BlackRock, the world’s largest asset manager, significantly increased its Bitcoin (BTC) holdings on Friday, December 6. The move comes shortly after another asset manager , Grayscale, sold $150 million worth of BTC.

This bold purchase symbolizes BlackRock’s growing confidence in the mainstream cryptocurrency. As major investors continue to buy in after Bitcoin’s $100K milestone, here’s what could happen next for the coin.

Bitcoin Continues to Receive Support from BlackRock

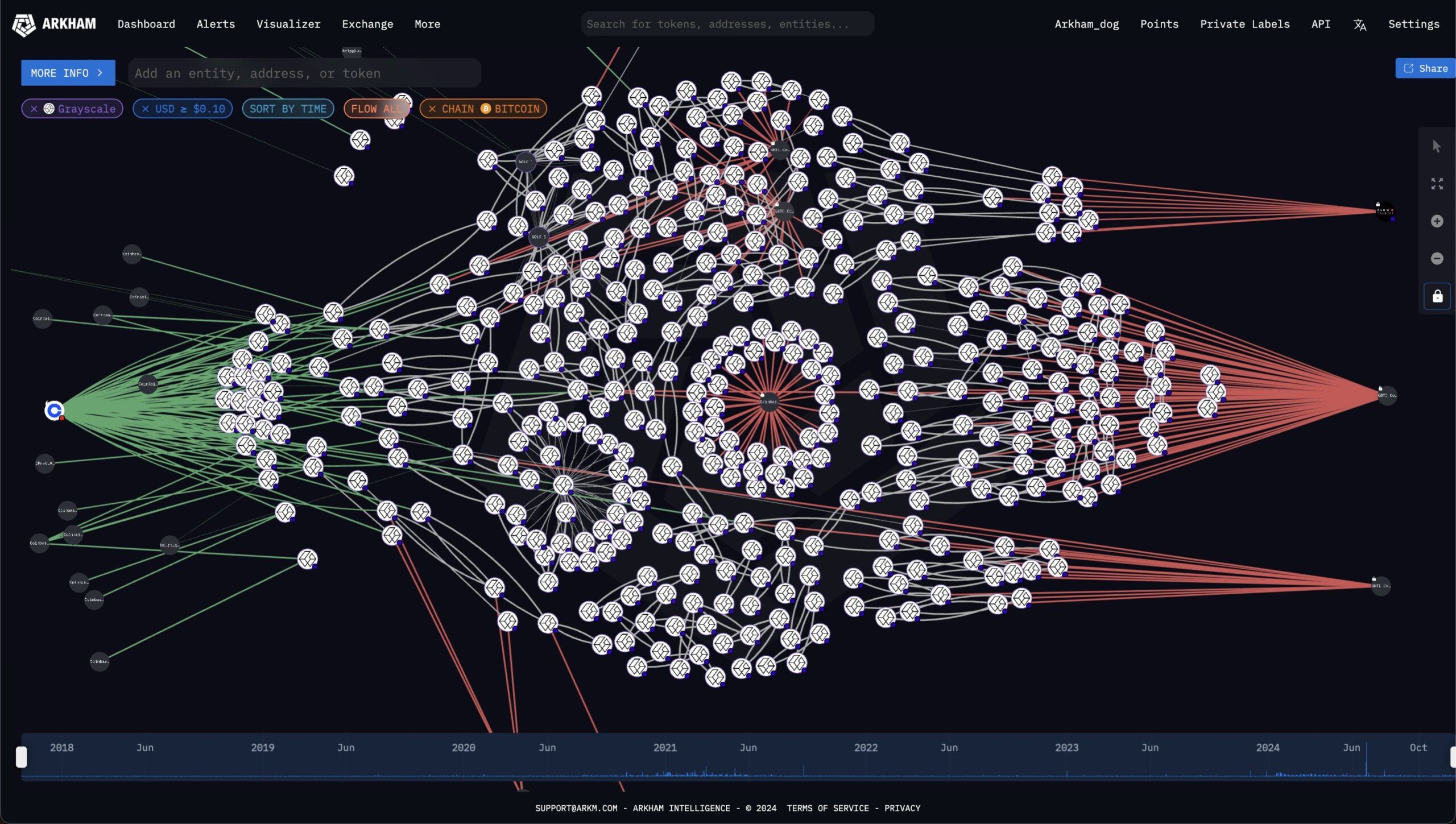

Bitcoin price spiked to $100K for the first time on Thursday, December 5. Arkham Intelligence said the milestone prompted Grayscale, a Bitcoin ETF issuer, to sell $150 million in BTC.

In complete contrast, BlackRock, which is said to own 500K BTC, has chosen a different path. The investment giant added $750 million to its Bitcoin portfolio a day later, demonstrating confidence in the asset’s long-term potential despite recent price fluctuations.

According to TinTucBitcoin’s findings, the massive increase in BlackRock’s Bitcoin holdings was a key factor in helping the digital currency retest the $100K mark after its brief drop to $97K. But the question now is: Will BTC continue to increase in price?

