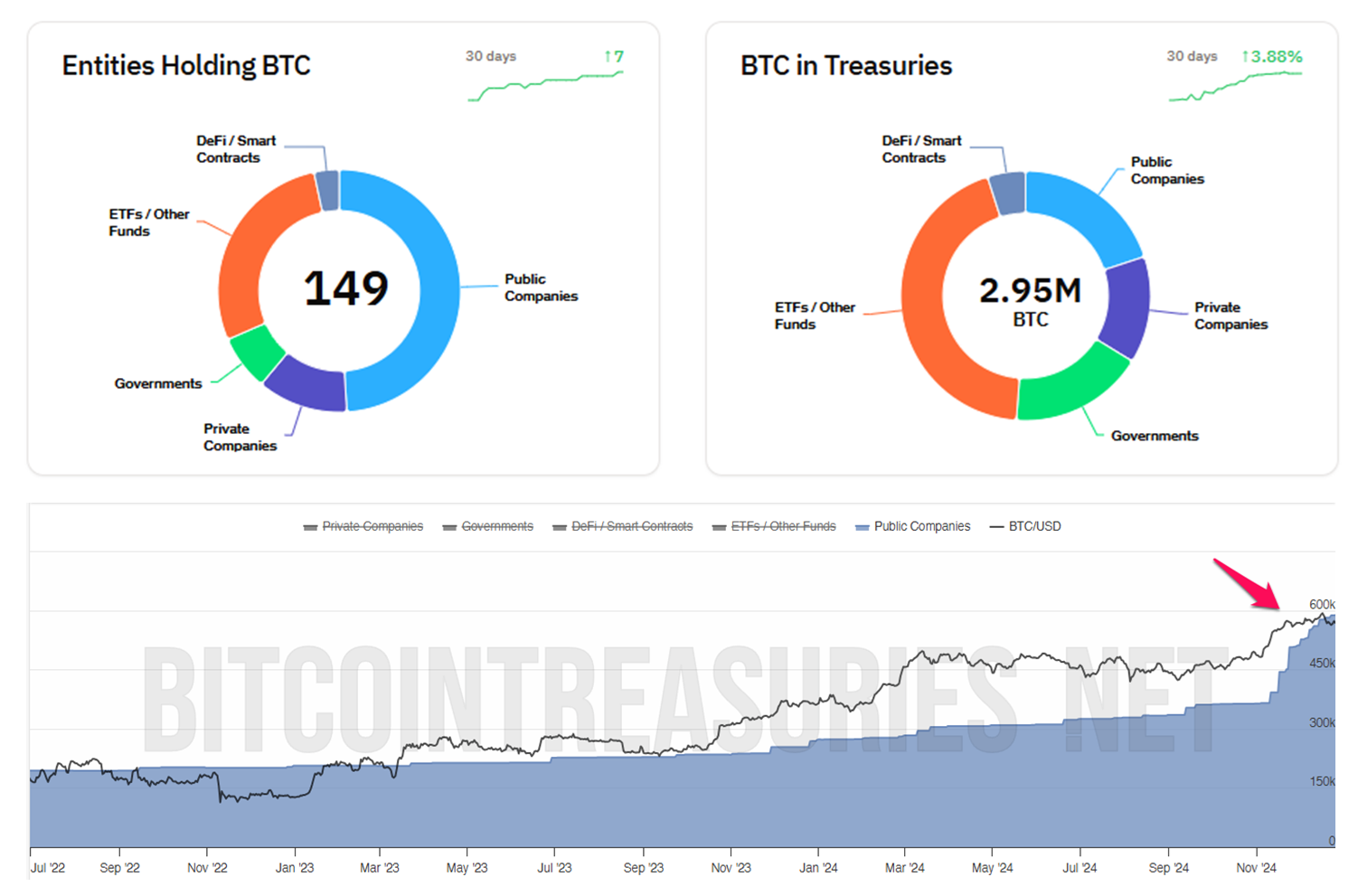

Trend of Increasing Adoption of Bitcoin Reserves in Corporations

On December 27, asset management company Bitwise announced submit application with the U.S. Securities and Exchange Commission (SEC) to launch a new ETF called “Bitcoin Standard Corporations ETF.” This fund will invest in companies that hold large amounts of Bitcoin as their corporate financial reserves.

According to the filing with the SEC, Bitwise will manage and own the index called Bitwise Index Services. This new ETF will invest in the securities of companies listed in the index.

Bitwise has also established specific criteria for companies included in this index. In addition to requiring companies to hold at least 1,000 Bitcoin, Bitwise also considers other financial conditions, including:

- Minimum market capitalization is 100 million USD.

- Average daily liquidity is at least 1 million USD.

- The percentage of publicly traded shares is less than 10%.

This move by Bitwise comes amid the growing trend of accepting Bitcoin reserves in corporations.

Based on data from BitcoinTreasuries, publicly listed companies account for 49% (73 out of 149) of all entities currently holding Bitcoin. Furthermore, in just the past two months, the amount of BTC held by publicly listed companies has skyrocketed by 60%. To date, these companies collectively hold 587,687 BTC, representing 20% of the total Bitcoin held by all entities.

Recently, many companies unrelated to cryptocurrency have also joined the race to accumulate Bitcoin. For example, companies like Rumble, Anixa Biosciences, Interactive Strength, Hoth Therapeutics, Nano Labs, Solidion Technology, and Cosmos Health—operate in areas such as biotechnology, pharmaceuticals, sports, cloud services, and video sharing—also announced the purchase of Bitcoin. The stock value of these companies immediately increased after the announcement.

“BTC treasury activity virus is spreading,” said Nate Geraci, President of The ETF Store, comment.

Furthermore, Strive, an asset management company co-founded by Vivek Ramaswamy, has filed for a Bitcoin Bond ETF. This ETF intends to invest in convertible bonds issued by companies that Strive predicts will use most or all of the proceeds from the bond issuance to purchase Bitcoin, called “Bitcoin Bonds.”