[ad_1]

According to on-chain data, BlackRock’s iShares Bitcoin Trust (IBIT) currently owns more than 500,000 BTC. This makes BlackRock the third largest Bitcoin owner globally, behind only Bitcoin’s pseudonymous founder, Satoshi Nakamoto, and cryptocurrency exchange tycoon Binance.

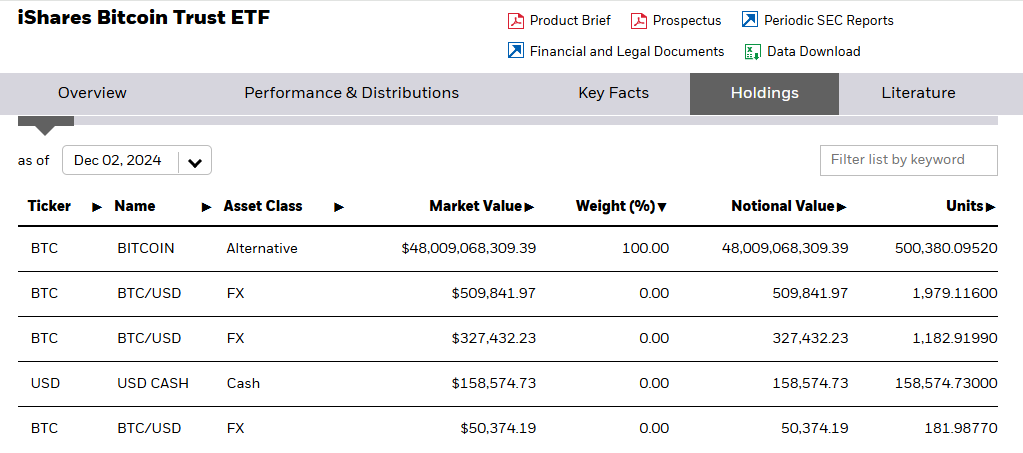

With holdings worth around $48 billion, BlackRock’s influence in the crypto market is expanding rapidly.

BlackRock’s Aggressive Bitcoin Accumulation Strategy

In just 233 trading days since IBIT’s launch, BlackRock has acquired 2.38% of all Bitcoin in existence. This move demonstrates their confidence in Bitcoin as a financial asset. With BlackRock’s total Bitcoin holdings reaching 500,380 units as of Monday, December 2, this reflects a major boost in their strategy.

The company recently made headlines with a $680 million Bitcoin buy amid an expanding accumulation effort. These purchases further strengthen BlackRock’s position in the market. BlackRock’s move toward Bitcoin resonates with CEO Larry Fink’s changing perspective. Once a skeptic who once dismissed Bitcoin as speculative, Fink now describes it as an “independent asset” with transformative potential.

This transition has prompted BlackRock’s deeper involvement in the cryptocurrency market. A senior company official, Jay Jacobs, recently said Bitcoin could become a $30 trillion market. According to TinTucBitcoin, Jacobs noted that there is still plenty of space for Bitcoin (BTC) to gain wider adoption.

BlackRock’s flagship product, iShares Bitcoin Trust (IBIT), is a central component of the firm’s Bitcoin accumulation strategy. IBIT reached $40 billion in assets under management (AUM) earlier this year, breaking speed records in the ETF industry. On its first day of options trading, the fund recorded sales surpassing $425 million, showing tremendous interest from institutional investors.

Four weeks ago, IBIT surpassed the performance of BlackRock’s gold ETF, illustrating Bitcoin’s growing importance in traditional finance (TradFi). According to data from SoSoValue, IBIT continues to lead the spot Bitcoin ETF market.

The financial instrument recorded inflows of nearly $340 million on Monday. Total net inflows were $32.08 billion as of December 2, with Fidelity’s FBTC following at 11.48 billion USD.

Institutional BTC Acceptance Raises Concerns Hierarchy

BlackRock’s Bitcoin strategy goes beyond ETFs. The company has also increased its exposure to Bitcoin through an investment in MicroStrategy, the largest holder of Bitcoin in the business. This move demonstrates BlackRock’s confidence in the long-term value of Bitcoin and its intention to dominate the institutional Bitcoin market.

BlackRock’s initiative, along with other players in TradFi, has undeniably recognized Bitcoin as an asset class. However, not everyone is happy.

Critics in the cryptocurrency community argue that institutional dominance goes against Bitcoin’s principle of decentralization. With BlackRock’s large holdings, the company can blur hierarchy in a space that is designed to empower individuals rather than institutions.

“There was a dream about Bitcoin… and this is not it,” said one user on X express regret.

For some criticthe surge in institutional buybacks is diluting the purpose of decentralization, with BlackRock gradually becoming the largest holder.

However, BlackRock’s emergence as a major Bitcoin holder marks an important transition in the cryptocurrency playing field. On the one hand, it confirms Bitcoin’s widespread acceptance and potential as a global financial asset. On the other hand, it highlights the role of large financial institutions in a space that has traditionally been linked to financial sovereignty at its roots.

With IBIT leading and setting the standard, the company is likely to maintain an important role in the crypto industry. However, the debate over whether this helps or harms Bitcoin’s fundamentals seems to be far from over.

General Bitcoin News

[ad_2]