Due to its rapid and impressive growth in 2024, BlackRock’s Bitcoin ETF ‘IBIT’ is said to be “The Greatest Launch in ETF History”.

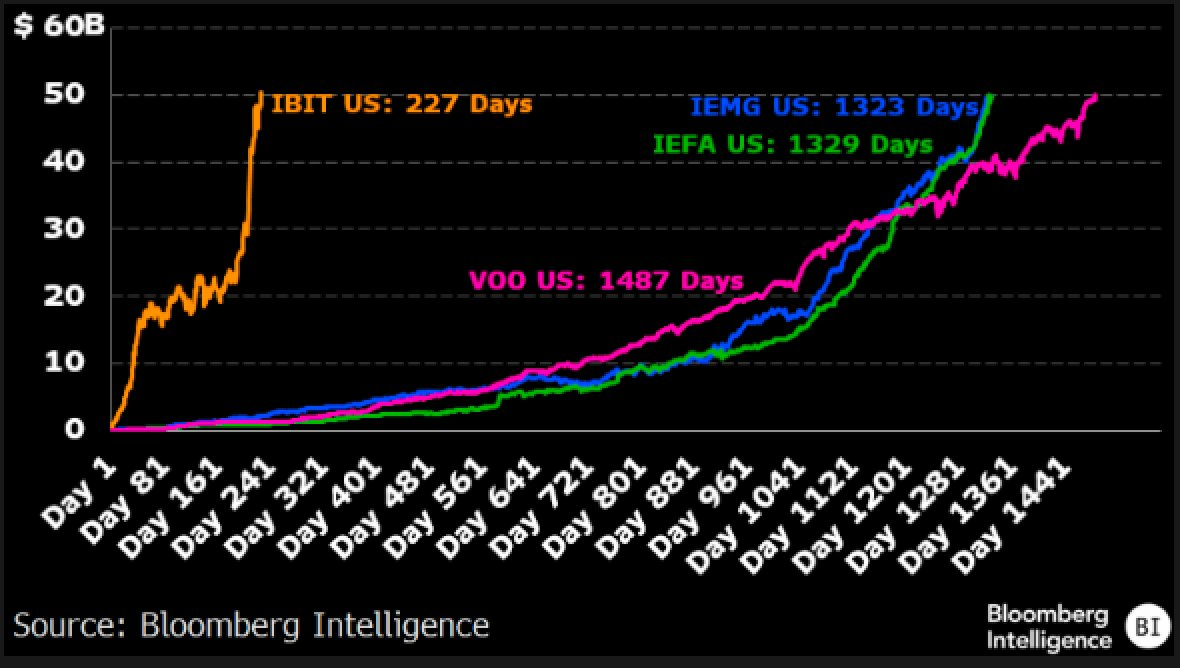

IBIT has made its mark in many important ways, raking in billions faster than any other ETF. It outperforms products that have been on the market for decades, elevating BlackRock’s position as one of the leading holders of Bitcoin.

BlackRock Breaks ETF Records

After the SEC authorized a Bitcoin ETF in early 2024, BlackRock took the lead in this large market. With IBIT, a BTC-based product, the company is constantly leading a new and dynamic market.

However, IBIT’s most notable feature is its explosive growth rate, which Bloomberg ETF analyst Eric Balchunas noted. mention in mid-December.

With IBIT, BlackRock is not only growing faster than other Bitcoin products but is also ahead of all ETFs in the global market.

For example, it surpassed all regional ETFs in the European Union, some of which are 20 years old, in December. With this spectacular success, Nate Geraci declare IBIT is the greatest ETF launch today.

“IBIT’s growth is second to none. This is the fastest ETF to reach most milestones, faster than any other ETF in every asset class. At current asset levels and a 0.25% fee rate, IBIT can expect to earn approximately $112 million per year,” asserts James Seyffart, another leading ETF analyst.

In many key criteria, BlackRock is undeniably the ETF leader. After the OCC allowed Bitcoin ETF options trading in November, IBIT’s options sales exceeded $425 million in the first day alone.

In addition, BlackRock is buying huge amounts of Bitcoin, even surpassing other ETF issuers. Thanks to that, this company became one of the world’s leading BTC holders.

Currently, Bitcoin price is witnessing significant corrections, and BlackRock will have to face this market reality.

However, the company has been bullish on Bitcoin for most of the past decade, and some of its executives expect the market to reach trillions. The company’s investments in the cryptocurrency space have yielded satisfying results, and BlackRock is well-positioned to go further.