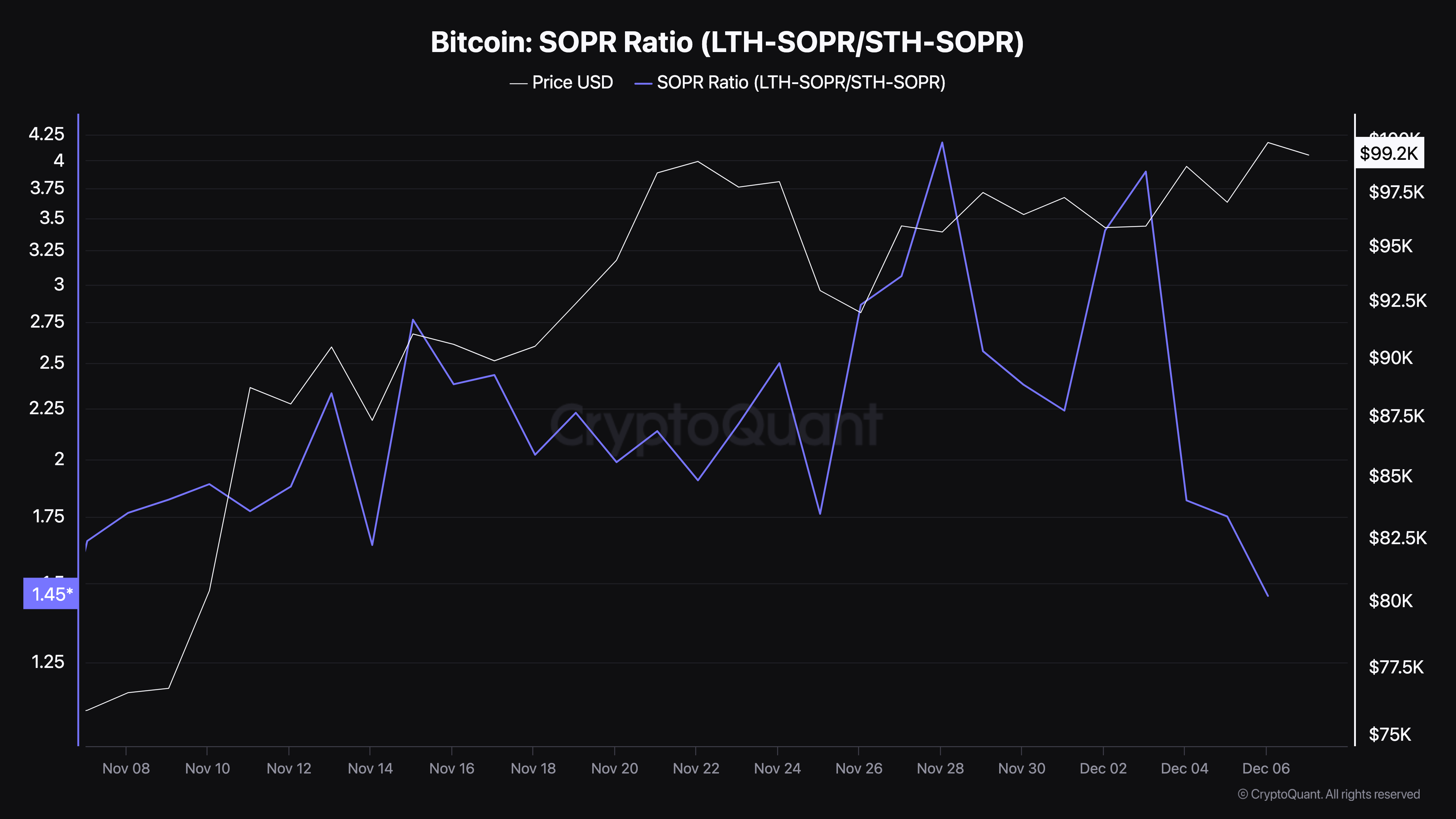

The way to predict whether the price of Bitcoin will continue to increase is to look at the SOPR. SOPR is the profit expended ratio, calculated by dividing the profit of long-term investors (LTH) by the profit of short-term investors (STH).

When the ratio is high, it means long-term investors are getting a higher return on spending than short-term ones. In this case, it indicates that the price is near a local top or market top. However, according to CryptoQuant, Bitcoin’s SOPR has dropped to 1.45, showing that short-term investors are prevailing and the price is closer to the bottom than the peak.

If this trend continues, Bitcoin price could surpass the $100K USD mark in the coming weeks.

BTC Price Prediction: Could $100K Be Just the Beginning?

From a technical perspective, Bitcoin price is trading within a symmetrical triangle pattern on the 4-hour timeframe. The symmetrical triangle pattern signals a period of accumulation, where price narrows between converging resistance levels before a breakout or decline.

A decline below lower resistance usually indicates the beginning of a downtrend, while a break above higher resistance usually marks the beginning of an uptrend.

Furthermore, the Chaikin Money Flow (CMF) index is in positive territory, indicating significant buying pressure. If this holds and BlackRock’s Bitcoin holdings increase, the BTC price could climb to $103,649.

In a highly optimistic scenario, the value of Bitcoin could increase to 110K USD. However, if organizations like Grayscale continue to sell in large numbers, this may not happen. Instead, Bitcoin price could drop to $93,378.