BlackRock’s Bitcoin ETF (IBIT) currently manages more assets than the combined total of more than 50 regional ETFs in the European market. Some of these products have been around for 20 years, underscoring IBIT’s unprecedented rise.

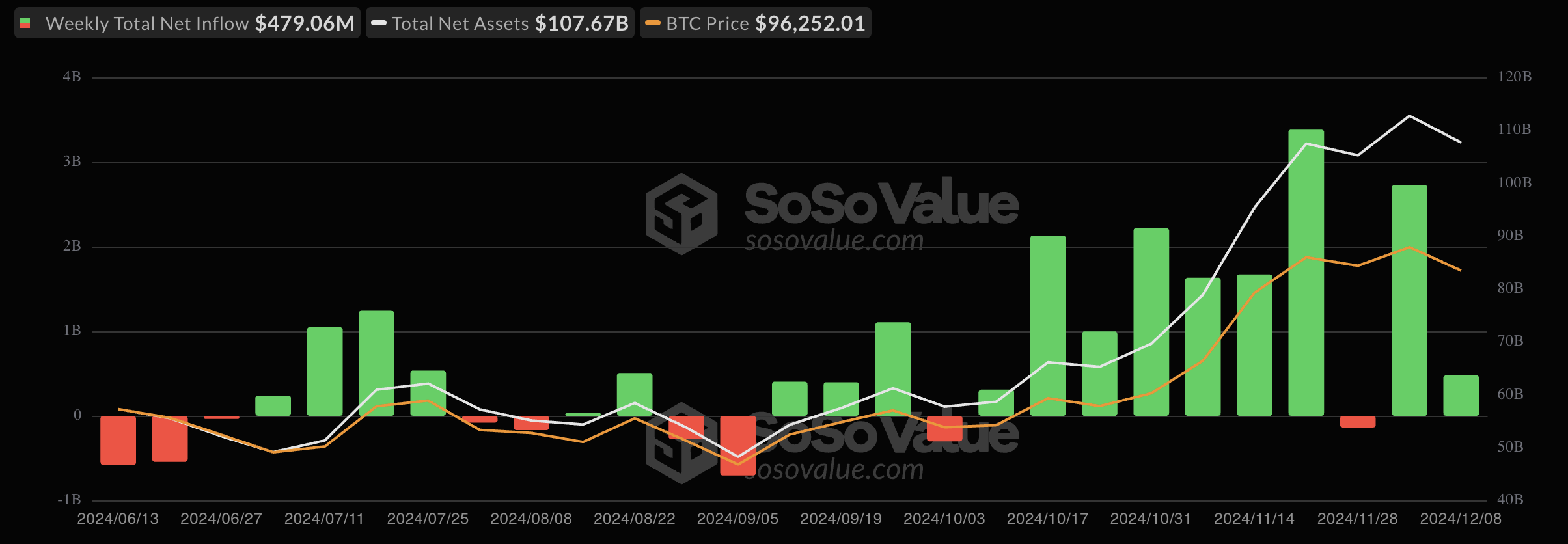

Over the past month, Bitcoin ETFs have seen record inflows, and BlackRock is comfortably leading the pack.

BlackRock’s IBIT: A Historic Success

This surprising number was revealed today by ETF analyst Todd Sohn, and his analysis focuses on the viability of these regional ETFs as well as how they compare to the outstanding success of other regional ETFs. Bitcoin products.

“IBIT has had the same asset value as the combined 50 Europe-focused ETFs (region + single country), and they’ve been around for 20 years,” said Bloomberg analyst Eric Balchunas.

“Cash outflow, no new products, generational inefficiencies for Europe… makes you wonder if it can work,” Sohn feedbackhinting at the possibility of weak performance by these regional ETFs.

BlackRock’s IBIT fund has led the Bitcoin ETF market’s surge since its launch in January. Quickly following Donald Trump’s election victory, IBIT surpassed its previous record and is worth more than a gold-based ETF by BlackRock.

This dynamic usually remains stable. Bitcoin ETFs hit their highest net capital inflows in November, hitting a record $6.1 billion, while the biggest inflows came from BlackRock’s IBIT. In the first week of December, Bitcoin ETFs saw the second largest week of capital inflows, with IBIT still leading the way.

Currently, BlackRock’s fund is managing more than $51 billion in net assets, accounting for nearly half of the Bitcoin ETF market size in the US.

The company has been a dominant force in many measures beyond weekly cash flow. For example, last week, all 12 ETFs owned more Bitcoin than Satoshi Nakamoto. Of these, nearly half belongs to BlackRock, and this company continues to acquire at a high pace.

Overall, these ETFs symbolize the growing institutional acceptance of Bitcoin and cryptocurrencies in general. For organizations slow to adapt, change can wipe them out. At the end of October, European Central Bank economists proposed price controls for Bitcoin. The EU has recently taken a strict stance on cryptocurrencies, and the underperformance of ETFs is clear evidence.