[ad_1]

Blackrock’s Bitcoin ETF Fund (IBit) is currently managing more assets than a total of more than 50 regional ETFs in the European market. Some of these products have existed for 20 years, which emphasizes IBit’s unprecedented rebellion.

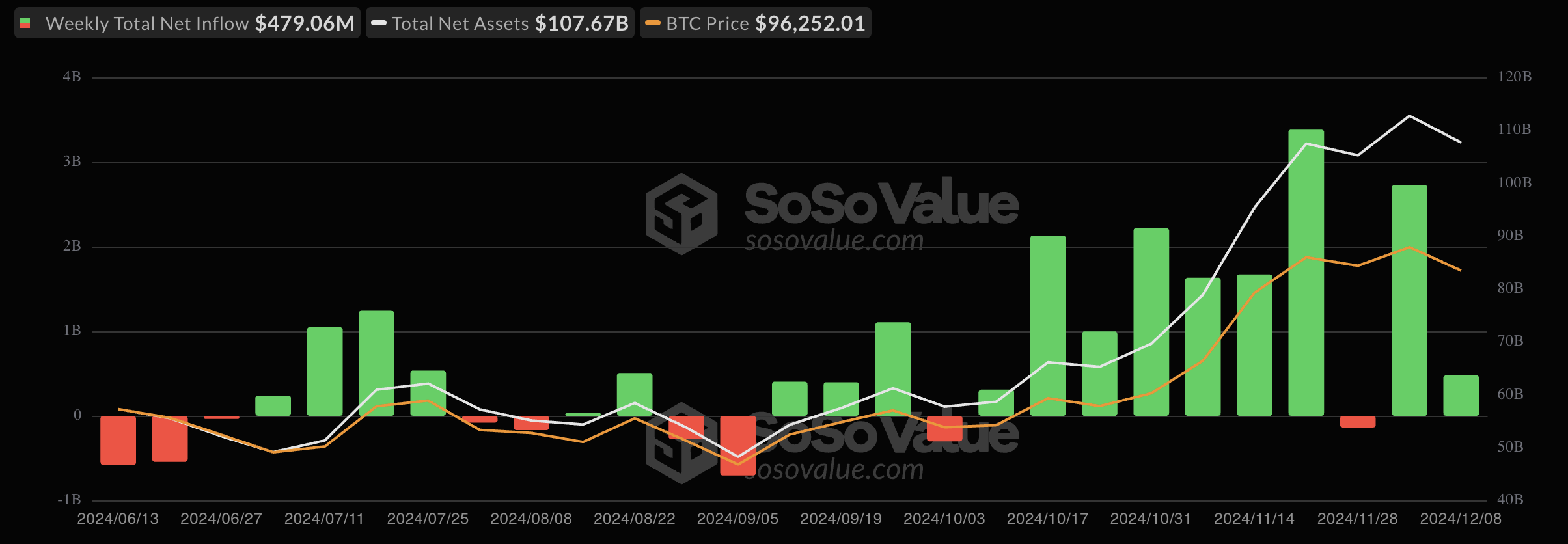

Over the past month, the Bitcoin ETF funds have recorded capital poured into a record high, and BlackRock is leading this group comfortably.

Blackrock’s ibit: A historical success

This unexpected figure was revealed today by ETF analyst Todd Sohn, and his analysis focused on the feasibility of the ETFs of this area as well as compared to the outstanding success of the products. Bitcoin product.

“IBit has the same asset value as a total of 50 ETFs focused on Europe (the area + single country), and they have existed for 20 years,” Bloomberg’s analyst Eric Balchunas said.

“The cash flow, no new products, the ineffective generation for Europe … makes you wonder if it can work,” Sohn feedbackreferring to the weak performance of the ETFs of this area.

Blackrock’s IBit Fund has led the Bitcoin ETF market soaring since its debut in January. Fast after the Donald Trump’s election victory, IBit surpassed the previous record and has a greater value than ETF based on gold. of Blackrock.

This motivation often maintains stable. Bitcoin ETF funds reached the highest net capital in November, reaching a record of 6.1 billion USD, while the largest cash flow from IBit of Blackrock. In the first week of December, the Bitcoin ETF funds witnessed the week of capital pouring in the second most, leading the IBit.

Currently, Blackrock’s fund is managing more than $ 51 billion in net assets, accounting for nearly half of the Bitcoin ETF market scale in the US.

This company has been a dominant force of many criteria outside the weekly cash flow. For example, last week, all 12 ETF funds owned more Bitcoin than Satoshi Nakamoto. Of which, nearly half belongs to Blackrock, and this company continues to buy at high speed.

Overall, these ETFs symbolize the growing acceptance of organizations for Bitcoin and cryptocurrencies in general. For slow -adaptive organizations, changes can wipe out them. At the end of October, European Central Banking economists proposed price control of Bitcoin. The EU recently had a strict attitude with cryptocurrencies, and the inefficiency of ETF funds was clear.

Synthetic Bitcoin news

[ad_2]